Fitch released a report “Corporate Bonds and Fire Sale Risk: Repo collateral Pools Highlight Liquidity Issues” last week (June 17th). It struck a chord with us. We’ll explain.

Fire sale risk has been hovering near the top of the regulator’s agenda for a while. At first, it seemed like the focus was on HQLA, the one market that didn’t seem it really needed help on fire sales. (Of course, that may have begun to change as liquidity in markets like US Treasuries has started to fade – but that is a different topic.) The markets that seemed to need immediate remediation were, in our opinion, the less liquid segments of the fixed income and equity world. The corporate bond market was the poster child.

During much of the 2007-09 crisis (and especially post-Lehman bankruptcy) liquidity in corporates was by appointment only. Markets were incredibly thin and unwinding a portfolio was done in weeks, not hours or days. If transaction 5 or 10 (or more) points off “fair” markets is the definition of a fire sale (it wasn’t much better covering shorts), then these were the real thing.

How to cushion the fire sale risk and prevent the externalities that the Fed, in particular, focused on hasn’t been fully fleshed out. Repo dealers, on the other hand, like business where they can earn a decent spread — and corporate repos fit the bill. Tri-party was custom built to help broker/dealers and banks raise cash to fund their corporate repo books.

In their report Fitch has zoomed in on the intersection of tri-party funding of corporates, fire sale risk, and the impact of rising interest rates. From the Fitch press release:

“…Fed officials have highlighted the risk that fire sales of securities could amplify price dislocation in a period of market turmoil. New York Fed researchers have estimated that up to $250 million per day in corporate bonds can be liquidated without negatively affecting bond prices. Total corporate bond tri-party repo collateral averaged approximately $75 billion in 2014. Forced selling of even a small fraction of that amount could accelerate price pressure during periods of market stress…”

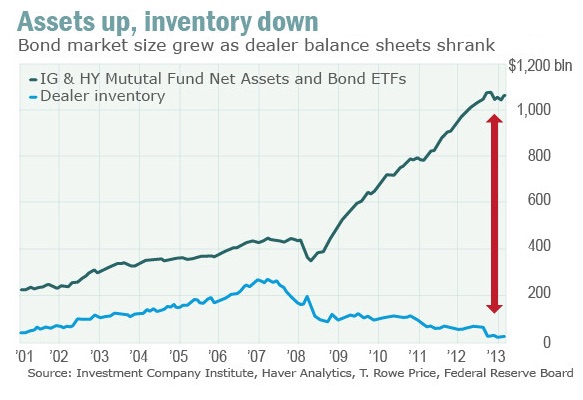

Corporate bond issuance has grown rapidly in the past several years, but corporate bond dealer inventories have shrunk. That is a recipe for illiquidity, especially in a world where the next move in interest rates is up. The business of making secondary markets in corporate debt, it turns out, isn’t very profitable yet absorbs a lot of capital. Remember the quote about the corporate bond market liquditiy being “a mile wide and an inch deep” from Will Rhodes, then of the Tabb Group, now at Boston Consulting. Its still an inch deep, only now it might not be so wide. Maybe some of the liquidity solutions (that seem more like fancy non-risk brokering) and/or non-capital constrained institutions will step up and provide deep markets, but we aren’t holding our breath.

Source: https://marketwatch.creatavist.com/story/7571

Source: https://marketwatch.creatavist.com/story/7571

We wrote in a SFM post dated Jan 9, 2014 “Corporate Bond Liquidity: Going, Going, Gone….” about repo haircuts and disappearing liquidity in the corporate bond market:

“…We wonder how the repo market has been taking this into consideration? Less liquidity should mean higher haircuts. While IG and HY corporates were only 4.1% of the tri-party repo market (FRBNY, Nov, 2013) that still represented $66 billion of collateral value. Median haircuts for IG and HY corporates were 5% and 8% respectively. To put this in context, the US Treasuries median haircut was 2% and the median h/c for equities was 8%. The Fed started to publish data on the tri-party repo market in May 2010 and median haircuts on corporate paper (IG and HY) back then were the same, 5% and 8%, respectively (and have been remarkably consistent throughout). In the period between May, 2010 and Nov. 2013, dealer inventories have continued to fall while IG and HY corporate bond funds kept growing…”

From an article in the FT last week “Fitch warns on repo threat to bank funding” (June 17, 2015) by Joe Rennison (sorry, behind the pay wall):

“…In a report released on Wednesday Fitch said more than 70 per cent of corporate bond repo transactions had a maturity of five days or less, illustrating how funding remains short-term in nature and thus vulnerable to any market shock that spurs investors to stop lending cash…”

Doesn’t LCR put pressure on repo dealers to fund their paper out past a month? The five day maturity comment makes you wonder. It could be that the stats collected by Fitch from cash investors did not paint a complete picture about where longer dated funding was coming from (e.g. asset-backed commercial paper, repo conduits, etc.). Is there simply not enough term cash for corporate bond funding? If that is the case, then repo desks still have some work to do.

So what will happen to tri-party funding of corporate bonds? First of all, higher haircuts should be a no brainer. Bracing for higher rates/lower prices should include stricter diversification and concentration rules, closer scrutiny of pricing sources, and credit and risk managers becoming more engaged.