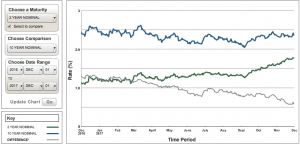

US Treasury yield curves are heading towards a possible inversion; that is, long-term rates could soon be paying less than short-term rates. This is not typically what financial markets want to see and has been called a harbinger of a recession. But we’re in a new regulatory environment where the old rules may have changed. We examine UST data and the argument for and against yield curve inversions as a precursor to a recession.

![]() This content requires a Finadium subscription. Articles with an unlocked symbol can be accessed with free registration. Log in or create a free account by signing up here..

This content requires a Finadium subscription. Articles with an unlocked symbol can be accessed with free registration. Log in or create a free account by signing up here..