Derivatives compression at OSTTRA is a global success story but can it be applied successfully to repo? Over the last 25 years, we have reduced the derivatives notional exposure of dealers by trillions of dollars, reducing systemic risk and creating balance sheet savings for participants. New incentives for bank risk reduction now are on the horizon: the Basel III Endgame, Basel Committee proposals on calculating G-SIB scores daily instead of annually, T+1 settlement and even climate change require that banks evaluate their options for further balance sheet savings. A fair question being asked is, could compression apply to repo markets, how would it work and what could it save?

Conceptually, repo compression is an attractive idea. By reducing the notional exposure of positions on banks’ balance sheets, banks will naturally save on RWA, G-SIB and Leverage Ratio costs tied to credit exposure and gross assets and liabilities. A lower requirement for balance sheet on the repo desk could make banks more competitive or give them a stronger internal argument when they need an allocation. In technology and risk, fewer positions mean less calculations, which means fewer opportunities for error and lower cloud computing costs. Regulators may also find compression attractive, since lower notionals mean less systemic risk from less interconnectivity between leveraged insitutions.

OSTTRA conducts portfolio compression runs for cleared and uncleared interest rate swaps, cross-currency swaps, credit default swaps, FX forwards and commodity swaps. Given the economic similarities of these products to secured financing, it could make sense that compression could apply to repo also. But before jumping in, there are some facts to consider.

What would repo compression require?

The derivatives market supports multiple conditions that must also be met for the repo market to benefit from a compression service. These include:

- Term. Transactions need to be outstanding for some period of time: the longer the term, the more viable and attractive the compression idea becomes. This duration of transactions is part of why running compression every second week works well in liquid interest rate derivatives, but a focus on term puts a ceiling on how much money market participants could save in repo since the majority of transactions are overnight/open. Compression has to occur more frequently than the average length of the contract it compresses to be meaningful.

- Two-sided books. Participants need two sided books, which means compression focuses on dealers. One-sided clients like money market funds investing cash or hedge funds financing collateral are not viable compression clients since there are no trades that could be reduced.

- Fungibility. Trades and instruments need to be fungible. The more common the term, the easier it is to compress the trades. In repo, this could result in limiting the service to General Collateral transactions.

- Market concentration. Repo is a concentrated market with a long tail; if enough dealers in the top 20 have enough positions with one another then compression would make sense. This is the case in FX forwards and credit default swaps where the majority of the market is traded by roughly 20 dealers. In repo however, if a large portion of business was with a broadly diversified set of smaller dealers, then compression would add less value.

- CCP or market cooperation. Derivatives clearing on CCPs is an attractive market for compression, given the standardization of discounting and no bilateral customized agreement. CCP repo compression under a US mandatory clearing rule for US Treasury repo or in Europe at LCH or Eurex could work, but might take some time to go live due to the additional complexities of rule books and the additional regulatory requirements on CCPs. Compression across bilateral counterparties is easier to set up but may result in more fragmentation at the end of the run given customized agreements and bigger valuation discrepancies between counterparties.

How much could be compressed in repo?

Since repo compression relies on transactions that are outstanding for a period of time, the portion of repo that would most likely benefit are term trades over 30 days. In the US, the percent of US Treasury (UST) term transactions outstanding on the books of primary dealers in March 2024 was $861 billion, $592 billion of which was in reverse repo and $270 billion was in repo, according to Federal Reserve Primary Dealer data. This was 26% of the reverse repo total and 12% of the repo total. There is also an unknown portion of the $1.7 trillion in UST reverse repo and $2 trillion in repo that is booked overnight or under 30-day term but is held for a long duration; this could be considered term if both counterparties agreed to change the formal contractual obligation. Primary dealers form the type of concentrated market that benefits from compression.

In Europe, EUR 2.1 trillion of the EUR 10.8 trillion in both reverse repo and repo volumes were term over 30 days, according to ICMA’s repo survey conducted in June 2023. There was another EUR 6.7 trillion in under 30-day volume that could potentially be recategorized as term if compression were a service. On the downside, the ICMA survey captured 62 entities. Depending on the distribution of the volumes, this may be too large a number for viable compression and may reduce the amount of available assets.

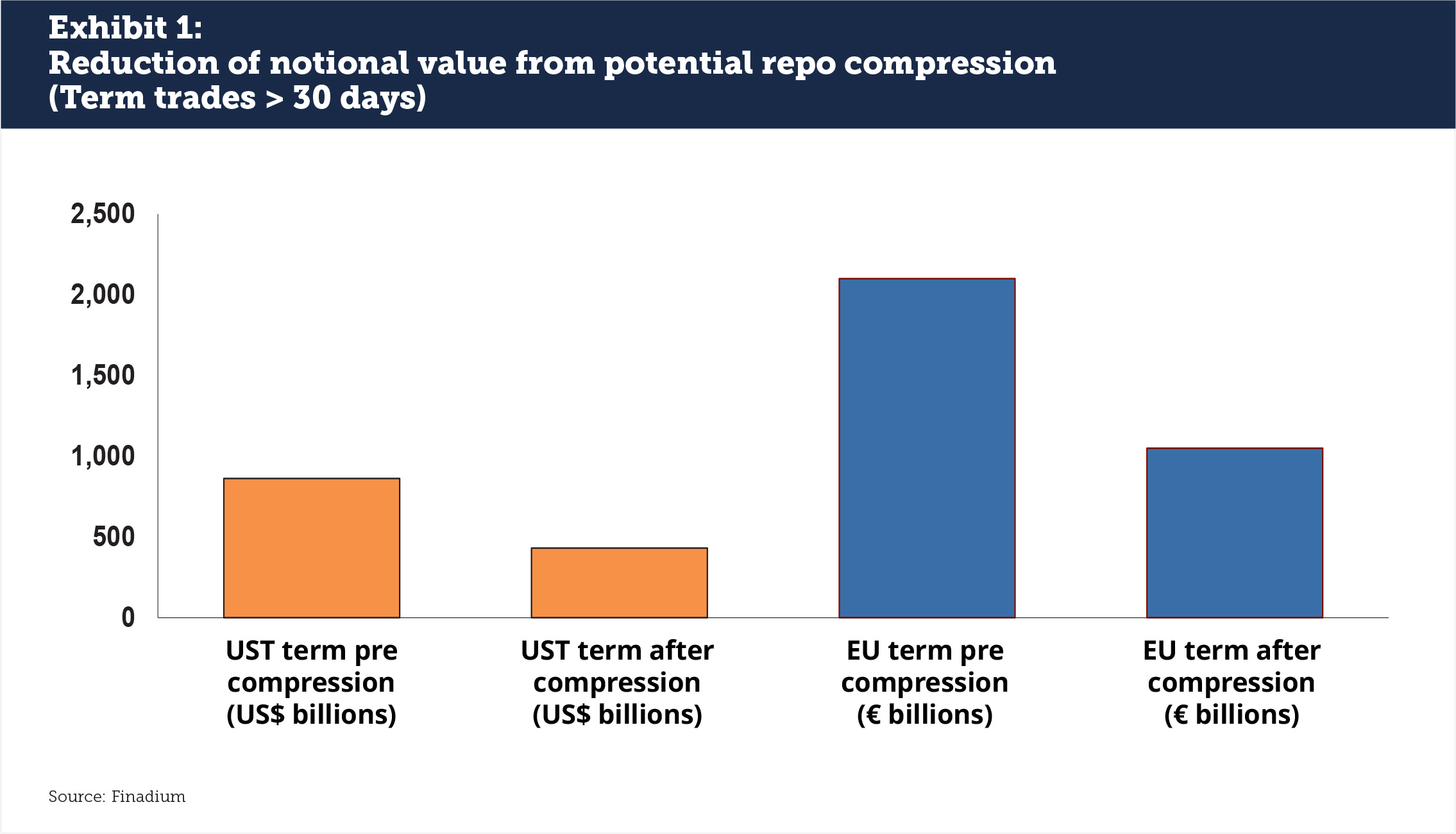

In derivatives markets, initial compression exercises have reduced notional values by 50%-80%, depending on trades and currencies. If even 50% of UST repo trades with over 30 days of term at primary dealers in the US and 50% of European term volume over 30 days were reduced, that would take away 9.5% of total UST notional volume and 9.7% of total European notional. Removing $431 billion and EU 1.05 trillion of balance sheet heavy, low margin transactions could be meaningful when looked at through the lens of balance sheet capacity (see Exhibit 1).

Avoiding physical settlement: an opportunity for DLT?

The market would also need to solve the question of how collateral and cash would move to settle the results of a compression exercise. Derivatives are easy in this respect: they are paper agreements that can be torn up and replaced with a smaller set of contracts by counterparty. Repo on the other hand requires that custodians and triparty agents engage to effectuate the movement of cash and collateral for both practical and contractual reasons. Any compression effort that ignores physical settlement will not get far.

OSTTRA has seen this challenge before in other markets with physical settlement. Compressing a portfolio of short dated oil contracts seems like a good idea until there is an oil tanker in the ocean on its way to a port. Likewise, metal or commodity futures with physical delivery elements present challenges for compression.

In repo and collateral, this condition gives rise to the idea that incorporating Distributed Ledger Technology (DLT) could make repo compression viable on a broad scale by removing settlement friction. A digitized ISIN could be used as the representation of the asset or cash while keeping the actual securities or cash immobilized at a custodian. A compression service could then direct the registry of the ISIN to make changes to the digital ledger; a trade registry or database that needs to be updated is much easier for compression to direct than asset transfers.

A similar model could be applied to triparty although given the number of triparty agents in the market, compression could turn into a series of smaller exercises that miss liquidity pools. It could be that attempting compression by triparty agent would lose the concentration of market participants or assets that is a prerequisite for a successful service.

OSTTRA is in the repo market already – should compression be next?

OSTTRA already has services that support post-trade repo processing, including the automation of affirmation and confirmation, lifecycle event management and allocation processing via OSTTRA MarkitWire. By creating a legally confirmed record, OSTTRA helps meet growing regulatory demands to increase settlement efficiency, minimising trade breaks due to a consistent data model and reducing trade confirmation processing times from days to minutes. In addition, transactions previously captured on OSTTRA MarkitWire can soon be leveraged to achieve settlement STP through SWIFT connectivity to custodians and depositories. The OSTTRA reconciliation service triResolve ensures the accuracy of repo portfolios on a multilateral basis, with streamlined exception management processes.

The next step for analysis will be the involvement of large dealers. While an initial review of data suggests that term repo trades reported over 30-days are a large enough market to make an impact, only dealers have the information on their books to confirm the hypothesis. Further, dealers can identify what percent of their overnight of under 30-day repo transactions are term in disguise by virtue of informal agreements or evergreen contracts.

If enough dealers are interested and there is a concentrated, two-sided market of size with adequate term, OSTTRA would continue the conversation. Repo could be the next opportunity in portfolio compression. We invite the market to come talk with us about the possibilities.

About the Author

Magnus Jonsson is the head of Optimisation Product Design at Osttra and is responsible for new initiatives and service enhancements for the Reset, triReduce and triBalance services. Prior to heading up this newly formed team, he led the business management team for triReduce and triBalance. He has held a variety of different roles in his 17 years of experience working with Post Trade Optimisation services at TriOptima/OSTTRA.

Magnus Jonsson is the head of Optimisation Product Design at Osttra and is responsible for new initiatives and service enhancements for the Reset, triReduce and triBalance services. Prior to heading up this newly formed team, he led the business management team for triReduce and triBalance. He has held a variety of different roles in his 17 years of experience working with Post Trade Optimisation services at TriOptima/OSTTRA.

Thanks to Neil Taylor for contributing to this article. Neil is responsible for Repo business development at OSTTRA.

For more information on OSTTRA services, please contact info@osttra.com

This article is for information only. OSTTRA Group Ltd and its subsidiaries including TriOptima AB (“OSTTRA”) makes no warranty, express or implied, as to the accuracy, timeliness or completeness of the information, or as to the results to be attained by you or others from its use and shall not be in any way liable to recipient for any inaccuracies or omissions. You hereby acknowledge that you have not relied upon any warranty, guaranty or representation made by OSTTRA. The information herein is not, and should not be construed as, an offer or solicitation to sell or buy any product, investment, security or any other financial instrument or to participate in any particular trading strategy. Without limiting the foregoing, OSTTRA shall have no liability whatsoever to any recipient, whether in contract, in tort (including negligence, under warranty, under statute or otherwise, in respect of any loss or damage suffered by any recipient as a result of or in connection with any information provided, or any course of action determined, by it or any third party, whether or not based on any information provided.

TriOptima AB is regulated by the Swedish Financial Supervisory Authority and operates the following services: triResolve, triReduce, triBalance, triCalculate and RESET. For more information, please visit https://osttra.com/