- Project Mariana tested the cross-border trading and settlement of wholesale CBDCs.

- Successful trading and settlement of hypothetical euros Singapore dollars and Swiss francs.

- DeFi elements tested in the project, specifically automated market makers, could form the basis for a new generation of financial market infrastructures.

The Bank for International Settlements (BIS) and the central banks of France, Singapore and Switzerland have successfully concluded Project Mariana. The project tested the cross-border trading and settlement of wholesale central bank digital currencies (wCBDCs) between financial institutions, using new decentralized finance (DeFi) technology concepts on a public blockchain.

Project Mariana was developed jointly by three BIS Innovation Hub centers (Switzerland, Singapore and Eurosystem Hub Centres) together with Bank of France, Monetary Authority of Singapore, and Swiss National Bank.

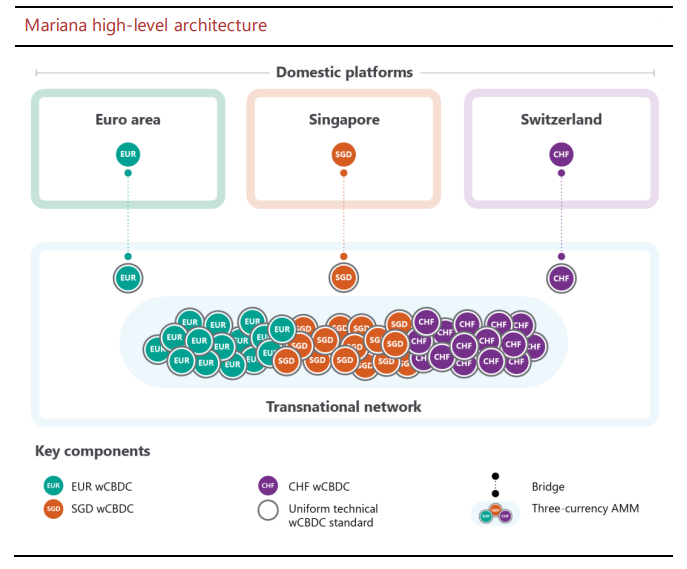

The project’s proof of concept successfully tested the cross-border trading and settlement of hypothetical euro, Singapore dollar and Swiss franc wCBDCs between simulated financial institutions. The process relied on three elements:

1) A common technical token standard provided by a public blockchain to facilitate exchange and interoperability between the different currencies.

2) Bridges for the seamless transfer of wCBDCs between different networks.

3) An Automated Market Maker (AMM), which is a specific type of decentralized exchange to trade and settle spot FX transactions automatically.

For Project Mariana, the AMM pooled the liquidity of the hypothetical euro, Singapore dollar and Swiss franc wCBDCs with innovative algorithms enabling spot FX transactions to be priced and executed automatically and settled immediately. These protocols could be used by the next generation of financial market infrastructures facilitating cross-border trading and settlement between financial institutions.

Project Mariana’s architecture balances central banks’ domestic need for oversight and autonomy with financial institutions’ interest in efficiently holding, transferring, and settling wCBDC across borders. This is achieved through the use of a common token standard on a public blockchain which facilitates interoperability and seamless exchange of wCBDC across varied local payment and settlement systems maintained by participant central banks. As such, Mariana offers possible approaches to factoring an international dimension into current wCBDC design explorations.

As tokenization and DeFi technologies are still nascent, further research and experimentation is needed. The BIS Innovation Hub and its global partners will continue exploring their benefits and challenges based on relevant use cases.

“Project Mariana pioneers the use of novel technology for interbank foreign exchange markets. It successfully demonstrated that it is feasible to exchange wholesale CBDC across borders using novel concepts such as automated market makers. Bringing together a diverse team of software engineers, policy, and FX experts across three Innovation Hub centres and central banks was key to this success,” said Cecilia Skingsley, head of the BIS Innovation Hub.

Collateral

The report noted that the use of AMMs requires the pre-funding of liquidity and their adoption would therefore entail a significant departure from the ex post funding (deferred net settlement) in use in today’s FX markets. All else equal, pre-funding is costly and needs to be weighed against a range of potential benefits.

In future work, the BIS highlighted investigating the economic use of liquidity pool (LP) tokens (eg in payments, repos and swaps). LP tokens are fungible and represent a claim against the underlying assets. In principle, they could be used as collateral in other transactions. However, this was out of scope for the project.