State Street released the latest findings from its research, the State Street 2018 Fund Strategy Survey, which surveyed 250 asset managers globally and analyzed how they are developing cross-border strategies, including the factors influencing their choice of fund vehicle, passport and domicile location.

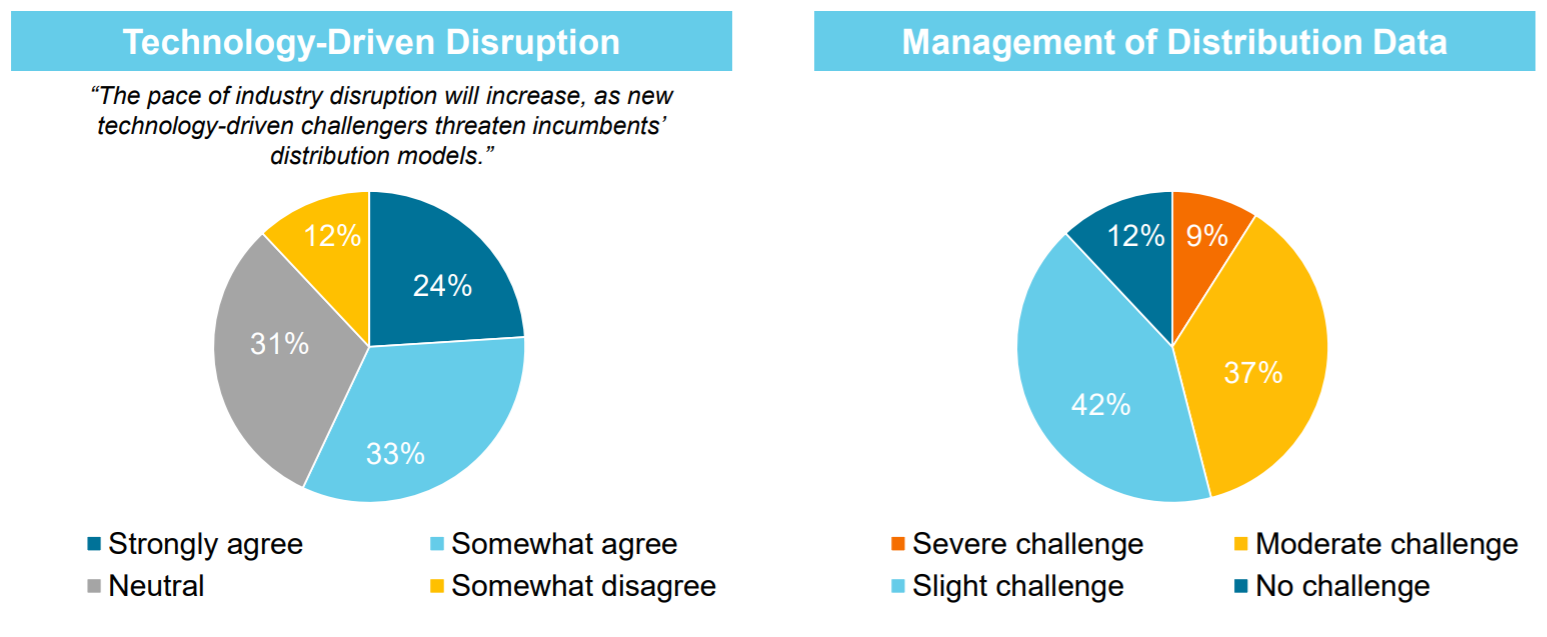

According to the survey, 64% of asset managers plan to launch cross-border products in the next five years. However, the majority (88%) see distribution-related data as a challenge in achieving this, and believe the pace of change is only accelerating with more than half (57%) worrying about new entrants from the world of technology.

Liz Nolan, State Street’s EMEA chief exec said in a statement: “As the world continues to innovate, the blurring of lines between man and machine will persist, and emerging technology such as artificial intelligence will be of increasing importance for asset managers to achieve their ambitious goals for growth.”

David Suetens, head of State Street Luxembourg added that as asset managers expand products and markets, they are also becoming less dependent on intermediaries, with 44% expecting to increase their volume of direct sales. “The effect of regulatory reform and technology may thus change the nature of distribution of funds,” he said.