Recent events and regulatory proposals show that repo remains a leading concern for dealer balance sheet constraints and financial stability. While mandatory clearing, Sponsored Repo and Peer to Peer can all help solve for overlapping problems, Sunthay argues that Guaranteed Repo is the only solution in the market that can be executed on quickly, reduces costs, solves problems of capacity, scalability and risk management, and can be a global standard.

Guaranteed Repo separates the economic exposure of a repo transaction on a bank’s balance sheet from the operational trading activity. Dealer capital exposure is what makes these transactions costly and creates constraints. Shiv Rao, Chairman of Sunthay Holdings LLC, says that “Guaranteed Repo carries lower Risk-Weighted Assets (RWAs) than either match-book or Sponsored Repo. As a result, dealers can improve their economics while simultaneously increasing their ability to support repo markets.” The party providing the guarantee coverage does not need to be a bank subject to capital and leverage constraints, although banks stand to benefit from the structure.

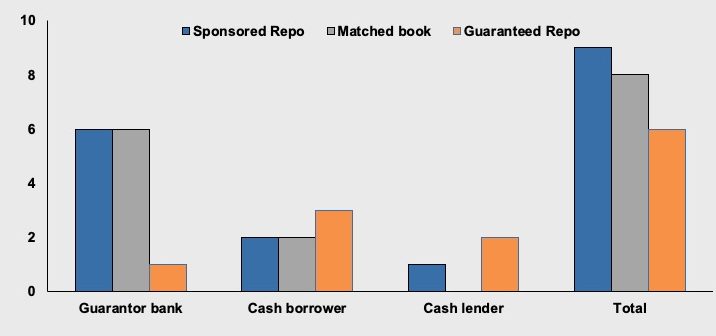

According to data provided by Sunthay to Finadium, Guaranteed Repo can save dealers and their clients 2-3 basis points per trade by avoiding bilateral, triparty and CCP costs (see Exhibit 1). Additional savings come from integrating electronic trading at no additional cost, and eliminating costs for CCP default funds and daylight overdraft associated with securities settlement. Dan Markaity, CEO of Sunthay, says that “by reducing operational costs across multiple settlement steps, dealers, cash providers and collateral providers all reduce their costs in the repo process.” While cash borrowers and lenders might see incrementally higher fees, the significant reduction in dealer costs gives room for price improvement to offset other costs.

Exhibit 1:

Sunthay Guaranteed Repo models costs vs. Sponsored Repo and Matched Book

(Basis points)

Source: Sunthay Holdings LLC

Sunthay says that the most important advantage of Guaranteed Repo is its speed to market. The US Securities and Exchange Commission’s (SEC’s) proposal for mandatory clearing of US Treasury repo may solve dealer balance sheet constraints but would take years to implement. It is expected to result in substantially higher costs for clients that could meaningfully impact market liquidity, not just in repo but in the cash markets as well. Sponsored Repo is a viable solution but as a voluntary exercise, it does not work for all firms due to competitive costs in bilateral uncleared markets and a lack of done-away clearing. Peer to Peer markets remain young and will take some time to develop. On the other hand, Guaranteed Repo is available to dealers and their clients today.

Precedents for why Guaranteed Repo works

The core idea of Guaranteed Repo – separating the components of credit exposure liability and trading – is well established in collateral markets. Well-functioning practices have emerged by both necessity and creativity for institutions that either want to reduce their Leverage Ratio, Liquidity Coverage Ratio, GSIB Surcharge and Net Stable Funding Ratio exposures, or need to improve their clients’ credit risk experience.

Banks have found success in working with specialized non-bank funding groups that can assume the same transactions but at a lower capital cost. In one example, a large bank may have a negative yield when holding government bonds for collateral against a capital requirement of 14% in cash. A structured product provider can issue debt in the market, buy the bonds and loan the securities back to the bank, thereby eliminating the need for the bank to hold the bonds on their balance sheet. A variation on this idea is Asset-Backed Commercial Paper (ABCP), where an issuer can repo in assets that a dealer needs to finance and issue highly rated ABCP debt to money market funds that would be prohibited from buying the paper directly from the dealer.

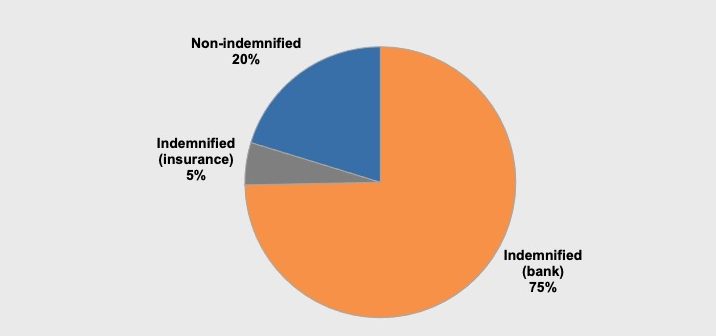

Exhibit 2:

Prevalence of counterparty default indemnification in securities lending

Source: Finadium

The provision of indemnification in securities lending by insurance companies has been accepted practice by major investors including pensions like CalPERS. While an agent lender acts as the manager of the securities loan and collateral movements, the insurance company bears the risk of a potential counterparty default in exchange for a fee. This solves a problem for all parties: the agent lender is supported by a strong credit partner; the client knows that the possibility of counterparty default is backstopped by the same partner; and the insurance company receives a fee for performing their regular services. In practice, the use of insurance for indemnification is estimated at only 5% by Finadium, compared to 75% of securities loans indemnified by a bank and 20% carrying no indemnification at all (see Exhibit 2). However, the ability to purchase insurance against counterparty defaults is open to clients of both bank-affiliated and non-bank agent lenders alike.

The concept of Guaranteed Repo is not only well-known, but also well established. The challenge in the repo markets is creating the operations and players for who will trade and who takes the liability. Sunthay has done this work: Dan Markaity says that “Sunthay has built a highly scalable market ecosystem for repo dealers and their clients to take advantage of an existing and successful market practice of separating exposure liability from trading.”

Guaranteed Repo vs. the SEC’s proposal for mandatory US Treasury repo clearing

The objectives of the SEC’s proposal for mandatory US Treasury repo clearing, as published in their proposed rule from September 2022, focus on reducing systemic risk and improving data availability. Regulators have targeted the bilateral uncleared market where dealers may require little to no margin from their hedge fund collateral providers based on internal risk models, and the Interdealer Broker market where one leg of a trade may be bilateral and other cleared. According to the SEC, all eligible US Treasury repo trades should be cleared by Covered Clearing Agency (CCA) members, with FICC as the only CCA at present.

A Finadium analysis of the proposal published in March 2023 found that it was long on argument but lacked critical analysis on liquidity and market impacts. A final rule based on the proposal would serve to increase dealer balance sheet capacity, but at a magnitude of cost increase to collateral providers that could force them to leave the market. Sunthay counters that Guaranteed Repo delivers comparable balance sheet capacity at a fraction of the cost and that Guaranteed Repo and mandatory clearing are complementary, as Guaranteed Repo transactions would be excluded from the definition of eligible transactions.

The SEC’s proposal gave no requirement for done away trades, a circumstance that hinders hedge fund interest in Sponsored Repo today and would serve to consolidate liquidity at a small group of repo dealers under a final rule or see it lost altogether. The Alternative Investment Management Association (AIMA) commented on the proposal by saying:

When faced with these new costs or the impracticability of direct membership, market participants may exit or limit their cash Treasury and repo trading, leading to a further reduction in Treasury market liquidity.

And while the proposal stated repeatedly that smaller dealers would benefit, the Independent Dealer and Trader Association (IDTA) responded that as written:

The Proposed Rule (and the current Sponsorship program) will make it extremely difficult for smaller and middle-market broker dealers to compete with the largest global banks that have unlimited capital and are able to significantly reduce and even eliminate haircuts on trades.

By maintaining current repo relationships and operations in place, and providing a possibility of a credit risk upgrade to smaller and mid-size dealers, Guaranteed Repo solves both concerns about collateral provider costs and the viability of smaller firms. Early adoption of Guaranteed Repo could encourage some firms that might consider leaving FICC membership – and the repo markets – altogether to continue to engage. Guaranteed Repo does not require clearing and avoids the legal, operational and default fund costs of CCA membership. This also avoids a trap last seen when regulators introduced Agent Lender Disclosure (ALD) rules that led to smaller dealers no longer borrowing from agent lenders due to increased costs.

Instead of smaller firms becoming captive to a new cost structure that the IDTA says is untenable, Guaranteed Repo provides a viable solution that maintains market liquidity. According to Sunthay’s comment letter on the proposal, “By removing the number of transactions and settlements required in connection with the provision of credit, Guaranteed Repos reduce complexity risk (which also has the benefit of incentivizing greater activity in the market, consistent with the SEC’s goals of increased market liquidity).”

Responding to regulatory objectives about reducing systemic risk and providing data transparency, Sunthay says that Guaranteed Repo does both. According to Sunthay:

Because neither banks nor any other intermediary (such as a clearinghouse) is exposed as principal to the party on either side of the guaranteed transactions, repos entered into under the Guaranteed Repo model would not impact any credit intermediary’s balance sheet unless the guaranteed party were to default and the guarantor were to step into its shoes.

Implementation of a final SEC rule on mandatory clearing of US Treasury repo is also likely to take years, starting with the SEC’s expected timeline but extending through the FICC’s rule writing process, the SEC’s approval of those rules, and industry preparedness in building the operations and legal processes to be ready for clearing. This will strain and sharply increase costs to the market.

Guarantees of repo trades will be required to be reported pursuant to the proposed rule issued by the Treasury Department’s Office of Financial Research on January 9, 2023. As the OFR notes:

Another factor that may affect flows into and out of sponsored repo is the development of guaranteed repo. Customers may move from non-centrally cleared bilateral repo to the same with guarantors as an alternative to transacting though tri-party repo or sponsored repo. Tri-party and sponsored repo platforms offer, through design, risk-reducing characteristics for cash lenders and cash borrowers.

Additionally, as guaranteed repo replicates the profile of offsetting legs of the same repo transaction with different counterparties, yet has different balance sheet implications, guaranteed repo may be an alternative to traditional repo market financial intermediation. This provides incentives for some financial institutions to participate in repo markets when financial intermediaries are economically constrained. For all these reasons, guaranteed repo addresses various needs in the non-centrally cleared bilateral repo market. A data collection regarding this final segment of the repo market is therefore essential to providing regulators with a complete picture of repo market activity and to realizing the full potential of existing data collections on other segments of the repo market.

Because Guaranteed Repo incorporates electronic trading and integrated post-trade collateral management and position reporting, the data required for regulatory reporting can be easily captured.

A global solution

A unique attribute of Guaranteed Repo is that it is a global solution, not just a regional one. The importance of this is substantial for global trading desks that need to harmonize technology, client and legal activities across their franchises. Guaranteed Repo works globally because dealers around the world look to versions of Basel III rules that direct their balance sheet costs, and often seek to book trades with entities that are the least prohibitive in terms of cost. Shiv Rao says that “Guaranteed Repo can be implemented once and work everywhere; this is not a US or Europe-specific solution where another option needs to be found for the next region.”

The speed to market also matters. Although every trading firm is bound by the actions of its central banks, the ability to implement the immediate cost savings available in the Guaranteed Repo model can be used everywhere. This translates into immediate cost savings for dealers and clients alike while keeping existing relationships and operations intact.

According to Sunthay, the Guaranteed Repo model may not be the only solution for bank balance sheet capacity and mitigating financial stability concerns, but it is the fastest to market and will support repo dealers and their clients with meeting their credit, data and trading obligations. As a global solution, it offers dealers the opportunity to implement a recognized and trusted economic model once across their franchise rather than bespoke regional solutions. The Guaranteed Repo model works and is ready for implementation.

This article was commissioned by Sunthay Holdings LLC.