Effective collateral mobilisation is a €7.3 billion cost savings opportunity for the global collateral management community, according to Finadium analysis, and includes the sourcing and utilisation of inventory across a global portfolio. HQLAX make the case that their Distributed Ledger Technology (DLT) solution achieves this goal for the financial services industry in the shortest amount of time.

A wide range of market participants are looking to access inventory between clients, counterparties and service providers: custodians, central securities depositories (CSDs), triparty agents, banks, and both regulated and unregulated investment firms. HQLAX says that its DLT solution based on Digital Collateral Records (DCRs) can be the market’s widely accepted platform for collateral mobilisation, solving the industry challenge of standardisation and interoperability between market participants.

From non-cash securities finance to collateral mobilisation

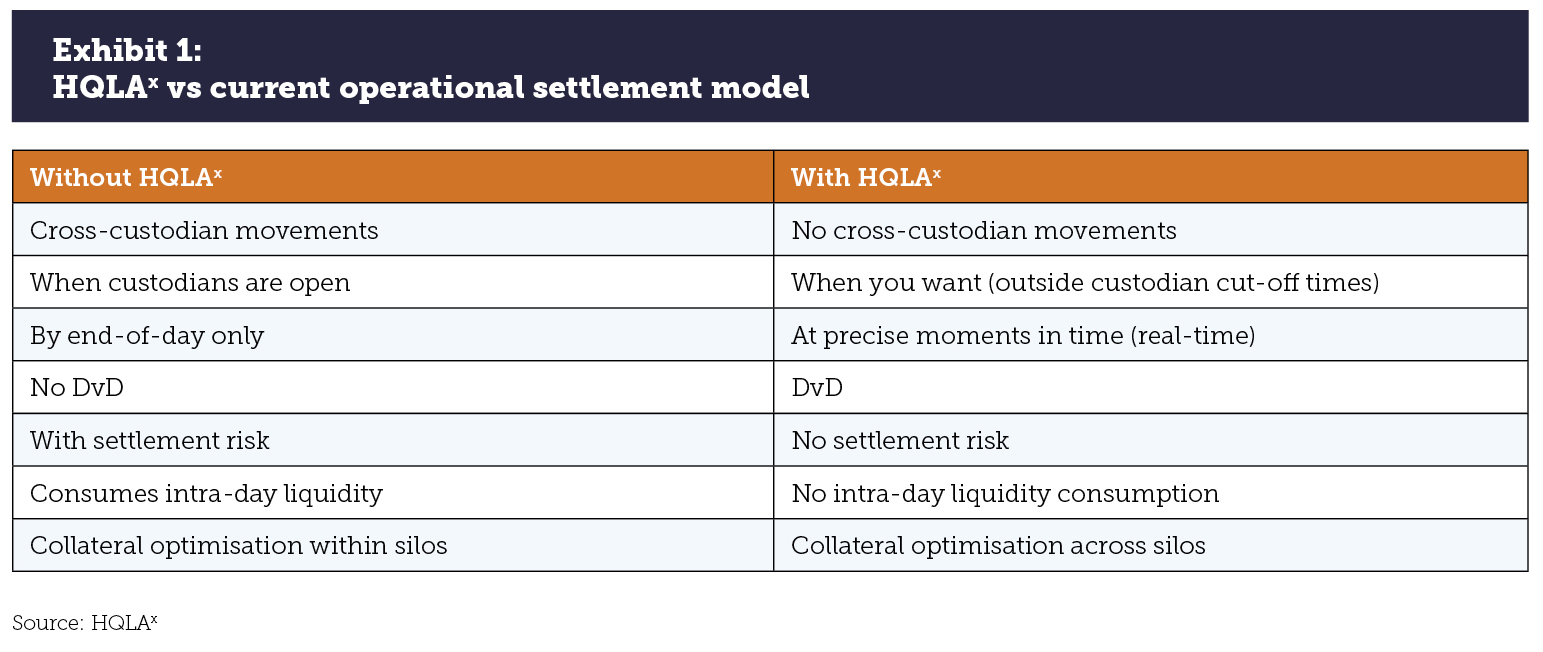

HQLAX’s initial use case for the market is in facilitating non-cash collateral securities finance transactions between counterparties using the DCR structure. The idea was to speed up and synchronise settlement using digitised ISINs created via an on-ramp from a participating asset custodian. A client would transfer ownership of the ISINs on the HQLAX registry then use an off-ramp to unwind the ISINs from the DCR when needed for a final sale or other disposition. As HQLAX notes, DCRs “enable holders and agents to transfer ownership of any security on the HQLAX distributed ledger, without the need for conventional settlement mechanisms.” The solution reduces time, expense and operational errors for participants (see Exhibit 1).

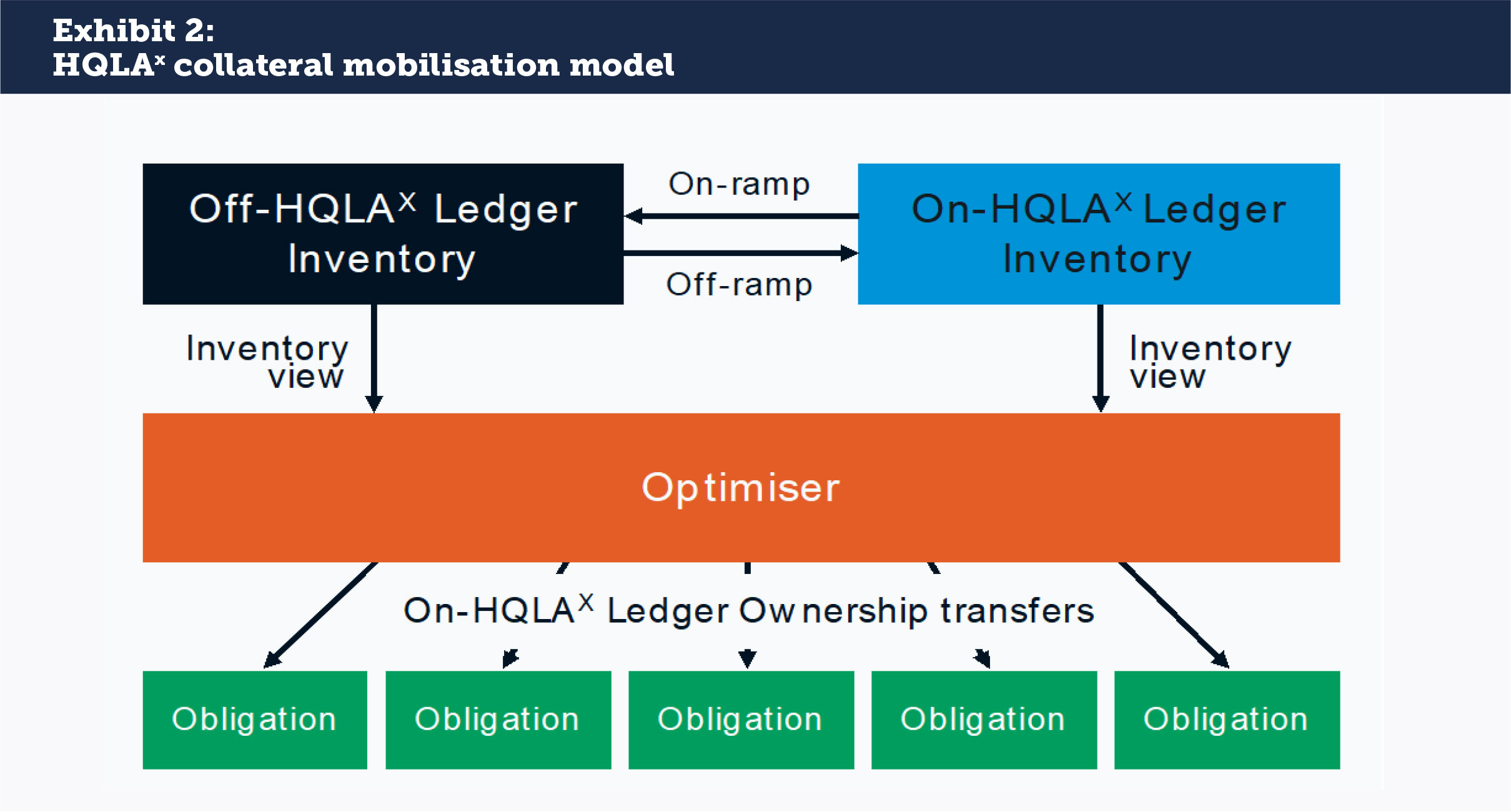

While non-cash collateral securities finance remains an opportunity, this is one part of a broader collateral story that is now coming into focus. The underlying challenge for market participants is mobilising collateral for all products, not simply securities finance. The same principles of the DCR can apply to repo, OTC derivatives, regulatory reporting, intercompany exposures and other collateral activities. In HQLAX’s collateral mobilisation model, bank nodes and custodial locations of inventory communicate their records to the HQLAX’s Digital Collateral Registry, enabling a central point for sourcing inventory and interoperability across assets wherever they may be held (see Exhibit 2).

What is collateral mobilisation

The collateral mobilisation layer of market infrastructure gathers all available assets into one central pool. Mobilisation has historically been hindered by the diverse number of custodians that clients use around the world; these assets are sometimes called “trapped” in silos.

The ability to aggregate all inventory into one location has been an objective of some banks for years, and more recently, for asset owners and managers looking to upgrade their cash and liquidity treasury management functions. This is an important step for market participants to create more capacity for their collateral needs and reduce their reliance on bank balance sheets, whether directly or as a counterparty.

Mobilisation in a digital registry is not competitive to the functions performed by custodian banks, CSDs and technology providers in trading, post-trades processing and collateral optimisation. Rather, it makes those activities more economically productive for the client by delivering more data for analysis in a central location.

DLT adds a new layer of efficiency to the collateral mobilisation process. A recent working paper from the International Securities Lending Association (ISLA) notes that “tokenised securities, particularly asset-backed tokens have the potential to integrate in the existing ecosystem, with closed networks such as tri-party being a natural place to demonstrate the releasing of trapped assets through tokenisation to deploy in a collateral setting.” Collateral mobilisation is different than tokenisation but supports the process by unsticking trapped assets for flexible use with external counterparties or for a better accounting of holdings.

The value of DLT is to provide a common framework for every market participant to join. In the HQLAX model of digitised ISINs, any asset custodian can deliver a digitised representation of the asset they hold in custody to the client’s account on the HQLAX platform. This decouples the operational requirement to move securities from one custodial location to another from the ability to transfer legal title ownership of securities.

The scale of the problem

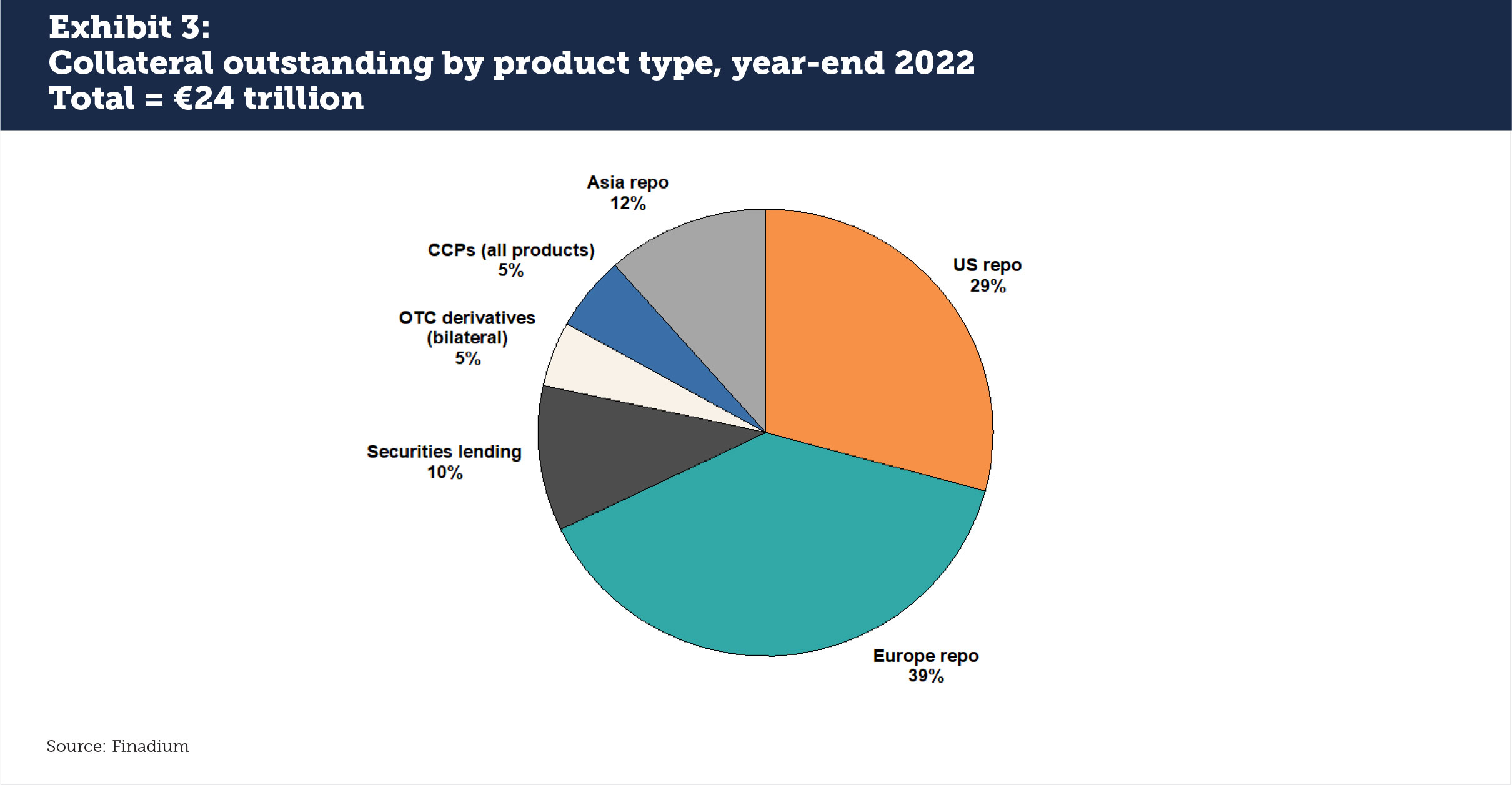

The most recent data on the collateralised trading market shows total asset values at €24 trillion across repo, securities lending, OTC derivatives, CCP-cleared derivatives and other products (see Exhibit 3). These markets are growing: as examples, ISDA’s most recent margin survey shows that posted margin went from €1.2 trillion in 2021 to €1.3 trillion in 2022, and the European repo market grew from €9.2 trillion in 2021 to €10.4 trillion in 2022.

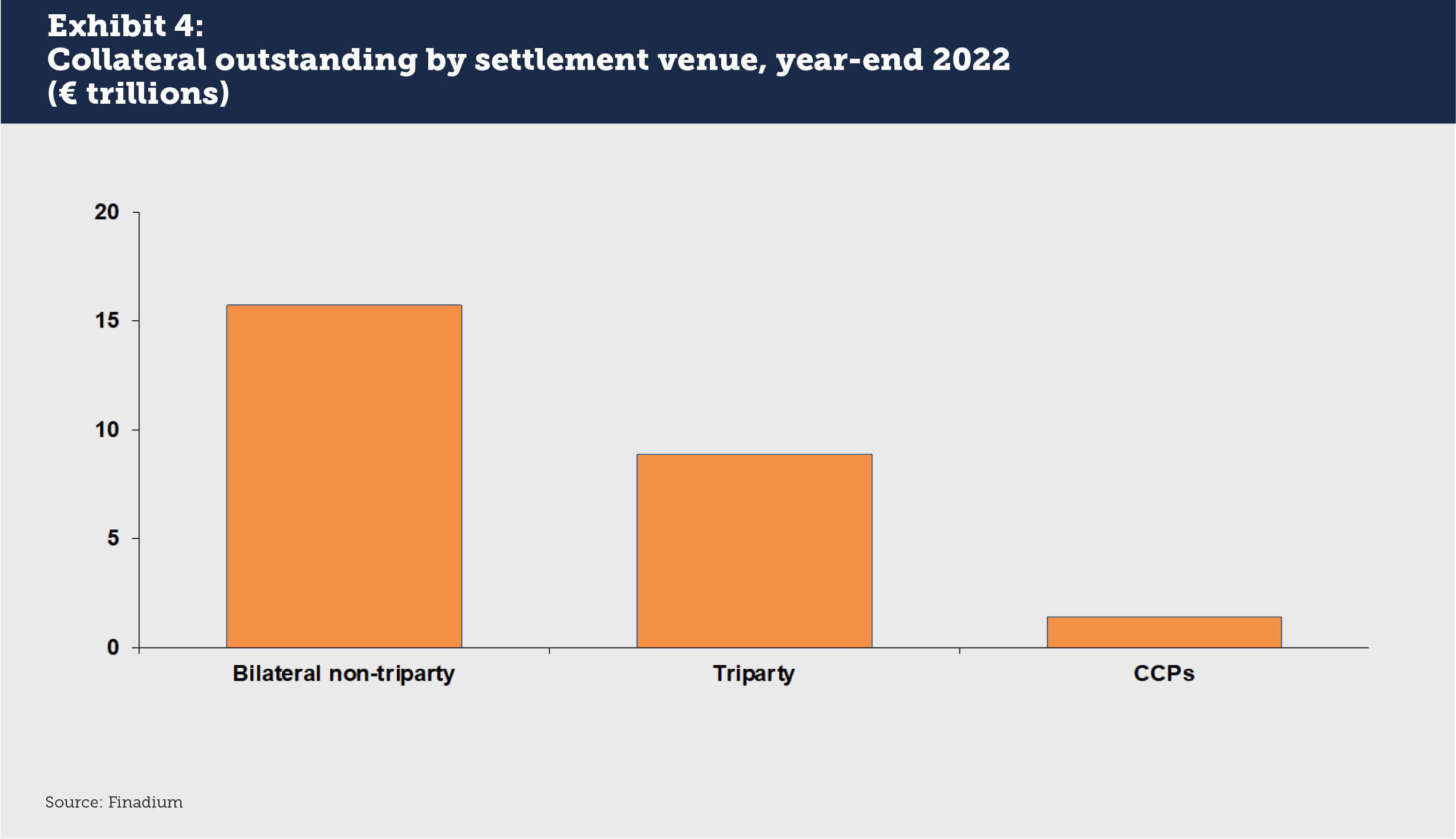

A mix of bilateral, triparty and centrally cleared business is an obstacle for efficient collateral management, starting with sourcing inventory. The latest data show bilateral settlement at 61% of collateralised trading exposures held by individual firms around the world (see Exhibit 4). Some firms have published the names of over 100 custodians and sub custodians holding assets on their behalf. Only 5% is held with CCPs, according to CPSS-IOSCO Principles for Financial Market Infrastructures filings.

The remaining 34% is placed with triparty agents including not just BNY Mellon, Euroclear, J.P. Morgan and Clearstream, but also specialist or regional institutions like SIX and ASX. New triparty agents are emerging on a regular basis: BNP Paribas and State Street have recent offerings, and last month TMX and Clearstream announced a new partnership for the Canadian marketplace. Triparty assets are on the rise, having doubled from 2014 to 2023, and the number of triparty agents is expected to grow still further in coming years.

Market participants across all regions continue to struggle with a lack of automation, and higher interest rates highlight cost inefficiencies in pre- and post-trade processing. Citing industry experts at the Rates & Repo Europe 2023 conference, Finadium recently published that:

In a zero-rate environment and before the Central Securities Depositories Regulation (CSDR), it was relatively easy to ignore fails costs. Today however, vendors and traders say that fails are showing up as tangible costs on the P&L. In response, front office managers have gotten involved with what have been historically back-office projects and are looking for quick benefits. If these costs do not get resolved, they can impact the bottom line in an unacceptable way.

With hundreds of private custodians, both major and smaller triparty agents, and up to 20 important CCPs around the world, the diversity of potential asset locations creates a substantive challenge for firms looking to mobilise collateral. The more that post-trade and inventory management are ignored, the more this translates into a problem for competitive front office business lines.

How much money can be saved?

Multiple studies have sought to quantify the financial impact of effective collateral mobilisation. A 2017 analysis of BNY Mellon provision of intraday credit and improved collateral management found “several hundred million dollars in annual savings” for dealers based on a 4% cost of capital rate and BNYM’s then-€1.95 trillion (US$2.1 trillion) in global triparty repo assets.

Extrapolating these figures for all collateral assets, and with a cost of capital hurdle of 12%, current cost savings for dealers is closer to €7.3 billion from effectively sourcing their collateral inventory. While a few dealers have already captured some of this cost from internal efforts, most are still working to integrate multiple collateral sources onto one or a reduced number of platforms.

A DLT-based registry solution using Digital Collateral Records solves the problem of collateral mobilisation for the entire industry, globally, and once. By centralising the mobilisation function for collateral being held for safe-keeping in multiple custodial locations, HQLAX enables clients to utilise the collateral optimisation engines of their choice (in-house or vendor) to direct collateral transfers onto the HQLAX ledger. Effective mobilisation becomes the stepping stone that firms and service providers can use to deliver further advanced functionality.

This article was sponsored by HQLAX.