Here’s the monthly update on the crypto fundraising figures. Let’s start with some good examples — Trustology raising $8 million in equity from Two Sigma and ConsenSys, and ErisX raising $28 million from Fidelity and Nasdaq. Those sound a lot like the institutional chassis needed for traditional players. However, from a retail perspective, the crypto markets are not holding their value in an overall downturn, and have been fairly correlated with traditional equities as everything nosedives together. This is in meaningful part, we think, driven by the availability of instruments to take short positions in the market.

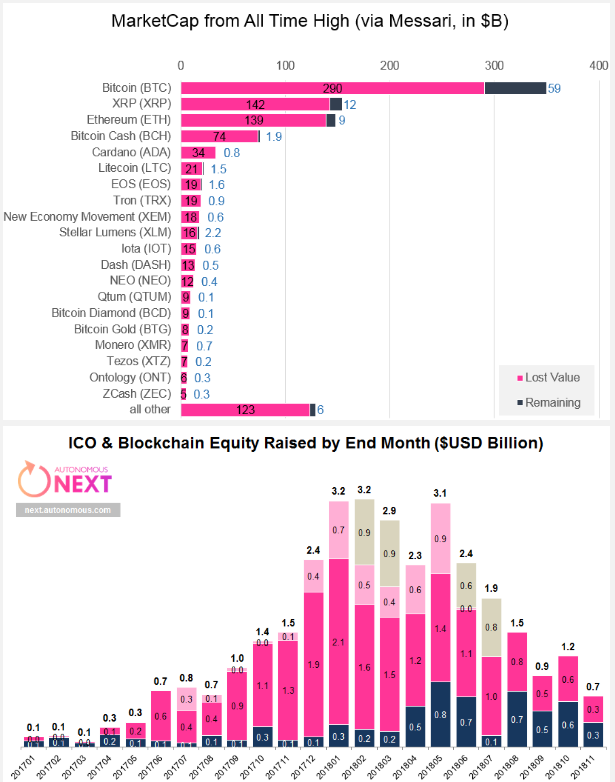

Using OnchainFX data from Messari, Autonomous Next looked at the total loss of market capitalization across their tracked coins from all-time-highs. The answer is that there has been nearly a trillion of burned down value in the last year. But it’s not all doom and gloom: November saw another $700 million or so in blockchain-first funding, again roughly split 50% between token sales and venture investment. The sustained flow of venture is encouraging to the promise of this sector in the future.