Davis Polk & Wardwell, the “white shoe” Wall Street law firm, periodically puts out a regulatory update, the “Dodd-Frank Progress Report”. As Dodd-Frank hits its stride in the “terrible twos”, it is worth taking a look at how things are coming along. But we have to confess, what we really like about this report are all the charts.

Form the report,

- As of October 1, 2012, a total of 237 Dodd-Frank rulemaking requirement deadlines have passed. This is 59.5% of the 398 total rulemaking requirements, and 84.6% of the 280 rulemaking requirements with specified deadlines.

- Of these 237 passed deadlines, 149 (62.9%) have been missed and 88 (37.1%) have been met with finalized rules. Regulators have not yet released proposals for 35 of the 149 missed rules.

- Of the 398 total rulemaking requirements, 127 (31.9%) have been met with finalized rules and rules have been proposed that would meet 135 (33.9%) more. Rules have not yet been proposed to meet 136 (34.2%) rulemaking requirements.

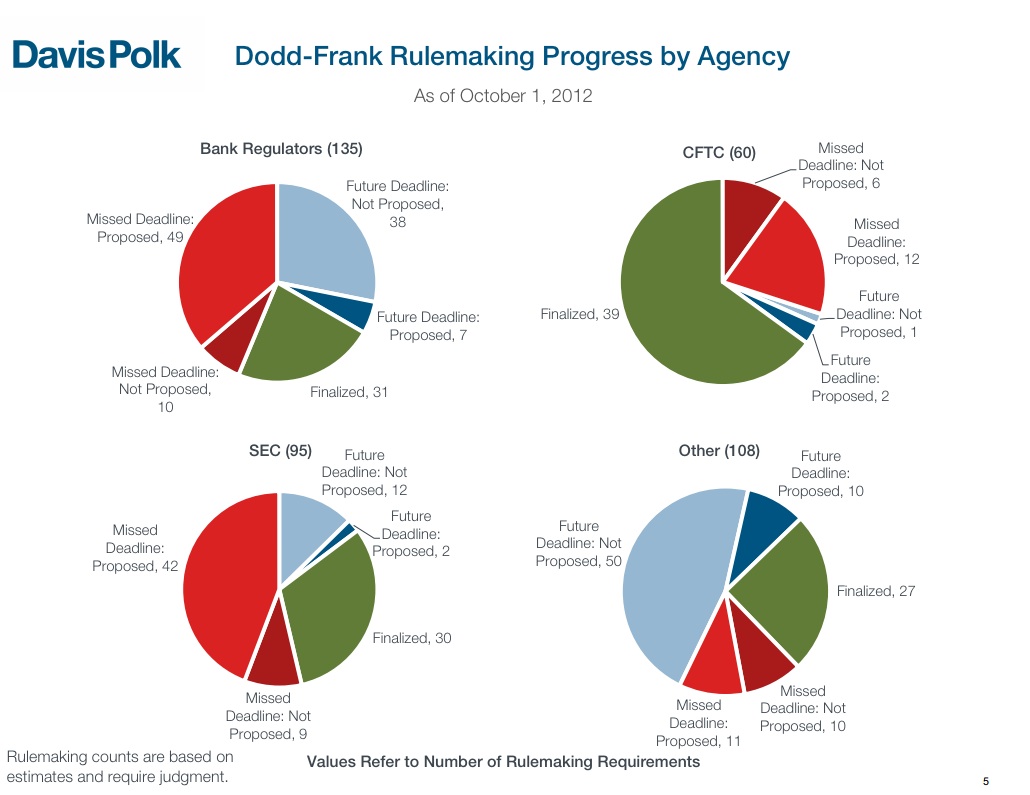

Looking at the progress by agency, we see

The CFTC continues to grind out rules on a more timely basis and with more finalized rules than any other regulator. But to be fair they had the lightest load — less than half of the requirements of the bank regulators and 2/3rds of the SEC. We are still trying to figure out exactly who is “other”.

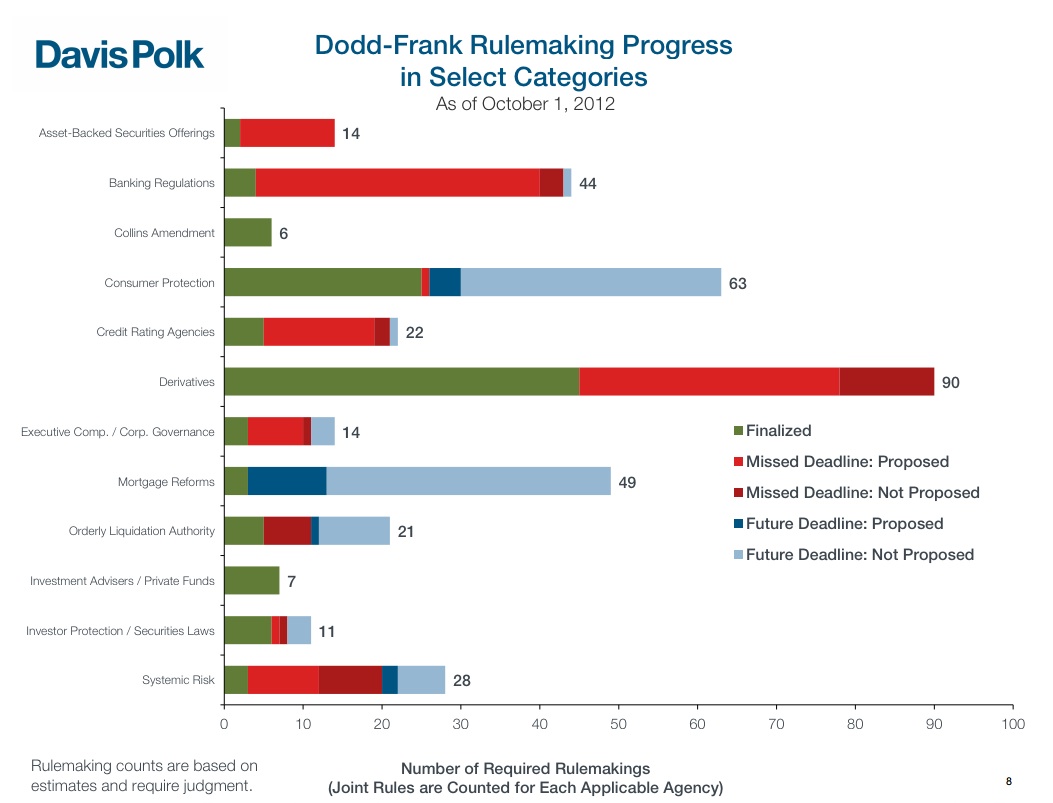

Dividing the rules up by category is interesting, too. Derivatives, Consumer Protection, and Mortgage Reforms are the top three. Banking regulation, surprisingly, only comes in fourth.

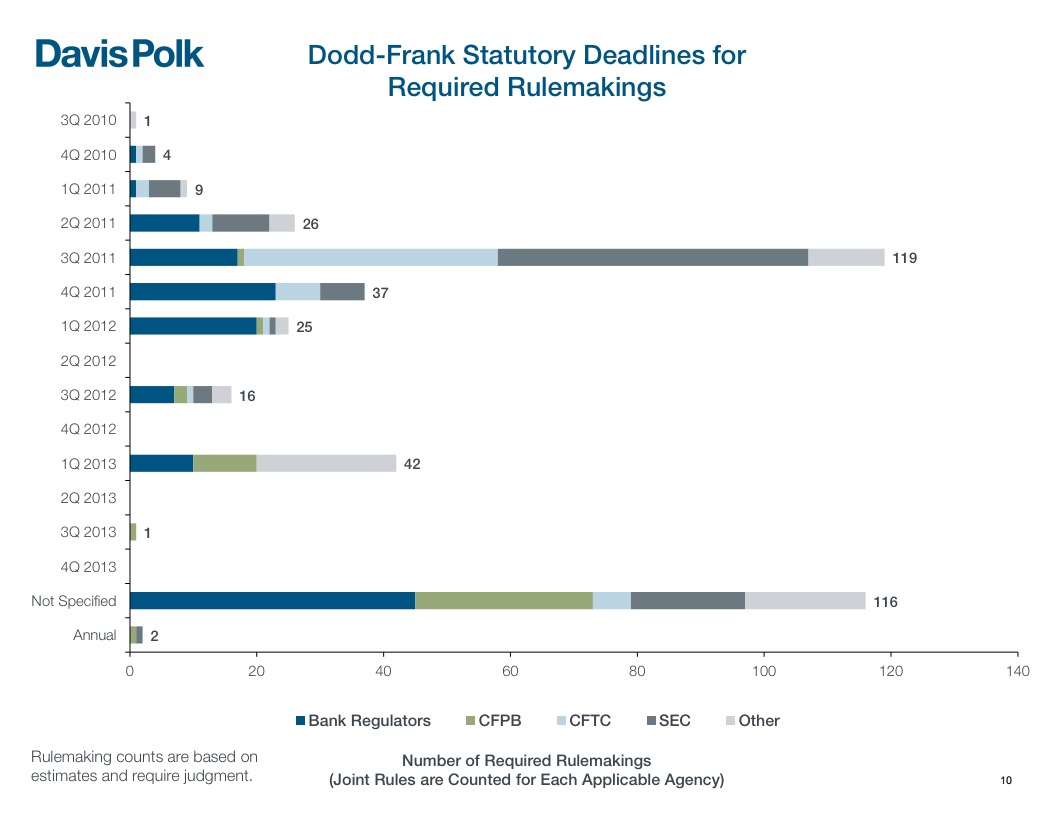

The deadlines for rules have, for the most part, passed. But what is amazing is the number of rules which don’t have a statutory deadline.

From the Davis Polk disclaimer: This publication, which we believe may be of interest to our clients and friends of the firm, is for general information only. It is not a full analysis of the matters presented and should not be relied upon as legal advice.

A link to the report is here.