We have looked at RWA in a couple recent posts. Yesterday was “Heard on the High Street: the realities of working out economic capital and RWA”. Last week was “Banca d’Italia paper looks at factors behind RWA calculations, why they differ so much” and “BIS paper on regulatory simplicity is well worth the read; hopefully this is a shape of things to come”. So while we are on a roll, we recommend taking a look at a piece from the venerable law firm Davis Polk, “U.S. Basel III Final Rule: Standardized Risk Weights Tool”.

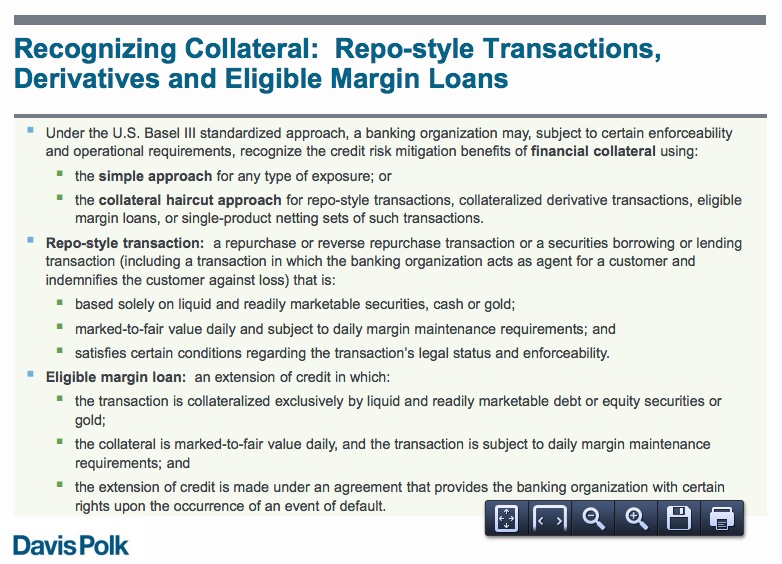

The tool goes through various asset classes and compares Basel I based risk weights to Basel III. Remember, U.S. banks never really did much with Basel II, so it is ok to skip over that. Looking specifically at collateralized transactions, they go through the simple approach as well as a “Collateral haircut approach”. The latter looks like it uses internal models to determine appropriate haircuts and compares those to the actual haircuts taken.

Here is an explanation of the simple approach.

If, as we hope, Basel simplification becomes a reality, it may leave only leverage and liquidity ratios and all this RWA stuff might be thrown out the window. The work done developing the internal models, which we noted yesterday took years and years and took its toll on both economic and political capital, could end up in the trash heap of models. But this would be a shame. Much of the work was oriented toward making sure institutions understood what specific businesses absorbed (in terms of RWA and risk) before it was then aggregated up. It will help senior management track how businesses perform on a risk adjusted basis. The answers may not be pretty or welcome, but they will be useful.

Here is a link to the SFM post “Heard on the High Street: the realities of working out economic capital and RWA”.

Here is a link to the SFM post “Banca d’Italia paper looks at factors behind RWA calculations, why they differ so much”.

Here is a link to the SFM post “BIS paper on regulatory simplicity is well worth the read; hopefully this is a shape of things to come”.

Here is a link to the Davis Polk RWA tool “U.S. Basel III Final Rule: Standardized Risk Weights Tool”.