So how are the CME Deliverable Swap Futures (DSF) doing? Are they living up to the hope (hype?) that as a margin-friendly alternative to cleared swaps they would take the world by storm? Not so much, at least based on the volume and OI figures.

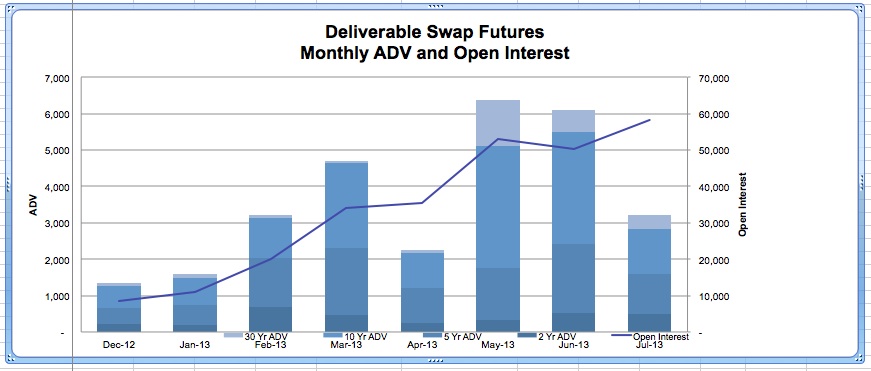

CME data shows that cumulative open interest across all 4 contracts (2, 5, 10 and 30 year) is just below 30,000. Each contract is for $100,000. Monthly average daily volume peaked just below 6,400 contracts a day in May. From the CME website comes the following graphic:

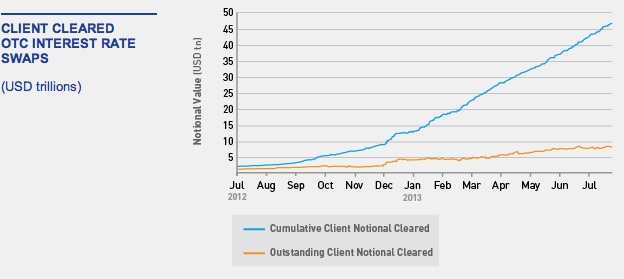

In the meantime, cleared interest rate swaps seem to be booming. Notionals – which we know isn’t a great way to look at things – are growing quickly. According to the July 19th report from LCH, the prior week there was $898 billion in buy-side notional cleared. Cumulative buy-side notional cleared was $46.4 trillion and total client notional outstanding was $7.8 trillion (gotta’ love trade compression and netting to get those outstanding numbers down). From the July 19th data:

The CME cleared swap volumes (and market share, so it appears) are also expanding rapidly. USD Equivalent Open Interest is $2.4 trillion. A graphic from the CME website illustrates:

So can we conclude that DSFs are not getting the critical mass necessary to work? OI in DSF are 0.54% of Eurodollar contract OI, 2.19% of the 10-year UST note future OI. It’s still a little early to write an obituary, but the numbers are hard to ignore.

2 Comments. Leave new

Interesting post. question — if notional isn’t a great way to look at things, then what should we be looking at instead? trade count?

Thanks for your comment. I would point you to two SFM posts we did, “Looking at Derivatives Notional: It makes for good eye-candy but not much else” on March 20th and “More on why looking at derivatives notionals makes for great eye candy but not much” from May 1st. Also, take a look at the OTC Space post “How Big is OTC Really?” on March 22nd. The issue with using OTC notional is that these trades start out with a PV of zero — they are worth nothing when executed. So if the market hasn’t moved, it makes no difference how much notional is outstanding. The numbers to pay attention to are gross & net credit exposure, and (if you can find it) potential future exposure (the result of stressing exposures to worst case scenarios).