Securities finance technology has developed sophisticated processes for managing automated workflow, ranging from trade acceptance and processing to collateral management. The manual side of the business, however, has been deliberately ignored to allow traders to focus on “high-value” activity. A guest post from ION.

This can lead to an awkward use of technology for non-standard transactions as well as the potential for error. A changing world is driving us to rethink the differences between automated and manual, and to rejoin these activities in a central technology platform.

A Classic Design for Automated and Manual Workflow

For many years, most large-scale strategic investment in securities finance technology has focused on automation. Vendors, utilities and banks have looked at the complex process of trading, settlement and post-trade position management, seeking avenues where technology can take on and automate high-volume tasks. The idea has been to identify the repetitive parts of the workflow where decisions are relatively simple, and where efficiency can contribute to profitability by reducing costs while keeping revenues steady.

In the 1990s and into the early 2000s, great strides were made in nearly all markets worldwide to make automation an accepted part of the business process. The value proposition was easy to articulate, and ran along the lines of: “We want to use the technology to free up your human resources for more important, high-value activities.” The technology, in other words, was positioned as a workforce augmentation tool, or an electronic replacement for teams of junior traders and clerks.

Along the way, bank technology teams, their vendors and the ultimate users of the technology went through a process of analysis designed to categorize the elements of their business as either “automated” or “manual.” After all, that was the stated goal: automate simple things, so human beings can devote themselves to more difficult or high-value transactions.

The return on investment on these efforts has been material. The securities finance business process is inarguably more efficient than ever before, and banks can effectively manage large trading books on a scale that could not have been contemplated without automation. Nonetheless, the automation drive has fostered and perpetuated a bifurcated environment. There are parts of the business that remain little changed from the 1990s. The very tasks and trade flows that were deemed “manual” in the analysis exercise have largely remained so, and have benefited far less from strategic investments in technology. This was by design.

The result is that when we look at most major core systems in securities finance, we see a greater level of technical sophistication on automated workflows, while manual workflows remain high touch and highly dependent on the user to do most of the work. This often includes not just the working of the deal – the negotiation of trade and contract terms – but also the data entry, confirmation, reconciliation and management of the post trade lifecycle. Certainly, the systems have evolved to take on the mechanics at the backend of the trade, for example to instruct and confirm settlement, but have left almost all other parts looking much as they were before there was any automation at all.

This was not the intent of the users when they decided a particular process was “manual.” Users wanted sophisticated tools to help them do their jobs, just not to yield decision-making authority to the system. In other words, “manual” may have been taken a touch too literally in the design.

The Current State: A Hybrid Automated/Manual Model

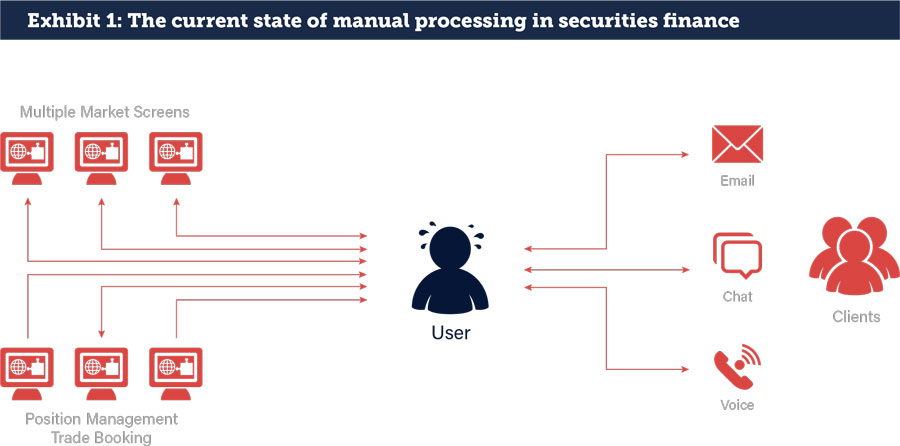

We are now left with a hybrid process for many important aspects of the securities finance business. Where human beings are driving or intervening in the workflow, they have become the point of integration and understanding of what is really happening. In a sense, human beings have become the automation tool used by the systems to get the job done, rather than the other way around (see Exhibit 1).

In practice, this hybrid model looks like traders and trade processors using Excel and Access databases to capture and record important information from one part of the process – for instance, data for a client term trade negotiated over the phone, via email, through an internal electronic trading network or by instant message – and then cutting and pasting that data into trade entry screens in their core systems.

This translation to the automated system causes the potential for error. Because it was structured outside the core system, the formerly manual trade might have an entirely different structure, and may even be entered as multiple trades that need to be cross-referenced so the trader can track the relationship. Only the trader might know that they are part of the same deal however. The trade may even be broken down across different core systems, which, on the backside of the flow, must be brought back together through another ad-hoc reporting or tracking mechanism. In the manual world, the phrase one hears most often is “this is our workaround.” The technology, then, can be seen as less of a productivity tool and more of a hindrance.

The Solution: Consolidate Automated and Manual Processes in One System

It is time to rethink what manual and automated mean in the securities finance workflow, and to rethink the role of technology in the manual workflow. At ION, we understand that banks, brokers and their customers are not engaged in “automated” and “manual” businesses. Instead, they are involved in simple strategies and complex strategies. Simple strategies are linear; one-dimensional; well-defined; largely isolated to a single asset class; and require very little human intervention. They are also well served by existing technology frameworks. Complex strategies may bridge multiple asset classes, multiple settlement networks, have multi-dimensional economics and terms; and may involve a wide variety of communications and reporting mechanisms. This is where systems need to work, and where these complex trades must be linked to their simpler counterparts in one technology platform.

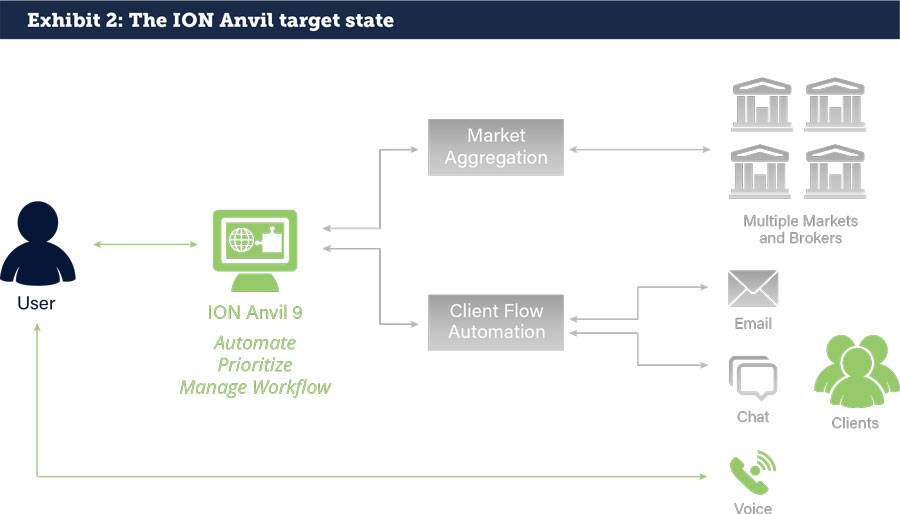

ION’s mission is to automate wherever it makes a positive difference to our users’ lives. Anvil 9 offers a fast, configurable, component based architecture to help consolidate flows and data from disparate sources into a single platform and enable operational efficiency through exception based processing and process automation. It provides real-time transparency and explanation of key business flows enabling rapid decision making and provides a framework to help address the complex and evolving regulatory landscape (see Exhibit 2). ION’s Anvil solution has been in the market for more than twenty years. Anvil 9 represents a major investment in re-engineering the product to solve business problems of today and tomorrow – and is live with customers all over the world.

The decisions about the deal may be sophisticated and complex and require the skills and knowledge of the trader, but the technology should be simple, easy to use and provide the same level of service as it does for the “automated” deal. At the end of the day, the same value proposition for securities finance technology applies: use the technology to free up human resources for more important, high-value activities. But it must be applied in a much broader context than simply “automated” or “manual.”

<img class=”alignright wp-image-20993 size-thumbnail” src=”http://finadium.com/wp-content/uploads/2017/01/Phil-Buck-150×150.jpg” width=”150″ height=”150″ /><strong>Phil Buck, CEO, Anvil Repo and Securities Finance Division</strong> has been at the forefront of repo and securities finance technology for more than 20 years. After studying Computer Science and Artificial Intelligence at the University of Edinburgh, he started his career in software development at Logica. In 1996 Phil joined an ambitious startup called Anvil, which later became part of ION. At ION, Phil held the position of Global Head of Sales prior to becoming CEO of the Repo and Securities Lending division.