Recent market conditions, impacted by events such as COVID-19 and Ukraine-Russia geopolitical developments, have demonstrated the pivotal role of repo in financing the real economy. On top of capacity limits, banks face constraints arising from the Basel III framework, leading them to review their funding and repo strategies. For the non-cleared repo market, there is also a potential push toward mandatory clearing and/or the introduction of regulatory bilateral haircuts in some jurisdictions. These factors demonstrate the need for repo market participants to widen their access to additional and deeper liquidity pools with a broad, active participant base. This paper examines the current state of the repo market and the challenges for participants and provides an overview of the clearing solutions LCH provides. It also outlines the complementary services LCH and London Stock Exchange Group (LSEG) offer to help optimise operations and support regulatory compliance.

Summary

Key Points

- Bilateral vs. cleared: the winds of change

Counterparty risk management is increasingly being addressed through cleared solutions - Market intermediation challenges

Due to growing debt issuance, there is a need to increase dealer capacity for repo trading - Sell-side balance sheet benefits

Pressure on bank balance sheets can be alleviated through netting in a cleared liquidity pool - LCH hybrid membership models

Sponsored Clearing and Guaranteed Sponsored Clearing offer solutions for connecting the buy-side and sell-side efficiently - LCH RepoClear’s operational and settlement efficiencies

LCH RepoClear increases operational efficiency through settlement netting and by using industry standard best practices - LCH’s suite of ancillary services

LCH’s non-clearing solutions meet members’ objectives in terms of reporting, optimisation and collateral management

Bilateral vs. Cleared Repo: A Pivot Point

Regulatory imperatives to minimise and contain systemic risk in the financial system raise a number of challenges. The most recent major capital requirements regulation, Basel III, imposed significant constraints that market participants are still adjusting to, and the repo market was significantly impacted. Sell-side repo market participants are having to be increasingly mindful of the impact on their regulatory resources and the overall efficiency of their transactions. Buy-side participants need to seek the deepest and most reliable liquidity pools. In the current uncertain environment, the value of access to plentiful and liquid collateral markets should not be underestimated.

During the peak of the COVID-19 crisis, repo demand from the buy-side increased dramatically due to the need for cash. However, banks struggled to provide an adequate level of intermediation, being bound not only by their own capital and balance sheet constraints, but also by operational capacities.

The need for solutions

In response to the impact of COVID-19, government and corporate debt issuance increased, and this increase will continue to generate challenges. There is, therefore, an important systemic need to better connect cash lenders and security holders to ensure that liquidity access is as smooth and deep as possible. Repo is a major component of liquidity and collateral management, and the recent growth in size of the repo market demonstrates the need for additional capacity to support the required levels of intermediation.

“The size of the Treasury markets will outstrip the capacity of dealers to intermediate the market.” – Darrell Duffie, Stanford University

Traditionally, the cleared market has been dominated by interbank dealer-to-dealer participants, whereas the non-cleared market is more dealer-to-client oriented. Cleared repo offers many advantages to dealers, including benefits to counterparty credit risk exposure and risk-weighted asset (RWA) calculations. Previously, however, some market participants, including pension funds, hedge funds, insurance companies, money market funds and corporates, were unable to join CCPs.

Cleared and bilateral repo both pursue the same goal: to provide short- and long-term secured financing liquidity. Indeed, cleared and uncleared repo complement each other to the benefit of market participants. When balance sheets become constrained and demand increases, the requirement for buy-side entities to access reliable, deep sources of liquidity (e.g., via cleared repo) is even more obvious.

In the future, we expect government bond repo markets will be cleared by a much broader section of buy-side participants.

Trade Economics: The Imbalance of Price vs. Risk and Capital

The current spread observed between cleared and bilateral repo illustrates a less rigorous counterparty risk management on the uncleared bilateral side. Dealers need to consider the counterparty risk holistically when making balance sheet allocation decisions.

When comparing the repo rate between bilateral and cleared repo, the obvious consideration with the latter is the additional margin cost as a result of more robust risk management.

The bilateral/cleared imbalance must be addressed

LCH encourages regulators to consider the liquidity landscape and whether a rebalancing of the overall cost between cleared and uncleared repo is needed to promote greater adoption by the market of risk management best practices.

If the regulatory objective is financial stability with improved access to liquidity, clearing should be part of the solution to achieve it.

LCH is working alongside regulatory and industry bodies and partners to increase recognition of the role the CCP plays in the stability and liquidity of the repo market, which we hope will translate into the recognition of the specificities of the role of sponsoring agents in terms of capital and balance sheet treatment.

Use case

This can be illustrated using the simple case of a repo and a reverse repo on a European government bond, with two buy-side counterparties rated AA+.

The uncleared repo rate with no haircut applied may be similar to the cleared repo rate (where margins are required). However, non-cleared trades will incur additional charges, namely:

- Cost of capital

- Balance sheet management

- Additional funding costs due to potential Net Stable Funding Ratio impact

- Comparing the cost of capital, initial margin (IM) for a cleared trade would attract a CCP treatment capital charge of 2%, whereas SA-CCR will be triggered for an uncleared trade applying a risk weight of either 20% for a highly rated counterparty or 100% for a lower-rated counterparty.

Additionally, the default fund contribution for a cleared trade should only be capitalised on the real exposure (Kccp), while the uncleared trade would require margins to be capitalised on full flows.

An additional and substantial benefit of clearing for the sell-side is balance sheet usage, given that no netting is allowed between different counterparties for uncleared trades.

The additional cost for liquidity metrics (mainly NSFR in this case) will force the bank to rebalance the Required Stable Fund (RSF). Given the impact of reverse repo on RSF, this cost will certainly outweigh the residual benefits of the bilateral uncleared repo rate.

Balance sheet netting, collateral optimisation and reduction of counterparty credit risk are among many elements that are often not directly priced but that have a significant effect on the total cost of the transaction when looking further than the headline repo rate itself.

With the requirement for increased market intermediation, balance sheet netting will become of paramount importance for market participants to allow a steady pace of trading volume.

Moreover, market standardisation in respect of trading flows and margining reduces the comparative operational costs as an uncleared trade is much more manual and time intensive.

There is a need to include the holistic cost of a transaction and IM optimisation, with both already being actively managed and eased through clearing.

In times of uncertainty, extra cost implied through higher cleared margin is largely offset by the benefits a CCP can deliver. Given the current situation, these benefits are likely to grow further.

A Hybrid Model to Better Reflect Current Market Structure

The conditions for becoming an LCH member were originally designed for the bank community and were previously unsuitable for buy-side participants looking to join LCH RepoClear. Conscious of the need to allow more actors to be able to clear, and therefore increase the depth of the liquidity pool and market stability, LCH successfully launched Sponsored Clearing in 2017 at LCH Ltd (for Gilts) and in 2021 at LCH SA (for Euro Government debt). Subject to regulatory approval, a Guaranteed Sponsored Model that broadens the type of entities allowed to join the clearing services is targeted for launch later in 2023.

With these buy-side clearing membership models, the direct relationship between dealer and client is maintained, with the additional benefit of cleared transaction risk management.

Sponsored Clearing is an avenue for efficient intermediation. A more streamlined process is necessary to allow those who need cash transformation to meet those with funding capacity or a need for collateral. Simply put, Sponsored Clearing allows more participants to access the CCP, increasing further the benefits to the ecosystem as a whole.

With buy-side clearing models in repo, members can trade over an MTF/RFQ platform in the usual manner and flag the trades for clearing.

Guaranteed Sponsored Clearing is a new hybrid model that will likewise allow CCP access to additional participants, such as hedge funds, that do not satisfy the minimum Internal Credit Scoring or the Net Asset Value threshold requirement to gain direct or sponsored membership. In the Guaranteed Sponsored model, the agent (sponsoring bank) will act as a guarantor, alleviating the mutualisation of the risk of such entities to direct members or to LCH itself.

Allowing this population to access cleared repo will enable a tangible increase in the size of the liquidity pool, foster the development of the sponsored eco-system, and reduce bank intermediation constraints.

Ultimately, once the trade is cleared, all parties to the trade (including the guaranteed member – the agent) benefit from an efficient and consistent risk and margin framework.

Through these three types of membership – classic bank membership, Sponsored Membership and Guaranteed Sponsored membership – LCH is broadening the spectrum of potential members, enabling both buy-side and sell-side access to a deep pool of repo liquidity.

Our role as a CCP is to alleviate this imbalance between cleared and uncleared by giving access to new segments of the buy-side community through adapted membership models, while achieving capital savings for the sell-side.

Improving Operational Efficiencies

LCH offers a variety of services to help members and clients manage their risk more effectively and reduce their operational burden.

The disruption caused by the pandemic has shown why it is critically important for firms to understand and manage risk in their processes and invest in their resilience.

The Basel Committee on Banking Supervision (BCBS) has produced Principles for Operational Resilience that emphasised continuity of critical services. This policy statement could be viewed as reinforcing regulations that have already been implemented, such as Risk Data Aggregation and Risk Reporting, Recovery, Resolution Planning Framework and Sound Management of Operational Risk.

Information for sound decision-making needs to be centralised and readily available to ensure the best price and execution. Can this be achieved in the bilateral market?

As trading volumes increase and the number of market participants grows, unified, centralised, reliable data and connected infrastructure are becoming crucial.

LCH, as part of LSEG, can help with the challenges market participants face.

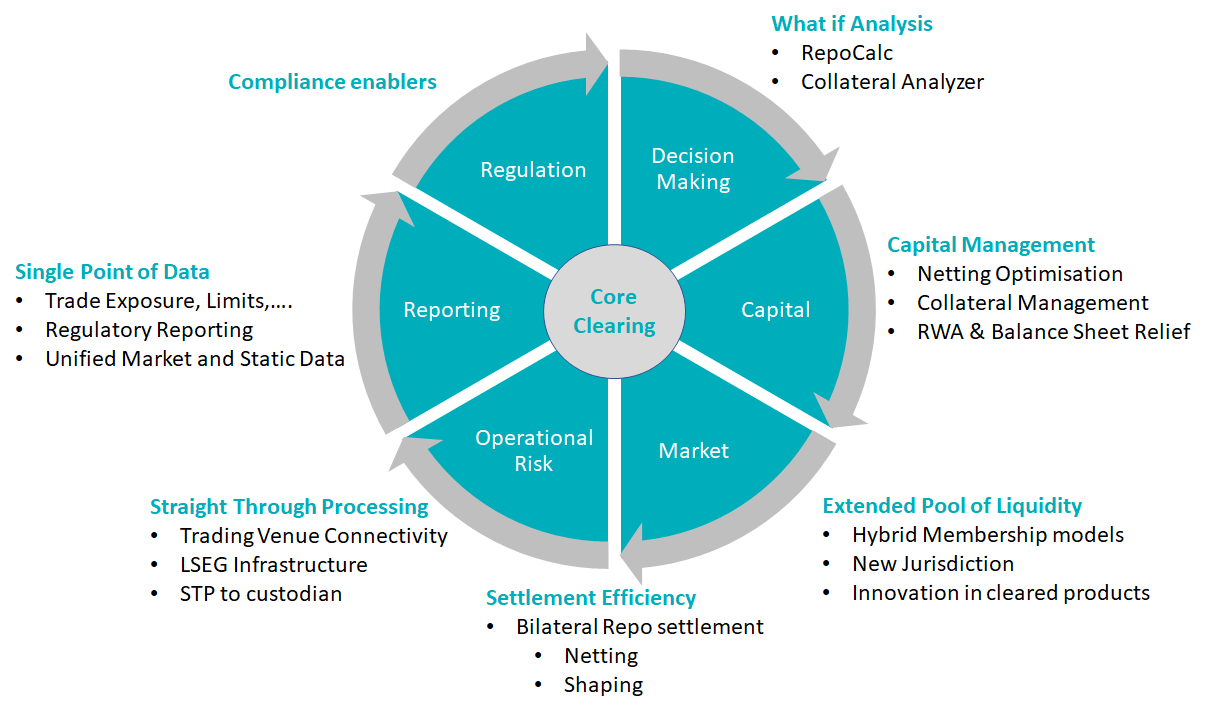

On top of its core clearing services, LCH has developed additional services to support smooth and straight-through processing (STP), from the executed trade to regulatory reporting and collateral management:

- Trade Venue Connectivity

- Collateral Optimisation

- Reporting

- Data & Analytics

- Settlement Efficiency

Trade Venue Connectivity

Open access connectivity with trading platforms allows participants, including those using the sponsored model, to submit a trade into clearing simply and easily via the route of their choice.

LCH RepoClear Margin Calculator

Members can pre-analyse trades and their margin implications using the Margin Calculator, which provides a holistic view of a transaction’s margin requirements.

Collateral Analyser

In addition to providing limits and eligible collateral, the Collateral Analyser offers recommendations to optimise and minimise the cost of collateral posted to the CCP, including both cash and non-cash options.

Reporting and Data & Analytics

In response to the increasing regulatory requirements around data control and management, UnaVista, an LSEG business, in conjunction with LCH, has developed data reporting management tools that satisfy both regulatory management and internal operational risk management thresholds.

By factoring in the pressure on data for FRTB (Non-Modellable Risk Factor, static data for SA-CCR), UnaVista’s Data Analytics and Reporting solution has become a very valuable tool for many market participants.

Settlement efficiency

Settlement fails are significantly reduced through clearing with LCH, as a result of settlement netting and STP processes, and also as a result of the size of the liquidity pool.

In order to help its members improve their settlement performance, LCH created Settlement Monitor. This serves as a control tower for members, who gain the ability to monitor all their obligations more effectively, delivering and managing their settlement performance by directly instructing the CCP.

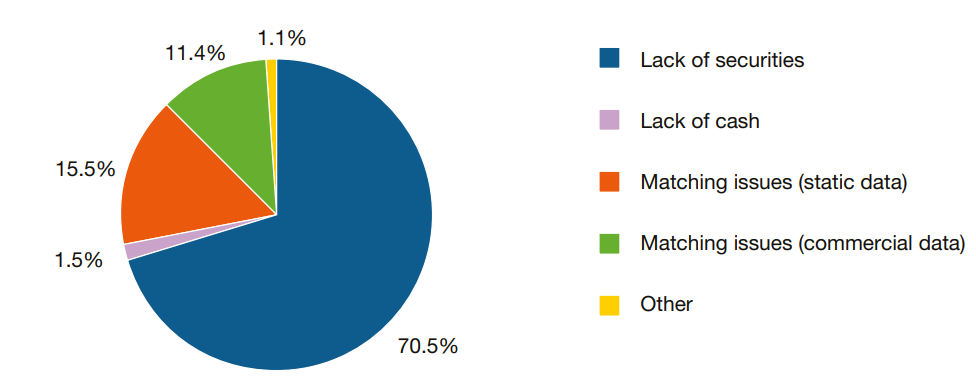

Main Causes of Settlement Fails

Source: ERCC Settlement Efficiency Survey – February 2022

LCH – Through the cycle services

Conclusion

The current market uncertainty and, more broadly, the global state of the economy, has reinforced the increased need for repo clearing by a greater number of market participants. The current observed imbalance between the bilateral repo market and the cleared repo market tends to just be a gross comparison on price.

When considering the overall cost of a transaction, even with zero or low haircuts on government bonds applied in the uncleared market, clearing is becoming increasingly attractive for both the sell-side and buy-side.

From the buy-side perspective, simplified – and, more importantly, reliable – collateral transformation at a fair price is required. Enabling access to clearing will enhance liquidity management options for the buy-side. The reliability of liquidity access in traditional markets, where banks intermediate in the bilateral market, is decreasing due to trading capacity constraints and settlement failure.

From the sell-side point of view, the challenge is being able to manage intermediation both in terms of capabilities and balance sheet.

The hybrid clearing models developed by LCH satisfy both buy-side and sell-side requirements and constraints.

LCH continues to work with industry bodies to find the most resilient risk solution, while adapting to external and regulatory constraints. This is achieved through:

- Development of cleared repo models to increase intermediation capabilities

- Lobbying for better recognition of these cleared repo models within capital treatment

- Additional services to better manage risks, capital and balance sheet

- An innovative approach to mitigating operational risk

LCH and LSEG can help market participants plot the path to more liquidity and robust, resilient risk management.

Further reading

- Client clearing: access and portability – BIS – September 2022

https://bis.org/cpmi/publ/d210.htm

- The repo market under Basel III – Bank of England – December 2021

https://bankofengland.co.uk/-/media/boe/files/working-paper/2021/the-repo-market-under-basel-iii

- Reserves were not so ample after all – Copland/Duffie/Yang – July 2022

https://www.ecb.europa.eu/pub/conferences/shared/pdf/20221010_mon_pol_conf/Duffie_paper.pdf

- A guide to best practice in the European repo market – ICMA – March 2022

https://www.icmagroup.org/assets/ERCC-Guide-to-Best-Practice-March-2022.pdf

- Collateral cycle – Bank of England

https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2022/margin-procyclicality-and-the-collateral-cycle.pdf

- United Kingdom: Financial Sector Assessment Program – Vulnerabilities in NBFIs, market-based finance and systemic liquidity

https://www.imf.org/en/Publications/CR/Issues/2022/04/07/United-Kingdom-Financial-Sector-Assessment-Program-Vulnerabilities-in-NBFIs-Market-Based-516267

- Assessment of show banking activities: Risks and adequacy of post-crisis tools to address financial stability concerns

https://www.fsb.org/2017/07/fsb-publishes-assessment-of-shadow-banking-activities-risks-and-the-adequacy-of-policy-tools/

- ICMA – European Market Survey

https://www.icmagroup.org/assets/European-Repo-Market-Survey-April-2022.pdf

- The netting efficiencies of market-wide central clearing

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr964.pdf