Quantum computing has entered the commercialization era, according to a recent report from quantum tech business intelligence firm Interference Advisors and quantum computing systems, software and services provider D-Wave.

For 2022, revenue is expected at $750 million, with more than 20% expected to come from commercial customers. This is an increase from some $12.5 million to $150+ million attributed to business-oriented use cases and clients rather than R&D partnerships. In the case of D-Wave, 68% of its Quantum Computing as a Service revenue is coming from commercial customers in 2021.

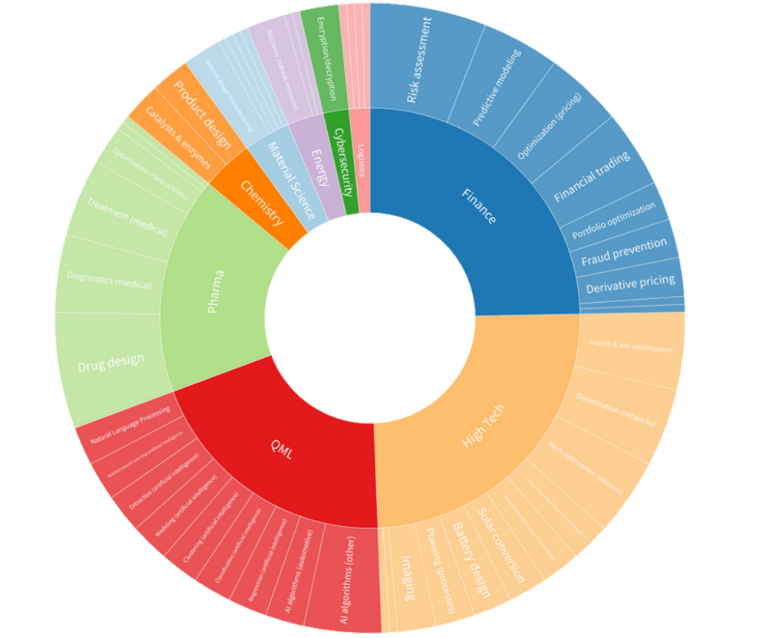

The North American market dominates the quantum computing landscape, with an increasing number of UK, European, Australian, Japanese and Israeli vendors emerging. The main algorithms driving QC usage were machine learning (24% of respondents), optimization (19%), modeling/simulation (19%), cybersecurity (14%) and Monte Carlo processes (9%).

Finance is among the verticals that are expected to be at the forefront of QC adoption. Financial applications include risk assessment, predictive modeling, portfolio optimization, trading and derivative pricing.

“Although the QC market has not yet seen an explosive increase in startups, funding or scaling, it has shown consistent growth with a strong focus on execution,” according to the report.