State Street announced that it will offer its State Street PriceStats Series, a comprehensive suite of indicators to monitor trends in retailer pricing and consumer demand in 22 countries, to central banks around the world at no cost. The announcement comes following an influx of inquiries from central banks as they seek to mitigate the negative economic effects of the pandemic.

The indicators, which are created by Price Stats, through its exclusive partnership with State Street, track daily price fluctuations in millions of consumer products sold by hundreds of online retailers around the world. This information is synthesized using econometric algorithms to produce high-frequency consumer price indices that help our clients monitor trends in inflation. Because many retailers adjust prices in real-time based on consumer purchasing patterns, the data can also offer insights into consumer demand in the real economy.

“While the COVID-19 pandemic has led to a sharp decline in aggregate retail prices, the drop thus far has been smaller than what we observed during the last downturn, following the default of Lehman Brothers in September 2008,” said Will Kinlaw, head of State Street Associates (SSA), an academic affiliate of State Street, in a statement. “State Street and PriceStats are pleased to make these indicators available to central banks around the world as they grapple with the economic fallout of the pandemic.”

Alberto Cavallo, the Edgerley Family Associate Professor of Business Administration at the Harvard Business School and co-founder of PriceStats, added that “Declining consumer demand has certainly introduced downward pressure on prices overall, but this effect has also been offset somewhat by supply chain disruptions in certain sectors. These indices will provide central banks with more up-to-date information to support decision making and policy formulation as the situation evolves.”

Examining the drivers of this trend in the U.S. economy, State Street Associates observes that:

- Prices in the energy and transport segment have been driven lower by the dramatic decline in oil prices and the implosion of demand for travel and airlines. This segment is down 4.5% during February and March, the largest two-month decline since Jan 2015. Fuel prices in emerging markets experienced a 5.6% month-over-month decline in March, the largest ever observed since PriceStats began publishing data in early 2009.

- These declines are counteracted somewhat by increases in food and beverage prices, which are up 1% in the United States during February and March, roughly four times the average historical increase seen during this time of year.

In our Eurozone and Global food indices, there are relatively sharp increases for such a short period of time; these measures have risen by 1.44% and 1.34%, respectively. This is the largest two-month increase in global food prices since Jan/Feb 2011 and the largest ever in the Eurozone since PriceStats began tracking there in 2009. - Since the virus first appeared in December, prices for furnishings and household equipment (for example, furniture, carpeting, and household appliances of all kinds) have also risen sharply as supply chain disruptions have impacted certain products.

- Other price categories such as health and beauty products as well as recreation and electronics have been relatively stable thus far.

The State Street PriceStats Series also tracks daily changes in the proportion of products that are out of stock. A greater proportion of certain items have been out of stock at major retailers as quarantined citizens around the world stock up on supplies:

- Since the end of January, the percentage of health care products listed as out-of-stock has risen from 18.3% to 23.2% in the US and from 17.6% to 23.8% in Germany. UK followed a similar trend, going from 6.1% to 14.3%, and then spiking over 40% as some retailers began listing all non-essential goods as out-of-stock in an effort to prioritize delivery of essentials.

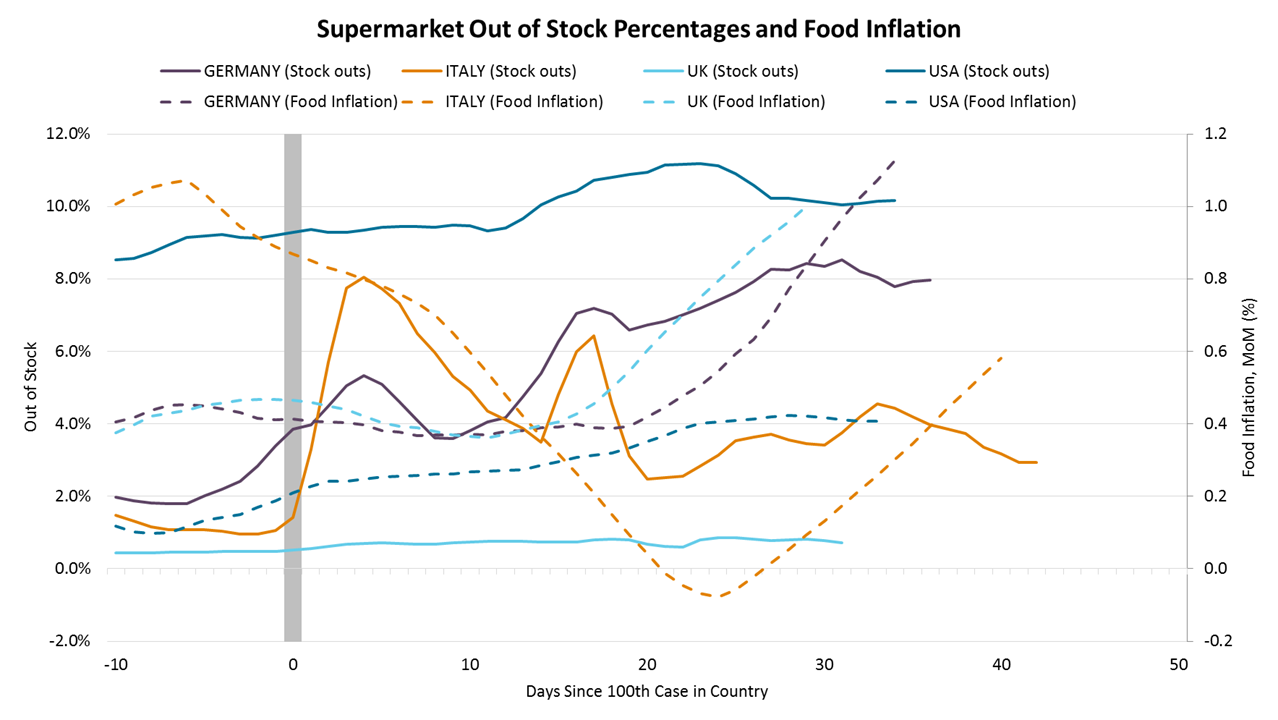

- Supermarket item shortage has been increasing as well, with stockouts rising from 8.3% to 10.2% in the US and from 2.7% to 5.7% in Germany. In the UK supermarkets have imposed per-customer purchase limits which is keeping stockouts low, but still rising.

- Stockouts are concentrated in specific categories (e.g. frozen food, cans, and cleaning supplies) but are persistent and expanding in some countries, indicating retailers are experiencing persistent supply-side disruptions.

The timeline of stockouts and food price increases is consistent with the contagion curve of the virus. Looking at these series on the date of each country’s 100th case, the increase in stockouts and acceleration of food price inflation is clear immediately following the onset of community spread.

Source: State Street Global Markets, European Centre for Disease Prevention and Control

Source: State Street Global Markets, European Centre for Disease Prevention and Control