The International Securities Services Association (ISSA) released its annual survey “DLT in the Real World”, looking at how and where distributed ledger technology (DLT) and digital assets are taking hold in the capital markets: what the business cases are built on, what challenges practitioners face and where the technology is being used to deliver benefits.

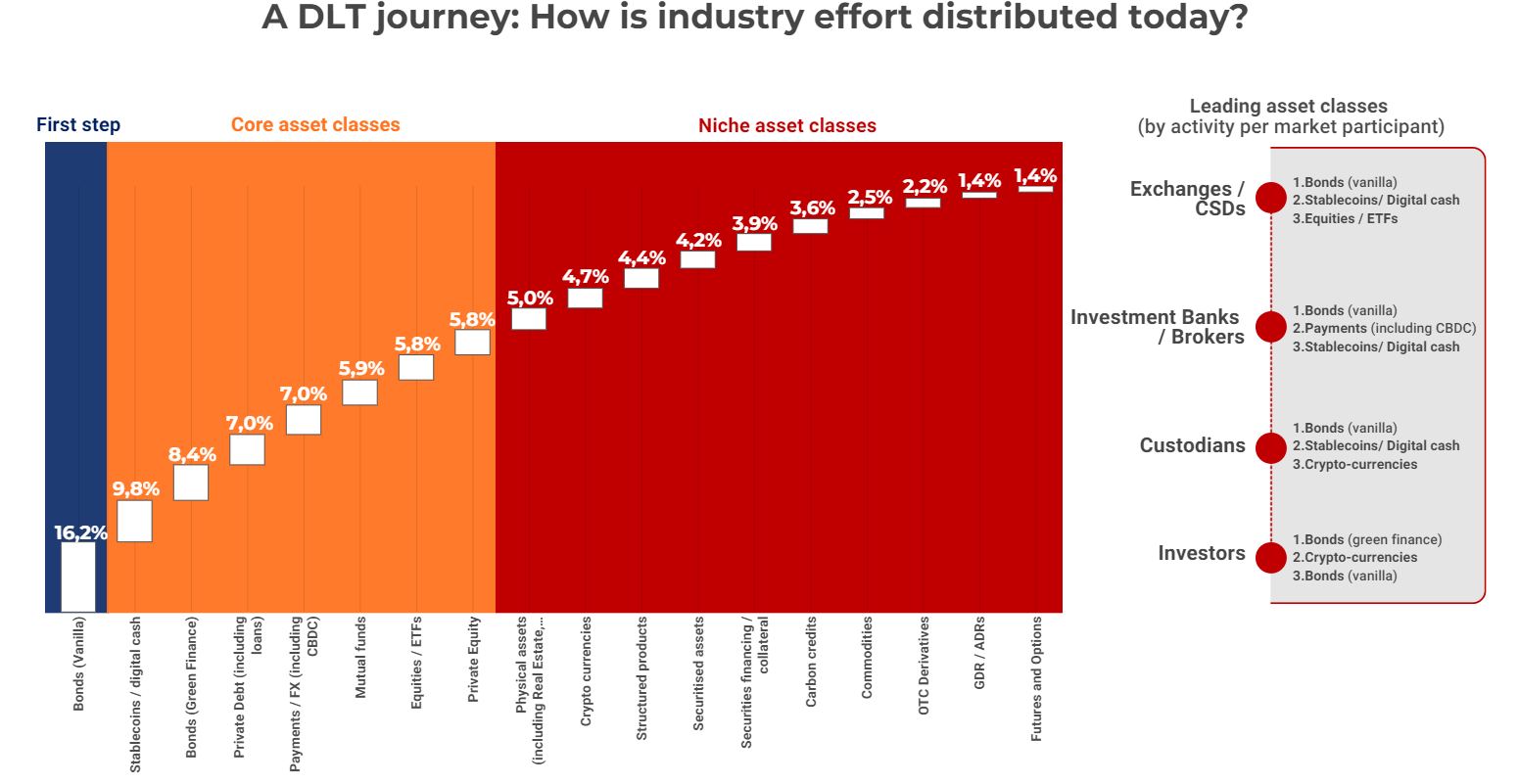

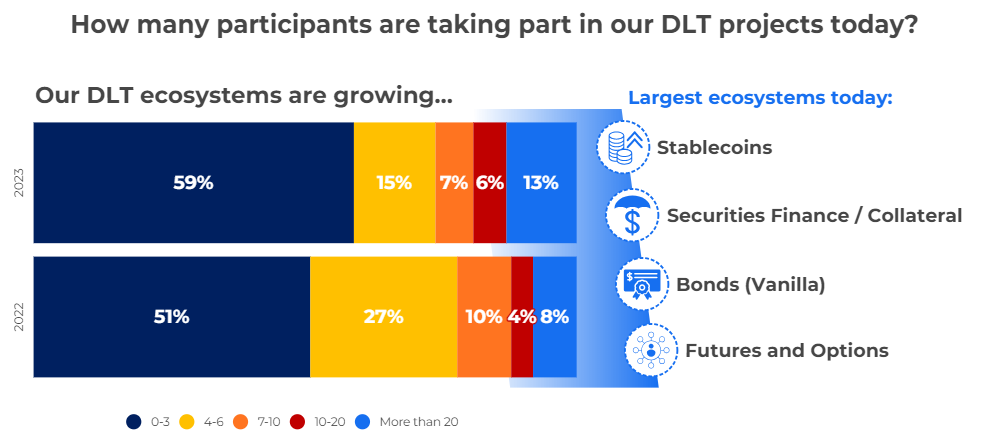

The survey gained insights from over 350 teams and departments across the capital markets globally and found that there has been a 7% increase in live DLT initiatives, with 75% of DLT and digital asset projects now delivering against expected returns – a marked uplift from 49% in 2022. Among these, returns are most consistent amongst five core asset classes – which look to be ready to scale in 2024 and beyond.

Yet 59% of respondents cite the business case as the biggest challenge in realizing DLT projects, a 10% increase from 2022. As usage grows, the operational benefits of DLT and digital assets are increasingly clear – with 28% of DLT projects being run with cost efficiencies as their key driver in 2023 (above new product revenues).

Despite increasing DLT volumes in securities finance and cash funding, only 9% of projects are today driven by potential liquidity and balance sheet improvements – highlighting a major area of opportunity. Possibly linked to this liquidity point, 50% of asset owners see DLT as less relevant to their businesses than the previous year.

Colin Parry, CEO of ISSA, said in a statement: “The ISSA DLT Working Group has been at the forefront of the digital asset journey to help the securities industry understand the latest trends and what to expect in the future.” This year’s research from ISSA and the ValueExchange was supported by Accenture, Broadridge, Fnality and Metaco.

“These results reflect the maturing of DLT, that industry efforts are stabilising and strengthening year on year,” commented Barnaby Nelson, CEO of the ValueExchange, in a statement. “We are clearer on which asset classes drive real benefits today and, despite the challenges of 2022, the industry is more committed to the DLT journey than ever. We are also clear on what we need to do now to accelerate the benefits of DLT at scale – driving innovation in digital cash, enabling much more interoperability of platforms and engaging much more actively across our firms as we execute on our DLT projects.”

“Distributed ledger technology is transforming global repo market infrastructure,” said Horacio Barakat, head of Digital Innovation at Broadridge, in a statement. “We are empowering leading financial institutions with the ability to dramatically increase liquidity while lowering risk and operating costs.”

Seamus Donoghue, chief growth officer at Metaco, said in a statement: “Markets will evolve as regulations and standards mature and technology players will play a critical role in providing the foundational networked infrastructure that serves as a catalyst to accelerate this evolution.”