The European Systemic Risk Board (ESRB) published the EU Non-bank Financial Intermediation Risk Monitor 2023 (NBFI Monitor). This is the eighth edition in an annual series monitoring systemic risks and vulnerabilities associated with investment funds and other financial institutions.

For the first time, this edition extends the monitoring universe to crypto-assets and associated intermediaries (namely stablecoins, centralized finance platforms and decentralized finance protocols) as they provide financial intermediation and can be exposed to the same vulnerabilities and financial risks as the traditional financial sector.

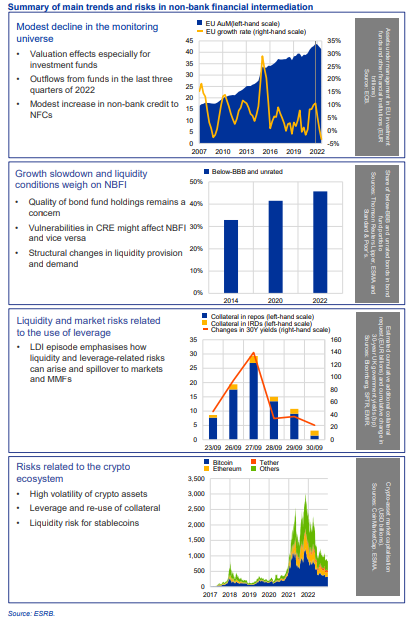

Financial stability risks increased overall in 2022, owing to rising geopolitical tensions, higher-than-expected inflation and tightening financial conditions. Against this backdrop, the NBFI Monitor highlights three main risks and vulnerabilities.

An economic slowdown and tightening financial conditions could increase credit risk. This is particularly relevant for investment funds exposed to low-rated bonds and loans, financial vehicle corporations engaged in securitization and financial corporations engaged in lending. If credit risk were to materialize it could lead to losses, which in the case of investment funds could result in large outflows and liquidity strains.

Market liquidity risk could put further pressure on non-bank financial intermediaries engaged in liquidity transformation. Several indicators show that liquidity conditions in EU bond markets deteriorated in 2022. Alongside cyclical liquidity risk, the monitor also identifies persistent challenges related to structural changes in liquidity provision and demand. These structural changes are linked, for instance, to open-ended funds offering daily redemptions.

Excessive use of leverage could amplify liquidity and market risks, lead to contagion and magnify shocks to financial stability. This vulnerability affects the traditional non-bank entities discussed in the report as well as crypto intermediaries, since both use leverage and rely on collateral.

There are two special features in the report: one on stress related to liability-driven investment (LDI) strategies and another on vulnerabilities affecting crypto-assets and associated intermediaries that are similar to those among traditional non-bank financial intermediaries.

There are two special features in the report: one on stress related to liability-driven investment (LDI) strategies and another on vulnerabilities affecting crypto-assets and associated intermediaries that are similar to those among traditional non-bank financial intermediaries.