A July 21st article in the Wall Street Journal “The Volcker Risk Bubble” by John Carney described a study by economists Jussi Keppoy and Josef Kortez about how banks are taking risk via increased US Treasury positions. We wonder if there might be another explanation: LCR.

The BIS described the ways that banks could comply with LCR. Banks could…

“…meet the standard by scaling back business activities which are most vulnerable to a significant short-term liquidity shock or by lengthening the term of their funding beyond 30 days. Banks may also increase their holdings of liquid assets…”

That BIS paper pegged the LCR shortfall at €1.8 trillion.

Goldman, Deutsche and others have cut balance sheet. Back in February we wrote a post “Deutsche to cut their US balance sheet by 25%, much of it on the back of repo”. Just recently there was press about Goldman doing the same. From a Reuters article: date July 15th: “…Goldman Sachs Group Inc (GS.N) has reduced its balance sheet by a total of $56 billion following a balance-sheet review in response to new regulations, Chief Financial Officer Harvey Schwartz said on Tuesday…”

The Fed wrote about WAMs on tri-party financing on less liquid paper extending out — a phenomenon likely driven by LCR considerations — in a Liberty Street blog post “What’s Your WAM? Taking Stock of Dealers’ Funding Durability”. A link to our June 16th post on the topic is here.

So that brings us to the final part of the BIS prescription: increasing holdings of liquid asset. From the WSJ article:

“…According to the paper, banks have managed to maintain their risk-taking in two ways: they have reduced the hedging of their banking books and increased the speculative uses of trading assets not limited by the Volcker Rule. Those assets would include U.S. Treasurys.…”

and

“…In the first quarter, banks grew Treasury holdings by 23%. What may have looked like banks becoming cautious may have actually concealed a move toward post-Volcker speculation…”

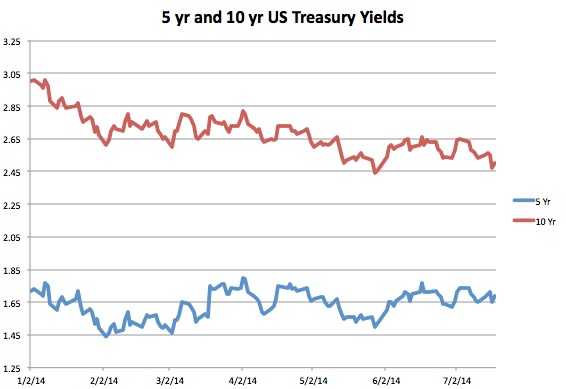

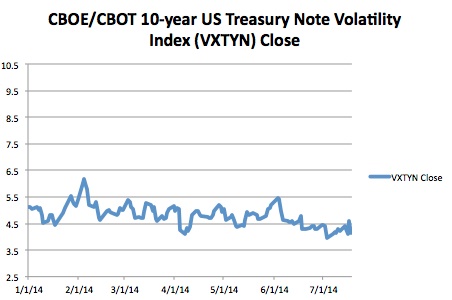

One has to wonder if banks were really increasing their US Treasury holdings as a way to take on additional trading risk. If that has been happening, it doesn’t seem like it has been a very profitable venture. UST yields have been locked in a narrow range and volatility — a trading positions best friend — has been very low. Interest rate futures would probably be a more efficient trading vehicle anyway.

So why would banks be loading up on US Treasuries? Could it be to comply with LCR? We know the rule doesn’t kick in just yet, but many big banks have said they are either compliant now or trying to get there quickly. If this is behind the ramp up in UST positions, that is probably a good thing for the banking system’s stability.