A number of initiatives to improve the matching of collateral supply with demand have begun to move forward in recent years. However, the system is still fragmented with a lack of centralisation and standardisation and there is significant scope for a more integrated global matching service offering high levels of Straight-through-Processing (STP) and automation. A guest post from Broadridge.

This would offer a more efficient way for those who are long high quality collateral to supply those who are short these assets.

A desirable model could include a more granular segmentation of collateral types into traded basket structures, for example, a Basel III Liquidity Coverage Ratio eligible basket of HQLA collateral for a given jurisdiction or, alternatively, a basket of eligible collateral for a specific CCP.

From there, these LCR, CCP or even Central Bank eligible baskets could potentially become packaged into tradeable liquid instruments. This could include vehicles such as ETFs or even derivative-like products. In fact, we are already beginning to see this emerging with product offerings like the traded HQLA funds offered by asset managers such as Lyxor.

These structured products could then be traded on a global central collateral exchange, underpinned by an intermediary or potentially a peer to peer network.

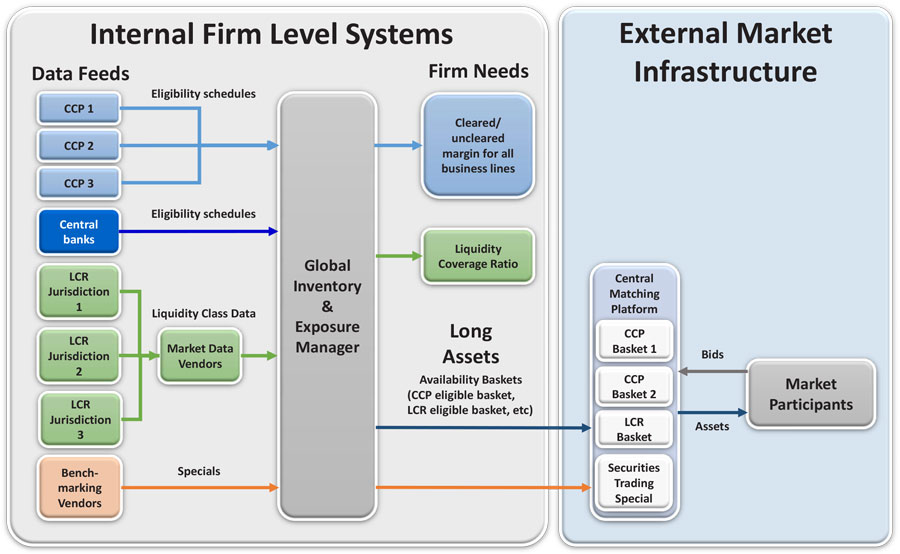

A series of steps are required for this end to end process to become more automated and STP for both firm level technology solutions and external market infrastructure.

Step 1. Automated Inbound Feeds of Eligibility Schedules

The first element of this process involves the ability at the firm level to receive and aggregate real time feeds of collateral eligibility schedules from different sources.

For example, Securities Finance and Collateral Management solutions such as Broadridge’s can receive an automated real-time feed of collateral eligibility schedules from various CCPs. This can reflect periodic updates to the CCPs’ eligibility criteria due to changing market conditions.

Likewise, it is also possible to receive inbound feeds of liquidity class data from market data vendors. Using this data, a Global Inventory Management solution can very quickly filter down firm level availability. This allows the user to rapidly identify ISINs that fall into specific Liquidity Coverage Ratio HQLA categories.

Furthermore, systems can receive feeds of securities trading special from benchmarking services available to the securities finance markets.

The value of a strong Global Inventory Management tool cannot be overstated in offering the ability to aggregate eligibility schedules, and then slice and dice inventory in this way. This centralised use of data displayed clearly and intuitively, on a forward-looking basis, makes it far easier to identify and source the right kind of liquidity quickly and efficiently.

Step 2. Matching Inventory with the Firm’s Inventory Needs

The second step requires the firm to ensure it has allocated enough collateral to meet its own and potentially its clients’ needs on a haircut-weighted basis. This includes meeting liquidity ratios and ensuring enough eligible collateral is available to meet cleared/uncleared derivatives, securities finance and any other margin requirements.

Supporting this is automated substitution of assets no longer eligible at the CCP or for LCR due to changes in eligibility schedules. Likewise, this also needs to take place when changes in the credit rating of pledged collateral lead to it becoming ineligible.

Once again, an integrated global inventory and exposure management solution such as Broadridge’s is fundamental to performing this allocation process efficiently with high levels of automation and minimal manual effort. This gives you the power to slice and dice inventory data on the fly, to simulate various scenarios and stress test different outcomes.

Securities trading special in the securities finance markets should also be allocated to the financing pool rather than pledged out as collateral.

Step 3. Broadcasting Availability

Stage 3 of the process could involve automatic broadcasting of availability to the central matching platform. This includes a mechanism for posting baskets of CCP or LCR eligible HQLA baskets to the central platform/electronic market.

Doing so enables firms who are long HQLA supply to finance these baskets of CCP eligible assets and mobilize them to those who need them. Underpinning this is a collateral transformation trade in the securities finance markets, which could potentially occur via a bilateral, peer to peer or triparty structure.

So, a buy side firm that requires collateral to margin its derivatives transactions could source a basket of eligible collateral for the CCP of its choice.

As discussed earlier, the market is already beginning to see the packaging of HQLA assets into HQLA funds which can then be traded.

There are also signs that a pricing differential is arising between these HQLA assets and General Collateral (GC). Those who are more clued up on what falls into each category can potentially arbitrage this by borrowing HQLA at GC rates from those unaware of the difference. A spread can be made by then lending/repo’ing these HQLA to those in need of HQLA.

Some caution is required however. For example, if your firm is not identifying and pricing HQLA effectively then you could be losing valuable revenue opportunities. The benefits of having a more transparent and publicly traded exchange for collateral also help with thorny issues such as funds transfer pricing mechanisms.

Future Developments

The trend towards packaging HQLA into traded funds could see further financial engineering take place, which could involve the creation of a range of different liquid ETF-type structures. As a further step, could we see collateral becoming a derivative in its own right?

For a buy-side shop, holding large amounts of cash or government bonds in its portfolio to meet the need for increasing amounts of derivatives margin is not an attractive idea. Cash and HQLA are not yield seeking assets and this creates a major drag on returns.

If a derivative contract, for example a future or option, could be taken out, then there is potentially less need to hold these assets as a buffer for margin. It could also provide a useful hedging tool to manage future collateral costs.

Obviously, there is a need for better forecasting of future collateral requirements. However, with the advent of CCP Initial Margin simulation tools and the ISDA SIMM, over time firms could move towards a more forward looking view of liquidity requirements.

A global inventory management solution that can aggregate internal liquidity pools and project inventory on a forward-looking basis is key to this process. It allows the firm to forecast collateral needs vs internal inventory and identify liquidity gaps over given time horizons.

Gradually the process described above means collateral management will become more automated with less manual effort. This will free up time for collateral managers to take a more strategic and proactive role in forecasting collateral needs and sourcing eligible assets at low cost.

Along with a more granular categorisation of different asset categories (CCP eligible, LCR eligible), this will also assist in risk management activities such as stress testing.

Conclusion

New rules around collateral will create huge demands for our industry. Out of necessity, it will need to become more standardised, industrialised and automated. A greater focus on data consolidation and management, coupled with the use of this data to improve strategic decision-making around collateral is now becoming essential to compete.

When combined with a more advanced market infrastructure that allows more transparent pricing, matching and STP around collateral trading, the industry will become more efficient at matching supply and demand, easing some of the pressures of regulatory compliance.

Martin Seagroatt is the marketing director in the securities financing and collateral management unit at Broadridge.  Previously he was marketing director at 4sight Financial Software. In June 2016 4sight was acquired by Broadridge and the 4sight Securities Finance and Collateral Management System rebranded as the Broadridge Securities Financing and Collateral Management Solution. In his 11 years at 4sight, he specialised in securities lending, repo and OTC/listed derivatives collateral management solutions. Prior to that Martin worked as a business expert in technology systems for risk management in the energy industry.

Previously he was marketing director at 4sight Financial Software. In June 2016 4sight was acquired by Broadridge and the 4sight Securities Finance and Collateral Management System rebranded as the Broadridge Securities Financing and Collateral Management Solution. In his 11 years at 4sight, he specialised in securities lending, repo and OTC/listed derivatives collateral management solutions. Prior to that Martin worked as a business expert in technology systems for risk management in the energy industry.