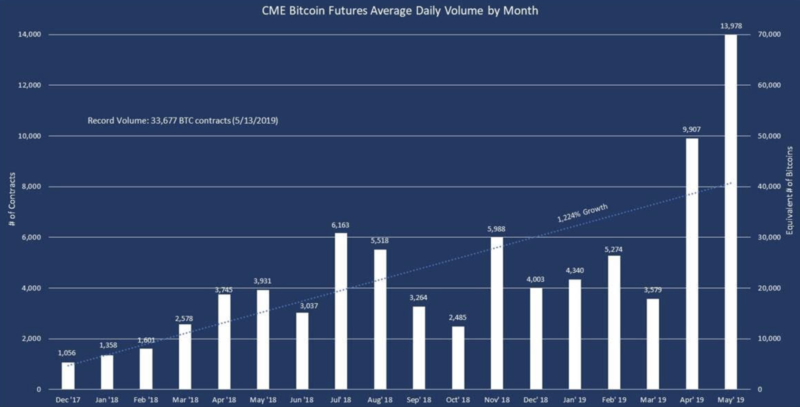

Specifically, the firm saw a record trading day on May 13 with 33,677 contracts having traded hands, the equivalent of $1.3 billion worth of bitcoin. In total, the average daily volume hit a record of 14,000 contracts in the month of May.

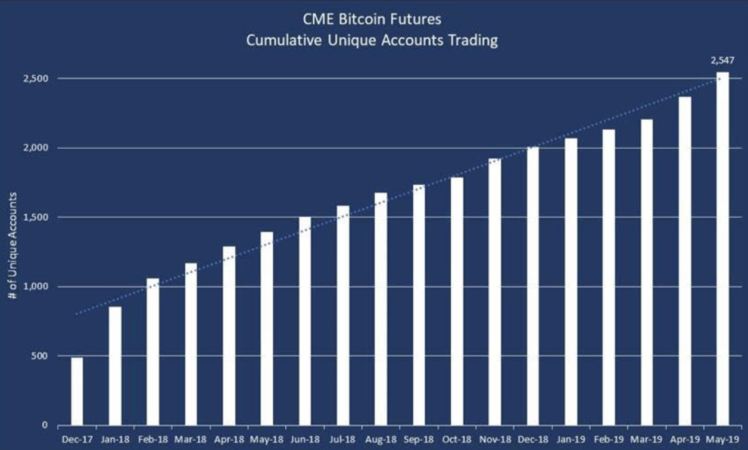

“Since launch in December 2017 we have traded over 1.6MM contracts (+8MM equivalent bitcoin) representing over $50BN in notional value ($4.2BN per month),” the firm said (emphasis is their own). In addition, the number of accounts trading bitcoin futures on CME has grown to an all time high above 2,500.

“The number of unique accounts continues to grow showing that the marketplace is increasingly using BTC futures to hedge bitcoin risk and/or access exposure,” the firm said. CME research shows the bitcoin futures reported its highest comparison to gold futures this May.