The process of funding exposures at cleared derivatives central counterparties (CCPs) has traditionally remained isolated from the sell-side’s moves to optimize collateral usage underpinning their bilateral securities lending, repo and OTC derivatives trading activities. This can largely be attributed to the fact that each CCP has unique formatting, eligibility criteria and manual operational constraints. In this article, I explore how new tools built to capture and act upon data from derivatives CCPs will overcome these restrictions. This in turn will lead to better productivity, controls and opportunities to optimize enterprise-wide collateral. A guest post from Transcend.

The last five years of cross-product collateral optimization have primarily focused on improving funding and balance sheets of OTC businesses, which were seen as low hanging fruit. However, the benefits of applying technology to funding cleared derivatives exposures at CCPs extends even further. Firms can ultimately reduce costs, implement stronger controls and drive better collateral optimization.

Acting on lessons learned from the Q1 2020 record market volatility

In any crisis, cleared derivatives are the go-to product for hedging and reacting quickly to uncertain market environments. The COVID-19 crisis was no exception and emphasized two previously known but understated points:

- CCP funding is a manual process that requires investment. In periods of market stress, human effort can neither scale overnight nor easily while reliably providing crucial exposure or liquidity management information in real-time. Manually initiating global payment/collateral movement instructions to meet multiple, often simultaneous, CCP calls is a daily scramble. Additionally, pledging collateral may involve using a different interface or user screen for each CCP. This creates an operational risk nightmare, since failing to meet margin calls at CCPs on time or erroneously moving assets between client-segregated pools and house accounts are regulatory breaches.

- Higher initial margins at CCPs are here to stay. Firms need smart tools for optimizing how exposures are covered on a day-to-day basis, especially if interest rates are changing at the same time. For technical reasons and in line with their risk policies, CCPs found themselves steadily increasing initial margin rates almost every day for the most volatile contracts during the start of 2020. The aggregate amount of initial margin at CCPs rose from $563.6 billion at the end of 2019 to $833.9 billion at the end of Q1 2020, a 48% increase, according to the Futures Industry Association, the leading industry body for CCP and exchange participants.[1]

Without scalable processes and flexible tools, firms were constantly on the back foot trying to manually manage rising margin calls, particularly in Europe and Asia. Meanwhile, CCPs issued repeated and competing unscheduled intra-day margin calls to secure the wildly changing real-time exposures of their clearing members.

Opening an optimization opportunity window by automating the underlying CCP margin process

CCP margin management can be at the nexus of multiple groups and functions, from a dedicated Operations or funding desk in the Front Office or the Group Treasury team. Each group understands that at a basic level, their primary objective is completing all mandatory funding moves on time. Ideally, they would also like the ability to integrate corporate objectives on liquidity management or funding cost optimization into how daily calls are met.

Manual processes and spreadsheets already make it difficult to stay on top of mandatory margin calls; without scalable workflows, firms will be unable to action the increased movements required for optimization. Firms face an added opportunity cost if Operation teams do not have unfettered access to the best available collateral inventory to satisfy a call. Those that fail to provide such access may lack the operational awareness of each CCP’s eligibility criteria and operational lodging procedures.

While a firm-wide optimization system that internalizes the constraints created by each CCP can solve these challenges, connecting CCP requirements is no easy feat: each CCP has unique eligibility rules and cut-offs for every asset, cash or securities, and at every location where collateral is needed. Varying regional requirements pose further challenges: in the United States, the Chicago Mercantile Exchange and Intercontinental Exchange operate under different regulations than the Options Clearing Corporation. Meanwhile in Europe, up to sixteen CCPs could be issuing margin calls to a firm within a two-hour window in the morning and can potentially issue intra-day margin calls every hour into the evening. In Asia, and to an extent in post-Brexit Europe, the global clearing business is channeled through local affiliates and external brokers that act as the access point to local CCPs.

Firms need a platform that unifies this mosaic of processing rules and consolidates exposures and assets for each legal entity. Such a system could process configurable rules to satisfy the initial round of CCP margin calls and feed reliable data to a secondary, deeper, daily optimization run designed to improve overall collateral allocations across the enterprise.

Achieving around the clock operational compliance and regulatory transparency

Firms that consolidate CCP call data, eligibility criteria and inventory management rules in a single global platform also ensure consistent global processing standards. Firms with CCP funding teams in different regional hubs can make “pass the book” handovers between time zones far more efficient and less risky.

Having scalable and automated processes for CCP funding is also a matter of compliance. In Europe, reporting complexity has been created as a result of the arrival of new segregation models that are margined with their own dedicated collateral pool but remain part of an overall net client-side settlement with CCPs to reduce payment costs. It is critical to effectively and accurately reverse-engineer CCP computations to journal each gross component into the correct ledger from a single net payment.

Equally, firms are challenged to comply with rules that prohibit automatically releasing excess collateral from individually segregated client accounts at CCPs. Firms must proactively initiate a recall if one client is covered overall but with an excess at one CCP and a deficit at a second CCP. Without proactive recalls, firms risk not being able to repay themselves in time to pay the deficit. This complexity of compliance increases for firms with several customers across multiple CCPs.

There are many more regulatory stakeholders in need of reliable CCP exposure data beyond those who simply handle daily CCP collateralization. Some, like risk managers, require trusted time series data to assess average and peak margins at CCPs for periodic regulatory reporting on their exposure to Financial Market Utilities (FMUs). Others, like senior treasurers, only need it by exception, such as on days of heightened market volatility, to assess at that instant the liquidity drag from CCP funding. Regardless of use case, all such stakeholders can mutually benefit from accurate, real-time, consolidated, and accessible data.

Considering the tensions caused by the increased intra-day margin calls issued by European CCPs during the first quarter of 2020, regulators have increased their interest in the liquidity impact of clearing at CCPs and expect firms to handle liquidity management more effectively.

Bringing cleared derivatives into the overall collateral focus

Cleared derivatives CCPs represent a growing proportion of collateralized exposures for many firms; this cannot be ignored. There is also the growing proportion of business directed onto CCPs in other asset classes such as FX and repo.

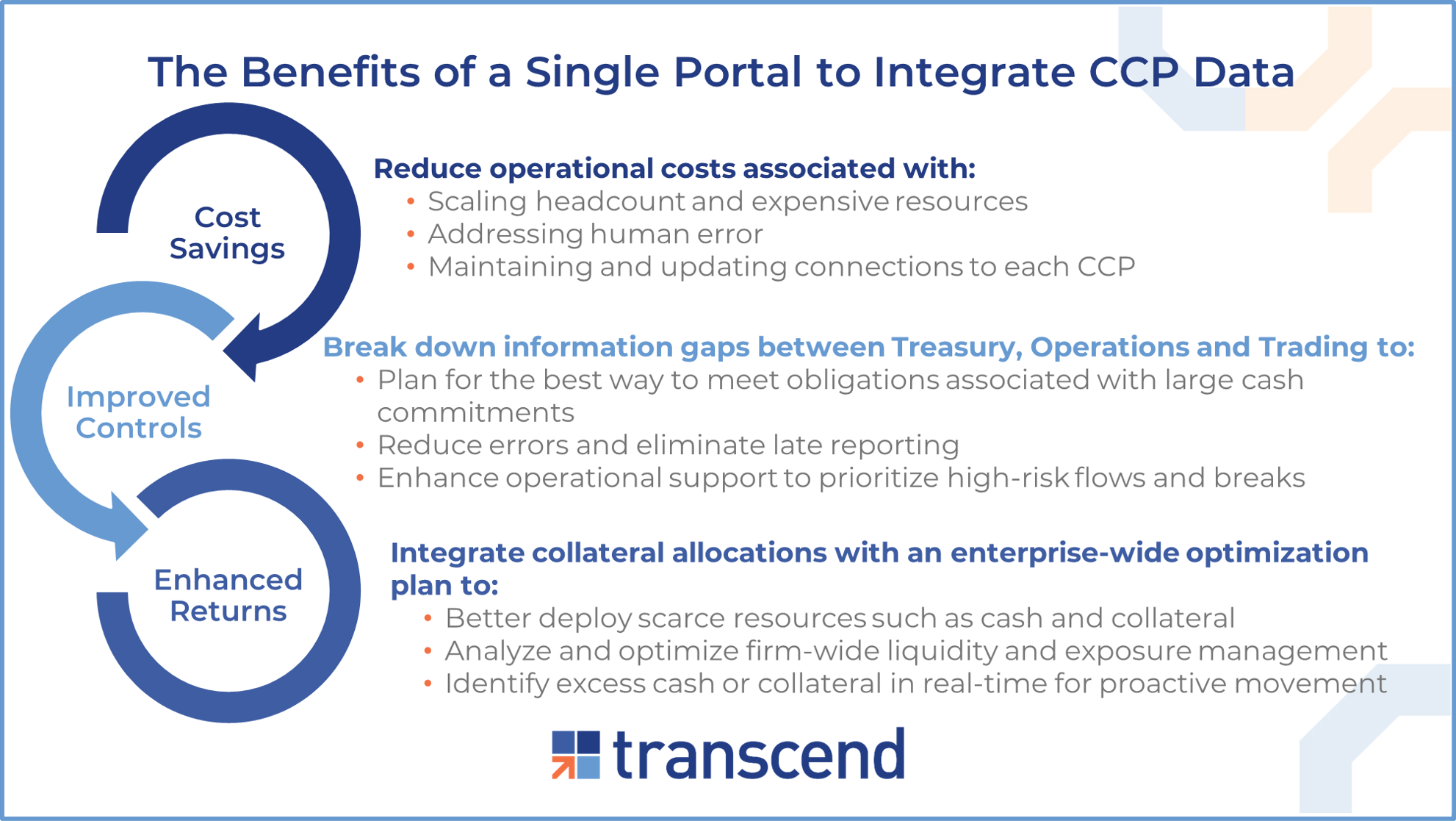

From our experience, firms that invest decisively in a smart CCP margin management platform that is integrated throughout the enterprise can expect to benefit on three levels:

- Cost Savings: A single portal that interfaces with CCPs globally and harmonizes their bespoke collateral eligibility, funding routines and collateral booking flows achieves operational cost-savings through end-to-end automation of transactions. It provides required scalability in an otherwise highly manual and error-prone environment, and removes the connectivity costs associated with constantly adapting to changing CCP interfaces and data formats.

- Improved Controls: Real-time visibility into global collateral and cash flows improves a firm’s control and risk management framework. Seamlessly sharing reliable data between Operations, Treasury and Trading teams delivers enterprise-wide harmonization and elevated strategic vision, such as the ability to detect large cash commitments in time to plan for the best way to meet these obligations. Deploying system-based rules to navigate the complexity of CCP collateral lodging rules improves accuracy, reduces unused excess and avoids time-consuming fails or missed cut-offs.

- Enhanced Returns: By optimizing funding across CCPs and further integrating with other firm-wide optimization strategies, a single platform can help firms better deploy scarce resources, ultimately lowering the cost of funding CCP exposures. Some specific benefits include:

- Analyzing and optimizing firm-wide liquidity and exposure management.

- Identifying excess cash or collateral in real-time with the confidence and controls to proactively reduce otherwise trapped liquidity.

- Integrating collateral allocations within a broader optimization strategy to scale collateral allocation by systematically selecting the best collateral to deliver based on comprehensive firm guidance, rather than historical availability.

With such a compelling case to improve controls and lower the cost of funding, now is the time to act on lessons learned from the start of 2020, while key takeaways are still fresh and before the next crisis hits.

Bimal Kadikar

Bimal Kadikar

CEO, Transcend

Bimal Kadikar is the founder and CEO of Transcend, a technology firm dedicated to helping financial institutions optimize collateral and liquidity enterprise-wide to increase efficiency, reduce risk and drive greater business performance. Bimal leads Transcend’s business and product strategies, working closely with major global banks to implement modular, innovative technology solutions that connect the front-to-back office for sharper funding and capital decisions.

Bimal previously served in several senior roles at Citi Capital Markets Technology Division. He also led the global technology organization for Citi’s Fixed Income, Currencies and Commodities (FICC) businesses, and built the Prime Finance, Futures & OTC Clearing technology platform, expanding Citi’s growth. Bimal spearheaded Citi’s firm-wide post-2008 crisis strategy for Collateral, Liquidity and Margin, leading to the inspiration for founding Transcend’s next-generation collateral and liquidity management solutions.

[1] “FIA issues white paper on the impact of pandemic volatility on CCP margin requirements,” FIA, October 29, 2020, available at https://www.fia.org/resources/fia-issues-white-paper-impact-pandemic-volatility-ccp-margin-requirements