The International Capital Market Association (ICMA) released a report that provides a closer look at Securities Financing Transactions Regulation (SFTR) public data for the year 2022. In line with SFTR itself, the data is split between figures reported for the EU repo market and those for the UK repo market.

Since the go-live of SFTR reporting in July 2020, ICMA has been collecting SFTR public data points that the trade repositories (TRs) are mandated to release on a weekly basis. ICMA collects this data, consolidates it and publishes the information in an aggregated form. While the number of public data points is limited, it is still a useful resource and provides an additional element of transparency.

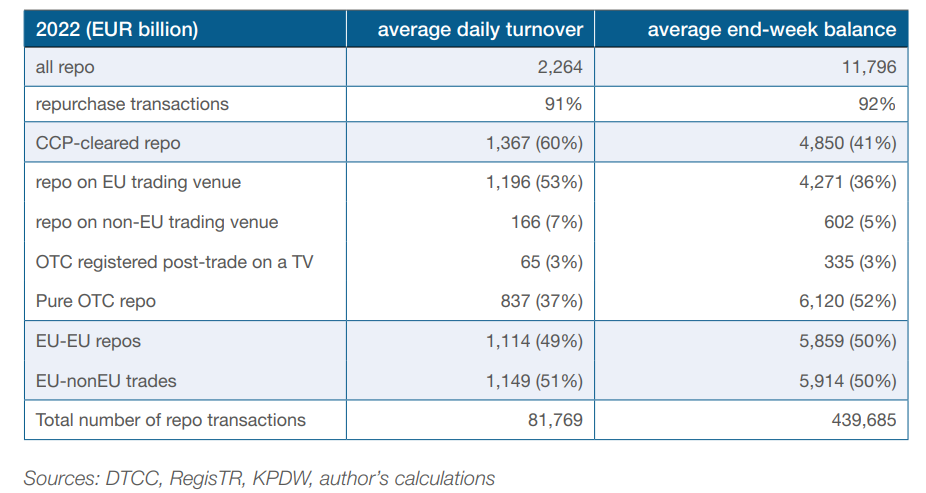

In 2022, the EU repo market saw the average daily turnover rise to €2,261 billion ($2,470bn) but the average number of new transactions fall to below 82,000 per day (+0.5% and -1.0%, respectively, compared to 2021). The average end-week balance of outstanding repos over 2022 was €11,796 billion and the average number of transactions outstanding at end-week was some 440,000 (+14.1% and 26.3%, respectively).