In the first edition of Securities Finance Monitor Magazine we tackled the question of where General Collateral (GC) lending was heading in the securities lending market. Using SunGard data, we found that through 2014 GC had remained pretty stable. We then asked asset managers what they thought in our 2015 survey. This suggests some possibilities for new directions over the next year.

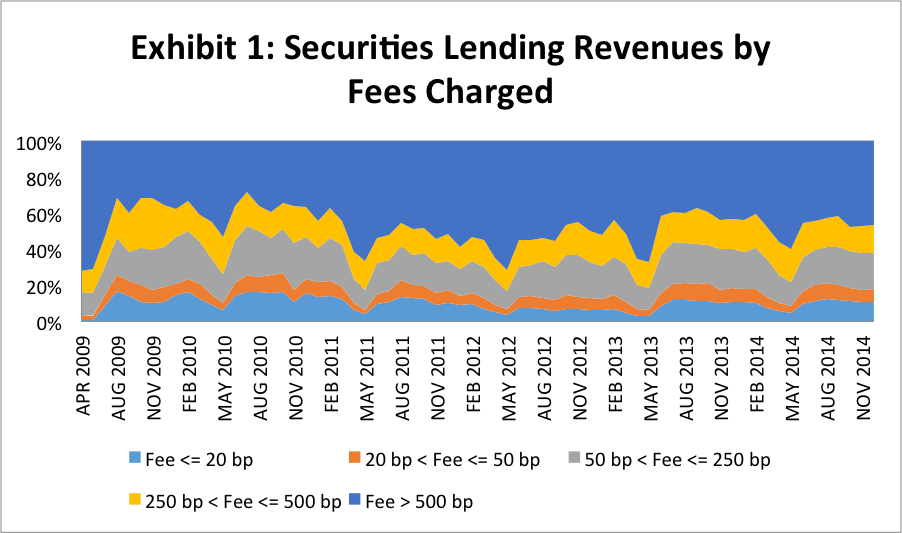

In our SFM Magazine article, using SunGard data from April 2009 to the present, we saw that the revenue generated from General Collateral (GC) loans by lenders has not fallen much at all relative to the market (see Exhibit 1). Excluding the Spring dividend arbitrage season, GC loans have hovered between 11% and 13% as a percentage of revenues.Including dividend arbitrage, in 2011 and 2014, the amount of GC revenue generated remained between 10% and 11%.

Source: SunGard’s Astec Analytics

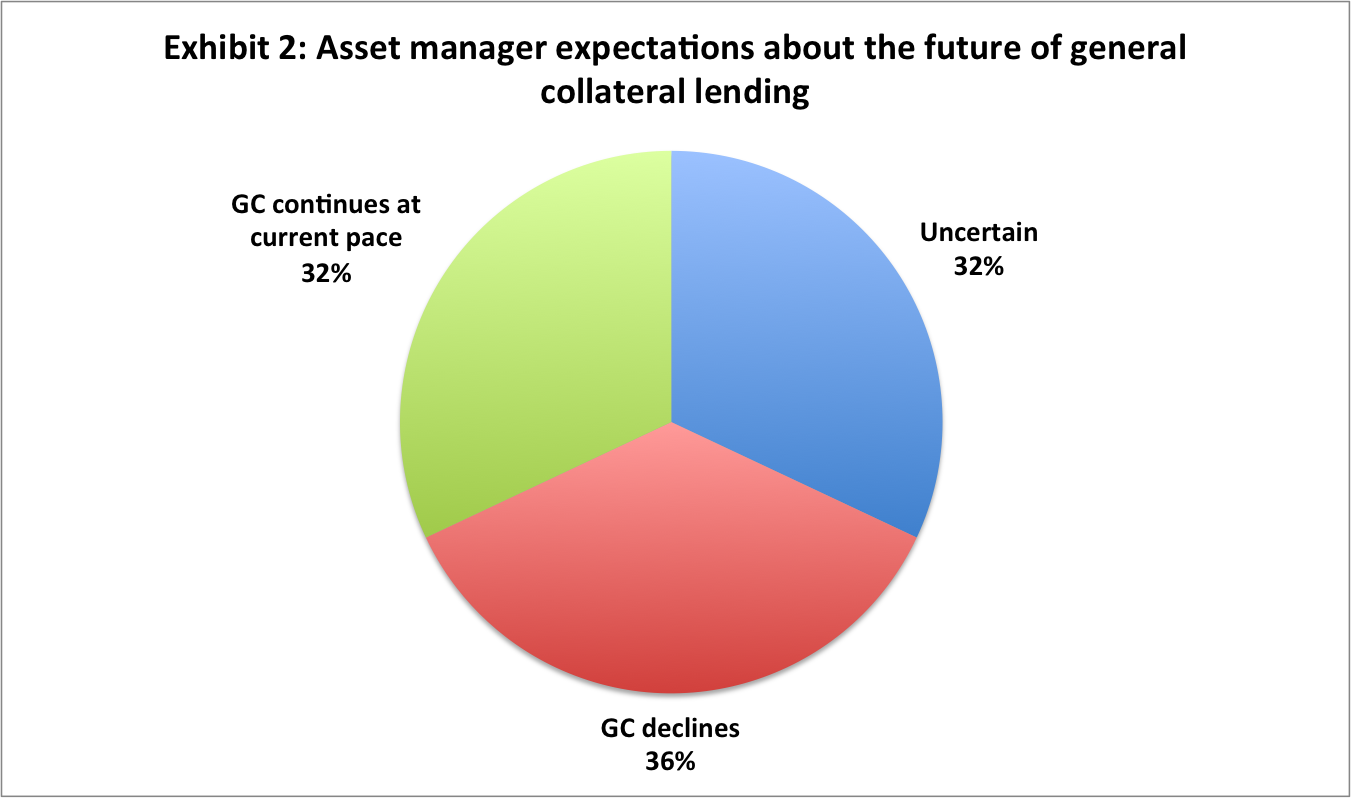

When we spoke with asset managers’ expectations for the near future of general collateral, their responses were mixed, but the long-term outlook appears grim. Not only do the majority of asset managers have minimum fee splits that would preclude general collateral lending at today’s rates, but they say that demand is down. Among the 37 professionals in our survey, 32% thought that GC lending would continue without trouble, 36% thought that GC would decline and the remaining 32% were uncertain (see Exhibit 2).

Source: Finadium

Here are some representative quotes:

“GC lending will always be here. It’s just a question about what the equilibrium levels are.”

– Securities Lending Manager, North American asset manager

“GC is pretty much dead in the water. Not everyone realizes it yet.”

– Treasury Manager, European asset manager

“GC is still an important source of income for us but this is shrinking. It is not clear what we will do if it shrinks dramatically.”

– Securities Lending Manager, European asset manager

We think that the GC market has already changed. Our observations of client data are that government bond lending for government bond or cash collateral is down dramatically from 2015. GC equity lending is still active but liquidity is down. This is important: lenders can still get loans out the door but there are fewer active and aggressive bidders. Lenders that are wholly or largely reliant on GC may want to look closely at their lending policies about now to see how they might want to respond if the GC market gets tighter.