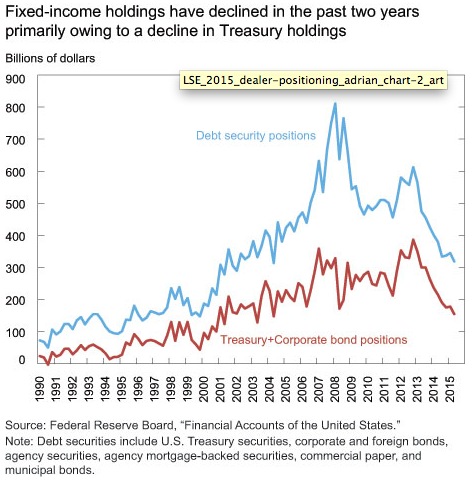

Securities broker-dealers (dealers) trade securities on behalf of their customers and themselves. Recently, analysts have pointed to the decline in U.S. dealers’ corporate bond inventories as evidence that dealers’ market making capacity is impaired. However, historically such inventories also reflect dealers’ risk management and proprietary trading activities. In this post, we take a long-term perspective on the evolution of dealers’ inventories of corporate bonds, Treasuries, and other debt securities and relate those inventories to expected returns in fixed-income markets in an effort to better understand the drivers of dealer positioning.

The blog post is available here.