Research shows one third of North America and Europe’s largest banks lack transparency and are failing to publicly report on the progress of their AI development.

Banks across North America and Europe are failing to publicly report on their approaches to responsible AI development, according to research from Evident, an independent intelligence platform that seeks to accelerate the successful adoption of AI in business.

SVB’s collapse, First Republic’s bailout, and escalating concerns about Credit Suisse have thrust the issue of banking sector transparency firmly into the spotlight once again, while also highlighting the need for many banks to overhaul and improve their approach to risk management.

However, Evident AI Index found that while AI is already used by banks for many critical processes, from authenticating customers to risk modelling, 8 of the 23 largest banks in the US, Canada and Europe currently provide no public responsible AI principles.

Evident analyzed millions of publicly available data points to assess how banks report against four main areas of responsible AI: creation of AI leadership roles, publication of ethical principles, collaborations with other organizations, and publication of original research.

Alexandra Mousavizadeh, Evident co-founder and CEO, said in a statement: “AI could be the key driver of better risk management and decision-making across the global banking sector. However, it is vital that banks develop AI in a way that meets high ethical standards and minimizes unforeseen consequences. Our research found a worrying lack of transparency around how AI is already used – and how it may be used in the future – which could damage stakeholder trust and stifle progress.

“In this highly regulated sector, the reality is that many institutions are taking proactive steps to address AI concerns and developing internal programs to address responsible AI. The problem is that there is no standard for responsible AI reporting, and many banks withhold the details of their efforts. At this critical time for the sector, the banks need to show leadership and start reporting publicly on their AI progress.”

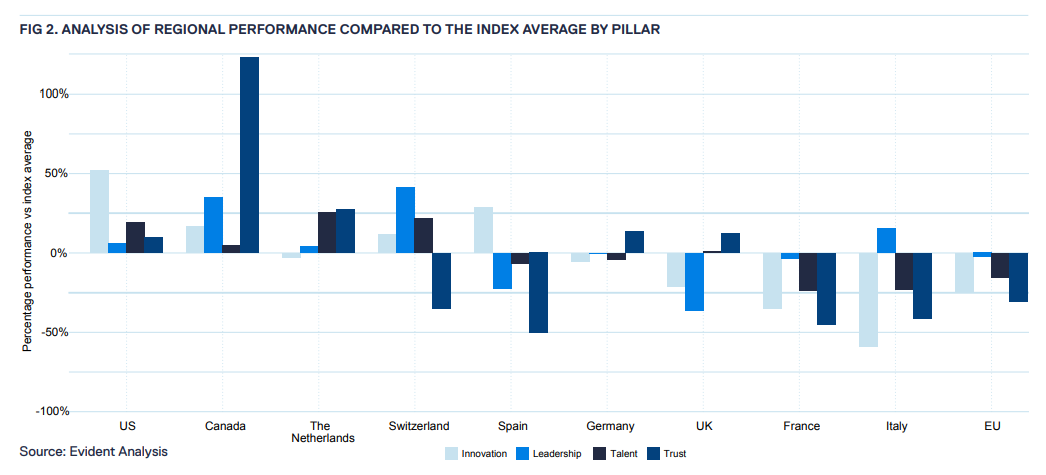

The Index found that Canadian banks are most transparent on responsible AI reporting, with European banks the least.

Only three banks – J.P. Morgan, Royal Bank of Canada, and Toronto-Dominion Bank – have a demonstrable strategic focus on transparency around responsible AI. Each showed evidence of creating specific responsible AI leadership roles, publishing ethical principles and reports on AI, and partnering with relevant universities and organizations.

Approaches to hiring AI talent also differ regionally. North American banks are more likely to hire specific responsible AI roles, usually from bigtech firms, and European banks tend to lead responsible AI within their data ethics teams.

Evident co-founder Annabel Ayles said in a statement: “It’s perhaps unsurprising that two Canadian banks, RBC and TD Bank, perform well as the country itself facilitates a lively AI ethics conversation. The top-ranking banks also tend to have strong research hubs, which we believe helps them address the technical challenges of implementing ethical standards into AI.

“It’s similarly clear that banks are trying to work out the links between responsible AI and data ethics. European banks which view responsible AI through a lens of data ethics, potentially due to the dominance of GDPR legislation, are perhaps missing a trick by not creating AI-specific roles and thinking holistically about the broader risks posed by AI.”

Evident AI Index is the first of its kind to track banks’ AI readiness using a wide range of independent data sources, rather than self-reported surveys. Its proprietary methodology was developed with input from more than 50 leading AI and banking experts, with each bank ranked and assessed on 143 individual indicators.