Regulators worldwide now recognize that market liquidity in fixed income is a Problem with a capital P. The interesting part is that in spite of the evidence, there is a struggle to accurately define what has caused the decline and how to reverse it. We look at recent regulatory commentary on market liquidity, what the work plans are, and see a couple of outcomes. Meanwhile, contrary evidence suggests that market liquidity is an obvious albeit indirect result of increased bank stability. Can regulators have both bank stability and market liquidity?

The issue for regulators isn’t whether market liquidity has declined – it has – but how to measure it. Federal Reserve Board Governor Governor Lael Brainard said as much in a July 1 2015 speech: “Recent events and commentary raise concerns about a possible deterioration in liquidity at times of market stress, particularly in fixed income markets. These concerns are highlighted by several episodes of unusually large intraday price movements that are difficult to ascribe to any particular news event, which suggest a deterioration in the resilience of market liquidity.”

This gets complicated though, as market illiquidity is expressed through high volatility but this might come after significant news or for no particular reason at all. Regulators are not keen to define something as a problem until they can measure it statistically, and here’s where the conversation breaks down. According to Brainard, “Although anecdotes of diminished liquidity abound, statistical evidence is harder to come by. Indeed, there is relatively little evidence of any deterioration in day-to-day liquidity. Traditional measures of liquidity, such as bid-asked spreads, are generally no higher than they were pre-crisis.” We noted last week that Fed Governor Daniel Tarullo said pretty much the same thing in a recent interview (“Why has liquidity decreased in the markets? Daniel Tarullo says he isn’t sure.“)

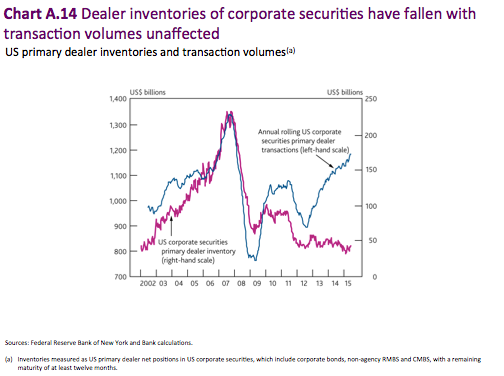

The Bank of England’s Financial Policy Committee tackled this topic in their Financial Stability Report, July 2015. They got to more specific details about market maker inventory vs. trading activity, which was helpful: “To date, transaction volumes have been unaffected; rather, inventories have worked harder – the value of transactions per unit of inventory stock for corporate securities now stands at around 30 compared to six at the time of the crisis.” Chart A.14 shows that dealer inventories of corporate securities are down but transaction volumes are up. The upshot is much less market maker capability to deal with bigger price swings if anything happens at all that is outside a low volatility environment. The Bank of England has its own ongoing work prorgram on market stability.

For most people, the “reasons” behind the liquidity decline are less market maker inventory, less financing capabilities and the rise of automated trading. This can be summed up as just regulation and automated trading. We are legitimately puzzled why regulators haven’t simply stated the obvious: too much regulation has damaged market liquidity. This is avoiding a fundamental problem that has been caused by regulators themselves. Do they not want to admit to being the cause?

The flip side of market illiquidity is greater bank stability. Regulators like this and the Basel Committee only wants more of the same. The latest BCBS review of the CVA framework wants more risks considered and may mandate use of the standardized method (“Review of the Credit Valuation Adjustment (CVA) risk framework – consultative document“). Meanwhile, S&P suggests that banks are faring well through less liquidity exposure to fixed income markets although the markets themselves are worse off (see this Bloomberg article for more.)

Regulators can’t have it both ways: either banks will be as stable as possible with heightened market volatility or banks will be less rock-solid but there will be more market liquidity. All the work plans in the world won’t change this basic fact, and with it the cause of changes to fixed income market liquidity.