The Financial Conduct Authority (FCA) released data on the firms supported by its Regulatory Sandbox and Innovation Pathways services including sectors, technologies, areas of innovation and locations.

Since its launch in 2014, the FCA Innovation Hub has supported a diverse range of firms, from incumbents to fintech start-ups, allowing firms to test innovative products or services in a live market through the Regulatory Sandbox or helping firms resolve regulatory questions through Innovation Pathways.

The data provides a picture of the firms supported between 2014 and 2022, showing more than 2,400 application received 867 firms supported, including 168 firms and products accepted for testing in the Regulatory Sandbox.

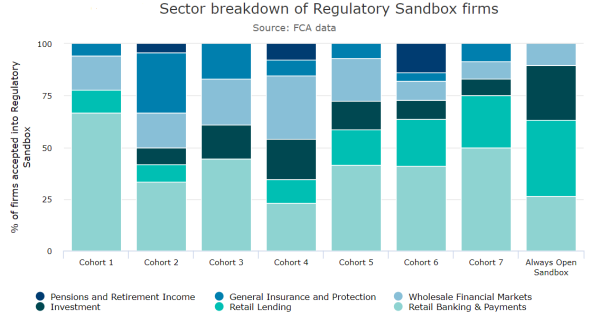

Historically, the hub has accepted the biggest number of innovators in retail banking and payments, investment and retail lending sectors. The ‘cross-sectors and others’ category refers to products or services that are not specific to one sector, such as software or regtech solutions for financial services providers.

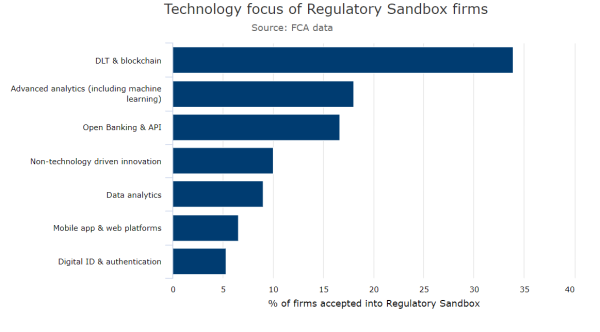

Recent use cases in the Regulatory Sandbox include:

- Open Banking technology to accelerate impact assessment in the Environmental, Social and Governance (ESG) space and affordability assessment for underserved borrowers,

- digital ID to enable smoother and more transparent housing transactions and access to financial services,

- development of software/app/platforms underpinned by analytics to improve ESG outcomes for consumers, investors and firms,

- blockchain to facilitate more efficient low-cost cross-border payments, security issuance and execution process.