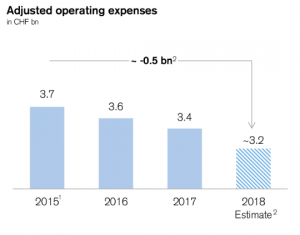

Credit Suisse said it expects to save CHF200 million ($202.0mn) on operating expenses year-on-year as a result of its digital transformation strategy.

Parts of the strategy highlighted in the Swiss bank’s Investor Day presentation included:

- consolidation of online banking infrastructure for private and corporate clients

- 80%+ of new private clients are digitally onboarded

- deployment of robotics for standard processes in business centers improving work force efficiency by 24% over the last 12 months

- reduced number of branches by 30% over the last 5 years

- digital legal entity onboarding in roll-out phase, providing opportunity for further efficiency gains

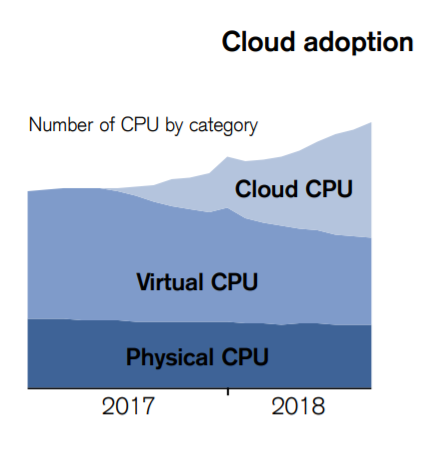

Credit Suisse also highlighted aspects of its infrastructure services: there’s been a 147% increase in automated problem tickets as of October 2018; 30% of service desk incidents are resolved by Amelia, an artificial intelligence agent; and cloud adoption is picking up speed.

Advanced risk management capabilities are next for the bank. Currently, it has over 40 data scientists and its surveillance covers 100% of traders. Distributed ledger and machine learning technologies are applied in the finance department, and an investment analytics platform is used by institutional clients.