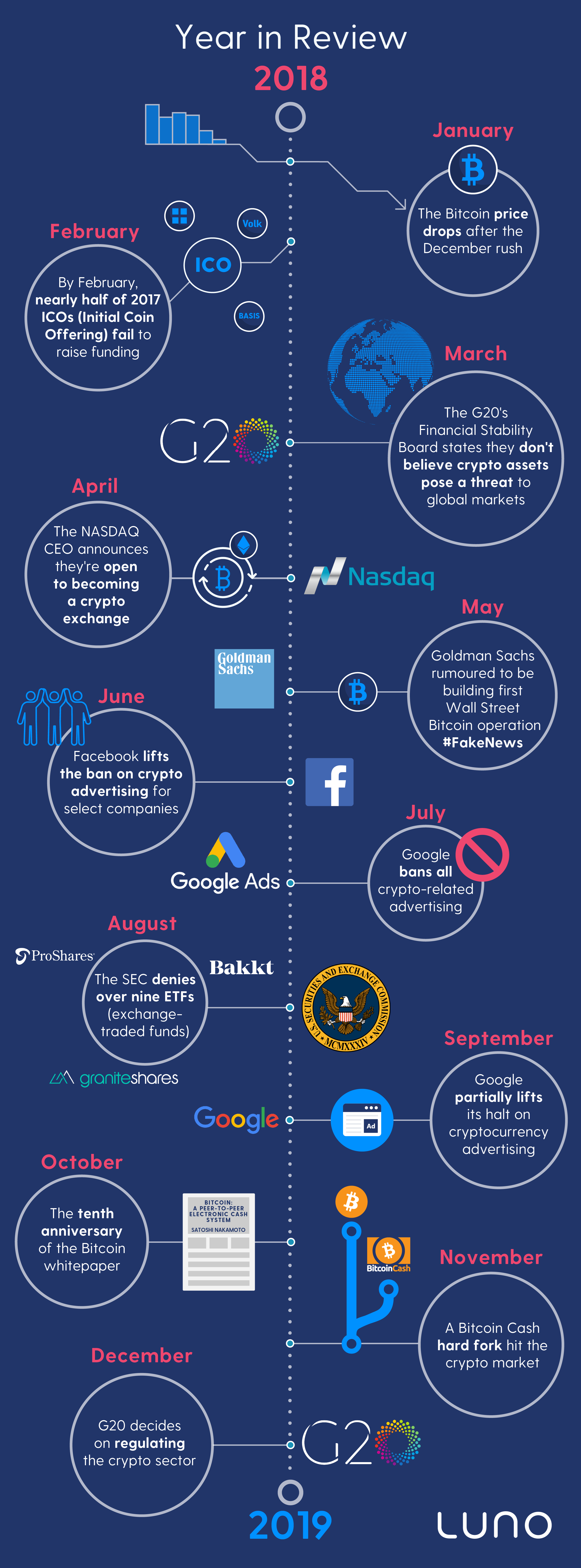

It’s been an eventful year in the crypto space: dramatic price changes, forks and shifting market trends. In 2018, cryptocurrency markets continued to show growth in regions across the globe. Here’s a summary of the year’s interesting crypto landmarks by Magdalena Golebiewska, country manager at Luno, a London-based cryptocurrency fintech.

January: The bull market of the holiday season came screaming to a halt as we entered 2018 Bitcoin lost 40% of its value over January. This decline was due in part to new regulations in South Korea, as well as Facebook announcing they were starting to ban the advertising of cryptocurrencies and crypto exchanges.

February: Nearly half of 2017’s ICOs failed to attract funding. Fortune reported that 142 ICOs failed before reaching their target, while another 276 failed after their fundraising ended. While some of these were actual token sales to raise money for would-be start-ups, a good number of these ICOs turned out to be scams, with the founders disappearing with the money raised. It’s always important to make sure you thoroughly research a company, its employees, and founders before deciding to buy their tokens.

March: Better news for the cryptosphere. The G20’s Financial Stability Board comprising of 68 institutions such as banks and ministries of finance, who then prepare suggestions for global financial systems, stated they don’t believe crypto-assets pose a threat to global markets. The FSB Chairman, Mark Carney, wrote a letter to the G20 Finance Ministers and Central Bank Governors, in which he expresses his concerns about the possible issues that will arise for consumers and investor protection. He noted, however, that the underlying cryptographic and blockchain technology has the potential to improve the inclusiveness of the financial system and the economy. The board delivered varying results for the world of crypto, but overall the sentiment was positive.

April: As the effects of the start of the year began to fade, the CEO of Nasdaq, Adena Friedman, came to give us a real reason to look forward to the future of the crypto industry. Friedman said: “Certainly, Nasdaq would consider becoming a crypto exchange over time. If we do look at it and say, ‘It’s time, people are ready for a more regulated market’, for something that provides a fair experience for investors.”

May: While many banks are hesitant about cryptocurrency, and what it could mean for them, Goldman Sachs had other ideas. The company announced their move to have the first Bitcoin trading operation on Wall Street. In a twist, however, it was reported that the firm was putting a halt on the operation. It seems as if fake news doesn’t discriminate, even with covfefe-crypto. When Goldman CFO, Marty Chavez, heard of the report, he stated, “I never thought I’d hear myself actually use this term, but I’d really have to describe that as fake news.”

June: Past the 2018 halfway mark, and Facebook lifted the ban on crypto advertising for select companies. The ban was initially put in place to try and prevent Facebook users from falling for misleading advertisements for ICOs and binary options. To advertise, crypto-related companies needed to pass an eligibility test. Once Facebook were able to assess potential advertisers more closely, there was less harm in allowing companies to place adverts on the platform.

July: Following Facebook re-opening the door for crypto advertisers, Google decided to move in the opposite direction by banning crypto adverts. Their March announcement came into effect with similar reasoning to Facebook.

August: The SEC denies over nine more Bitcoin ETFs (exchange-traded funds), including the Winklevoss’ Gemini. The agency claims the Bitcoin market is too loosely structured and lacks protections against fraud and manipulation to merit an exchange-traded fund or product.

September: Google partially lifts its halt on cryptocurrency advertising. Since the announcement of the original ban, the company said in a press release that, “Advertisers will need to be certified with Google for the specific country in which their ads will serve”. They continued by saying advertisers will be able to apply for certification once the policy launches from October 2018.

October: Ten years have passed since the anonymous programmer (or programmers) known as Satoshi Nakamoto first published Bitcoin: A Peer-to-Peer Electronic Cash System. The paper served as the first published document to outline what is revered as the world’s first scarce currency.

November: A Bitcoin Cash hard fork hit the crypto market on 15 November. Since its inception, the Bitcoin Cash blockchain has been undergoing scheduled hard forks every six months to upgrade and improve the protocol.

December: G20, the international forum for governments and central bank governors, decides on regulating the crypto sector. The declaration detailed that they’ll regulate crypto-assets for anti-money laundering as well as to counter the financing of terrorism.