- Securities lending revenues fall below the $1 billion mark for the first time this year

- Q3 revenues of $3.13 billion generated, a decline of 7.5% year-on-year (yoy)

- Specials revenues across US equities decline by 61% month-on-month (mom)

- APAC is the only region to see yoy growth in revenues (+26%)

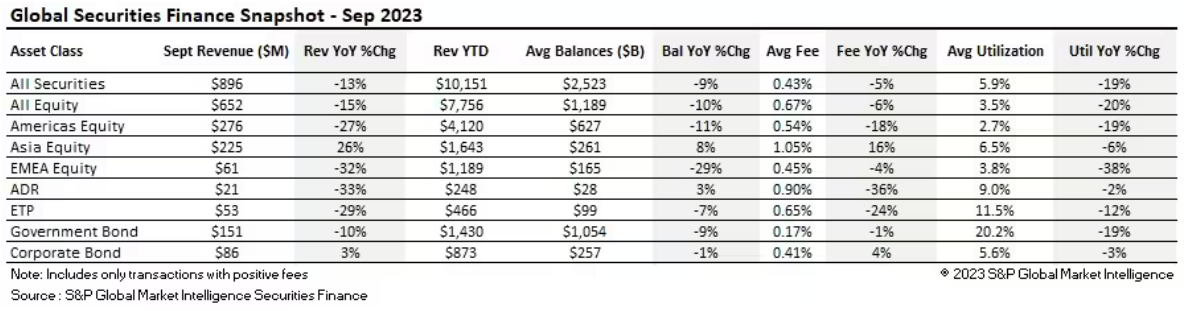

Securities lending activity generated $896 million in revenues during the month of September. This is the lowest revenue generating month of the year so far and the first time during 2023 that revenues have fallen below the $1 billion per month mark.

September’s revenues were also the lowest seen since October 2022. Most asset classes experienced yoy declines in revenues, balances, fees, and utilization during the month. In the equity markets, the only region to see any revenue growth was the Asia-Pacific (APAC) region. Europe, Middle East and Africa (EMEA) equity revenues continued to decline, and Americas equities returns fell following a substantial decline in specials revenues.

Across the fixed income markets, despite a 3% yoy increase in corporate bond revenues ($86 million), monthly returns were lower than those seen during previous months. Many market participants may have become accustomed to seeing double digit increases and monthly returns that are closer to the $100 million mark across the asset class since the beginning of the year. Government bonds experienced a 10% decline in revenues yoy along with a fall in average fees, utilization, and balances.

Across the fixed income markets, despite a 3% yoy increase in corporate bond revenues ($86 million), monthly returns were lower than those seen during previous months. Many market participants may have become accustomed to seeing double digit increases and monthly returns that are closer to the $100 million mark across the asset class since the beginning of the year. Government bonds experienced a 10% decline in revenues yoy along with a fall in average fees, utilization, and balances.

The third quarter of the year was slightly disappointing for securities lending markets when compared on a yoy basis. During Q3, $3.13 billion in revenues were generated for securities lending participants, which is a 7.5% decline when compared with Q3 2022. Average fees across all equities fell to 49bps (-1% yoy) which is lower than during both Q1 (53bps) and Q2 (56bps). Average balances for the Q3 period also declined yoy (-9%) as did utilization (-17%). Lendable increased by 8% over Q3 2022, however.

Despite the decline in revenues and general borrowing activity during the quarter, given the strong start to the year, on a YTD basis, annual revenues are still trending 7% higher than at the same point during 2022.