Chainalysis released a report looking at a variety of dynamics in the decentralized finance (DeFi) market.

Real-world assets (RWAs) and asset tokenization

Real-word assets (RWAs) are moving on-chain through mass tokenization and quietly changing the landscape of asset management and investment. Real-world assets (RWAs) refers to any asset — tangible or intangible — that derives its value from outside of the blockchain. Asset tokenization refers to the process of converting rights to a non-blockchain native asset into a digital token on a blockchain.

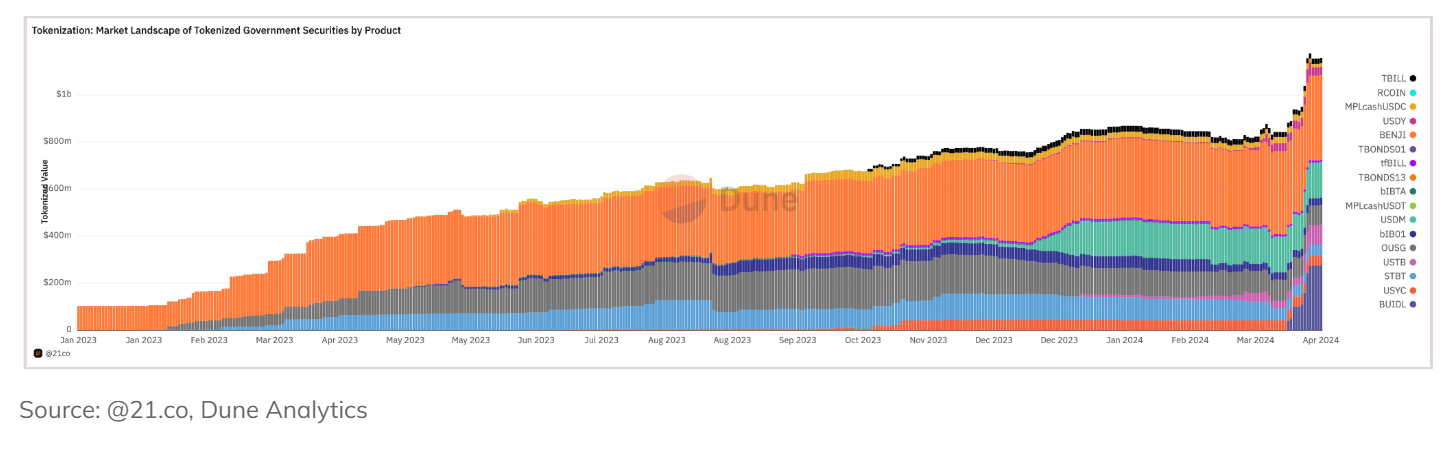

Various types of assets, both tangible like real estate and art, as well as intangible ones such as intellectual property rights, can be represented as tokens. Currently, most RWA projects are focused on tokenizing relatively simple and stable financial instruments, like US treasury bills. According to data compiled by asset management firm 21.co, as of March 26, 2024, more than $1 billion worth of US treasury bonds are now tokenized on public blockchains.

Stablecoins

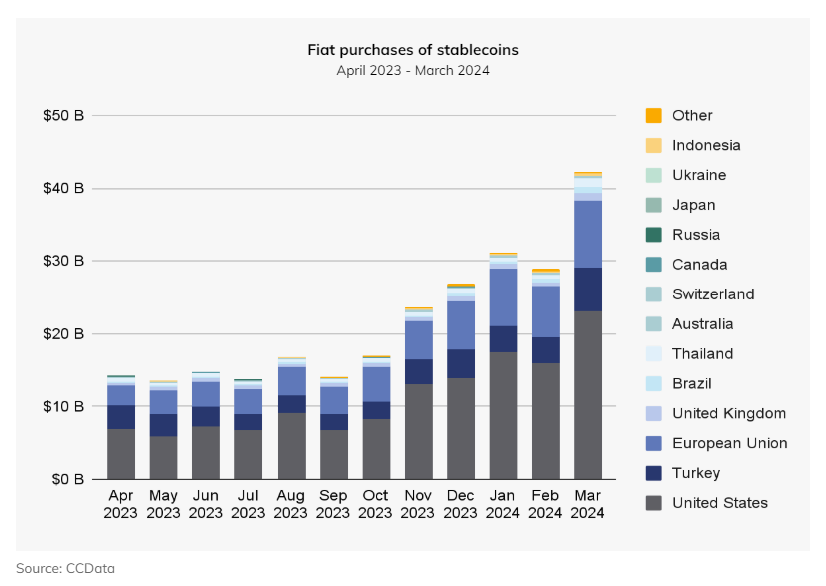

While the United States consistently accounts for the lion’s share of stablecoin purchases, global demand is increasing, with a diverse representation of nations and regions contributing to over $40 billion in purchases in March 2024 alone.

Bitcoin on balance sheet

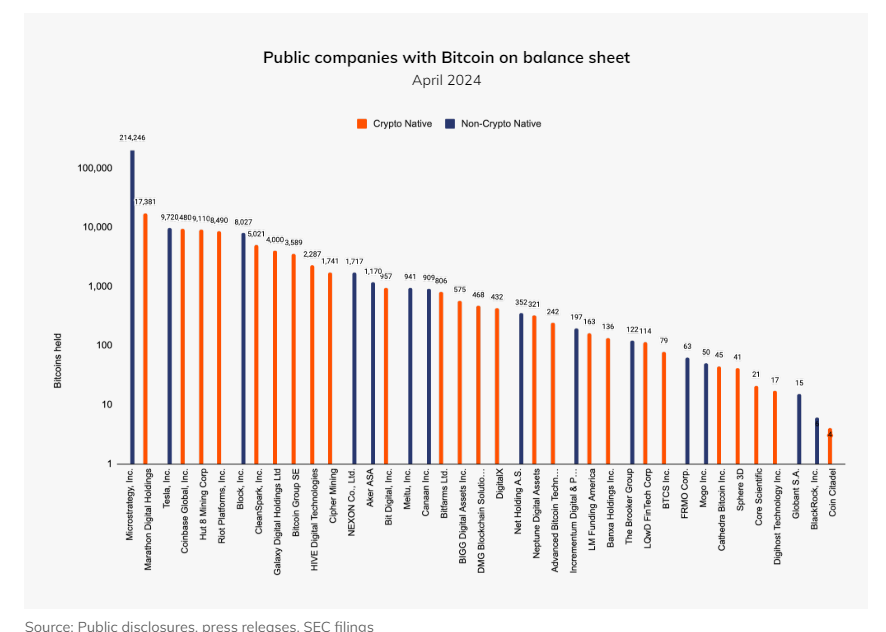

The recent IPO filing by internet forum giant Reddit revealed holdings of BTC, ETH, and MATIC, underscoring the growing trend of public companies incorporating crypto assets into their balance sheets.

Microstrategy leads with 214,246 bitcoin, according to recent reports. Total disclosed bitcoin held by public companies stands at 303,055 BTC. Crypto native companies, such as mining companies, are well represented, holding 65,519 BTC collectively, while non-crypto native companies hold 237,535 BTC collectively, with Microstrategy’s holdings constituting the majority of that number. Microstrategy now holds about 1% of the total finite supply of bitcoin.

“Such disclosures not only reflect the widening acceptance and legitimization of cryptocurrency in the corporate world, but also signal a positive outlook for the market at large,” Chainalysis wrote in a recent report.

“When prominent companies publicly commit to holding cryptocurrencies, it can stimulate investor confidence and interest, potentially leading to increased growth in the space.”

The report noted that there are public companies that have disclosed that they hold bitcoin but are not included in the above totals since the specific amount has not yet been revealed, such as Reddit and R8 Capital Investments PLC, formerly Mode Global Holdings which previously disclosed holdings of 85 bitcoin.