The European Securities and Markets Authority (ESMA) published the second Risk Dashboard for 2021, covering the third quarter of the year. ESMA maintains risk levels unchanged, at a high level, as the market environment remains defined by very high uncertainty, continued elevated asset valuations with risk of price corrections and abrupt shifts in risk premia.

The past few months have seen the macroeconomic outlook brightening, and there is realistic scope for a reduction in risk levels if improvements in financial markets prove resilient in the medium-term. This critically depends on the ability of markets to withstand the potential future phasing out of the pandemic-linked public and monetary support without material disruptions.

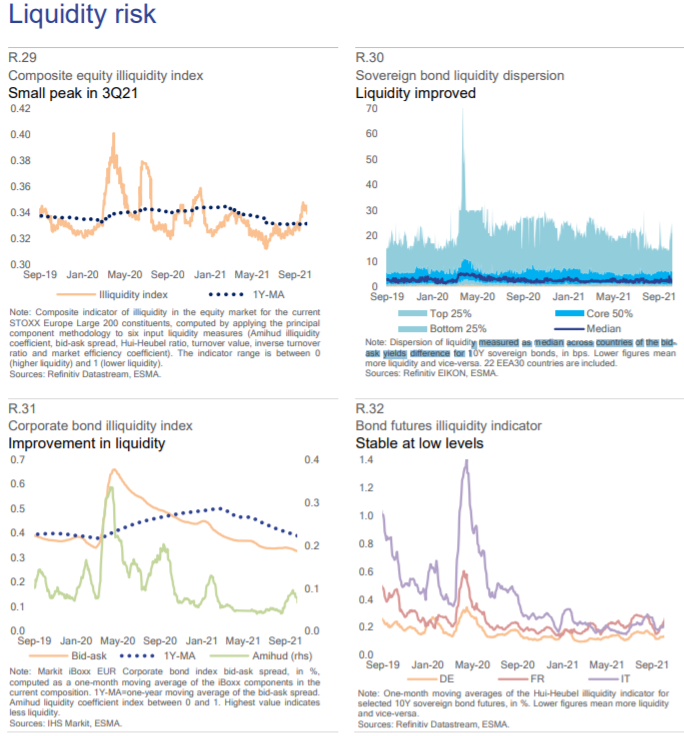

The most important risk drivers for the quarter are the economic outlook, inflation uncertainty, indebtedness in sovereign and private debt markets and political and event risks. Looking ahead, the scars of the pandemic, its resurgence in Q4, and uncertainty around inflation and the continuation of fiscal and monetary policy support may exacerbate long-term vulnerabilities both for the financial and non-financial sectors.

Market reactions to the issues related to Evergrande have shown the continued importance of event risks, the reactivity of markets to such events, and the continued potential impact on investors and financial stability going forward.