The move to T+1 settlement in US markets is forcing a re-evaluation of manual processes that have constrained repo post-trade. Firms should reconsider the process of staffing up to resolve trade breaks and find new solutions to automate repo processing. With T+1 expected to take place in less than two years, the time has arrived to secure funding and integrate with strategic technologies. A guest post from MarketAxess.

In February 2022, the US Securities and Exchange Commission (SEC) proposed changing the US settlement cycle from T+2 to T+1. Compressing the settlement cycle has taken place previously from T+5 to T+3 and T+3 to T+2, in 1993 and 2017 respectively. This shift protects investors, reduces risks and increases operational efficiency. The SEC has also mandated brokers to “shorten the process of confirming and affirming the trade information necessary to prepare a transaction for settlement” and “facilitate straight-through processing” (STP). The SEC notes that the move to T+1 is a prelude to a T+0 settlement cycle in the future.

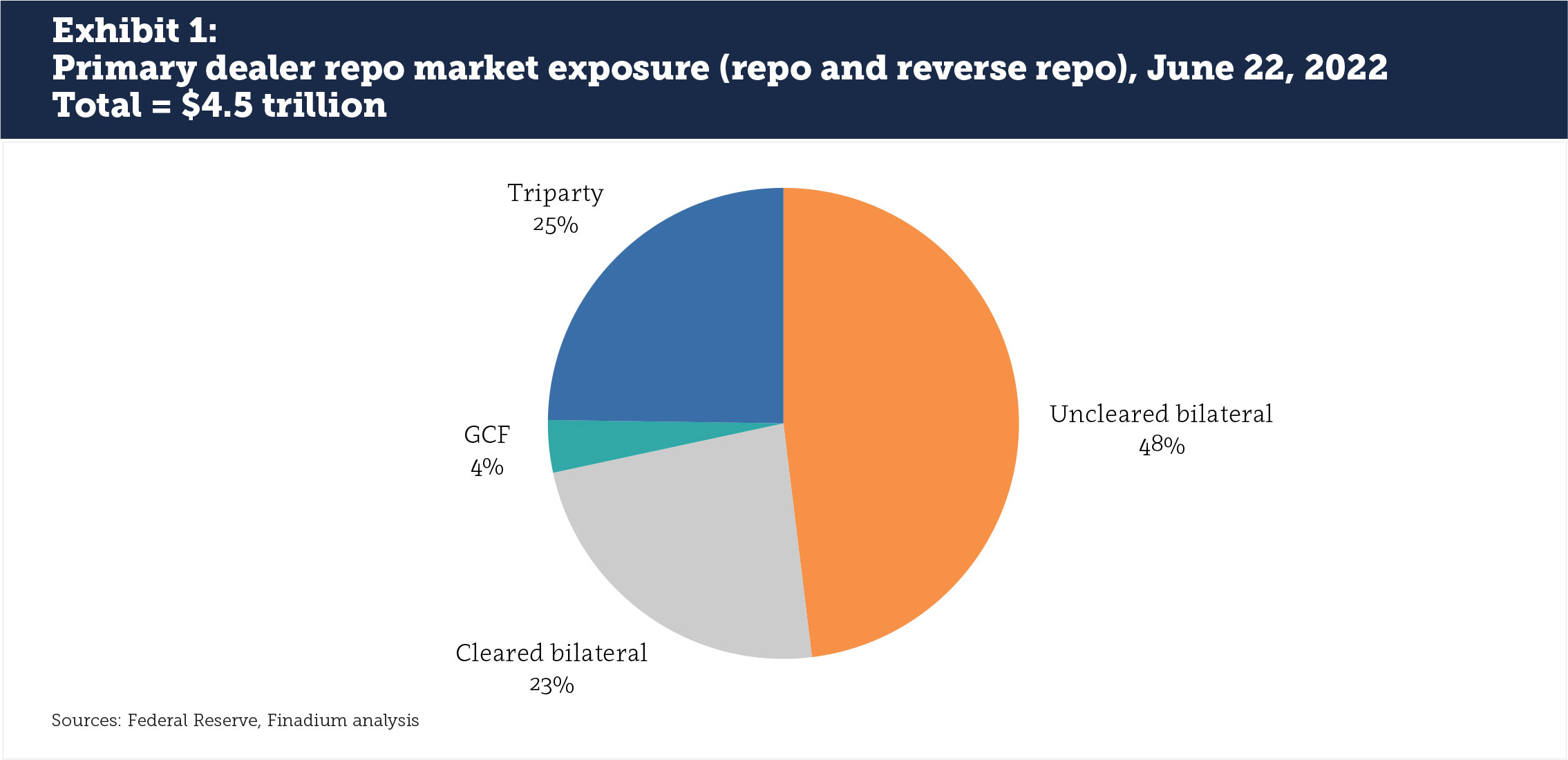

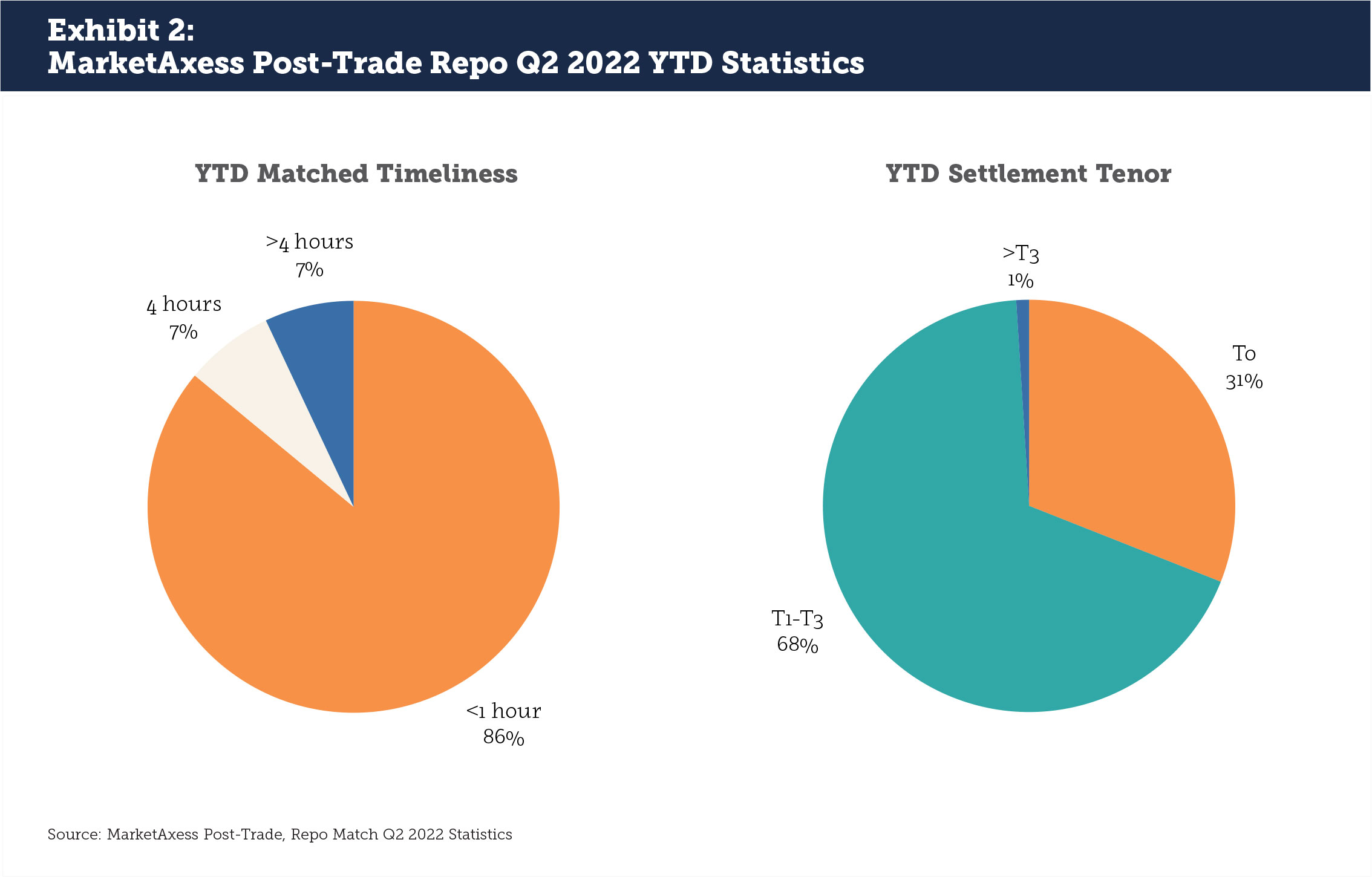

The impact of T+1 will be felt most in uncleared bilateral repo, which remains the biggest US repo segment. According to primary dealer data published by the Federal Reserve, 48% of primary dealer repo and reverse repo exposure is in uncleared bilateral repo, compared to 25% in tri-party, 23% in cleared bilateral and 4% in GCF Repo® (see Exhibit 1). In this uncleared bilateral repo space, firms that have been proactive in deploying new technologies to support operational efficiency will face a smoother transition to the upcoming T+1 settlement cycle than their peers. MarketAxess Repo Post-Trade user statistics show that users on the platform year-to-date see 86% of repo transactions matched in less than one hour with around 31% of repo transactions traded for T+0 settlement (see Exhibit 2).

T+1 STP pressure points for repo

T+1 will impact repo differently than cash equity or fixed income markets, both of which are better equipped and more automated than uncleared bilateral repo. Equities are most prepared to move to T+1 already, with fixed income credit and rates close behind and emerging markets (EM) lagging. The volume of repo transactions tends to be significantly larger than equity or fixed income (credit, rates, or EM) transactions, resulting in larger fail and funding claims.

The constraints and inefficiencies of manual repo processing are not new. T+1 magnifies these issues by speeding up the timeline: if a firm is not automated for uncleared bilateral settlement now, it can only expect processing costs to increase. The challenge is not limited to dealers but also involves asset managers, hedge fund administrators, middle office solutions, and prime brokers.

As a specialist in helping firms move from manual bilateral repo confirmation to STP, MarketAxess Post-Trade has identified a series of touchpoints that we expect to impact most firms in the uncleared bilateral confirmation process. These include:

- Automation in the affirmation and confirmation process. A trade can be sent to market with manual confirmation, but this increases the risk of fail due to human error. Manual confirmations using email, PDF, spread sheets or fax also lengthen the time required to complete the process relative to a standardized matching platform.

- An inability to staff up to manage manual challenges. It may not be feasible to depend on large teams to support the functioning of a T+1 model, given high staff turnover post-COVID and the current employment environment. Firms may wind up paying more for new hires and training those hires, which can increase costs. Further, many experienced operational knowledge experts move to the front office, hedge funds, or tech firms when they are needed most.

- Overnight batch processing gives less time to work on exceptions. Due to system limitations, once a trade is executed, the trade might not be confirmed until the following day when settlement is required in a T+1 environment, which increases settlement risks. Downstream, tracking settlement fails using legacy technologies and Excel macros will be unsustainable.

- Other manual actions slowing down the process. There are still numerous operations activities being performed manually, including trade booking for voice transactions, corrections of trades due to mis-bookings, recaps requested or sent to clients, delivery of PDF or fax confirmations, allocations to trade details, booking collateral allocations, and standing settlement instruction (SSI) management. These operational processes exist, and firms will have less time to resolve them.

- Excessive email communications. Trade exceptions are discussed and resolved over email with varying response times. As we found last year in a study on the use of email and repo post-trade, the more that dealers and clients can reduce variation in text strings and attachments and link these messages to an automated platform for post-trade reconciliation, the more that firm-wide and industry-wide efficiencies can be generated.

- The New York Fed’s Treasury Market Practices Group (TMPG) and cash funding payments and processing will be costly. TMPG claims and coupon payments are tracked via spreadsheets and sent via email. Chasing counterparties to agree to make payment and confirm SSIs are additional steps.

Pair-off communication deserves a special mention with the manual instruction of a securities payment order (SPO) or Fedwire payment method to net the difference, since finding potential pair-off opportunities can require individually searching in an Order Management System. An automated platform to identify and communicate pair-offs can improve the netting process and achieve higher efficiency. Through feedback from clients, MarketAxess Post-Trade has built a feature that allows clients to search for pair-offs and communicate them in the user interface with their counterparts. Additional developments are in the pipeline to improve pair-off processing in the future.

A common theme of these touchpoints is the lack of a management information system that offers transparency into bottlenecks, identifies exceptions early and reduces repeated manual activities that inhibit efficient repo operations. While this may appear to some as a nice-to-have in a T+2 market, it is essential to running operations in T+1, and subsequently T+0. As settlement cycles shift in the US, we also expect to see changes in mitigating the risk of fails through STP with Europe’s Central Securities Depositories Regulation (CSDR) and around the globe.

The T+1 takeaway remains the same: start early to identify solutions and partners

The default strategies of hiring more staff and utilizing legacy technologies to solve manual processes may not suffice going forward. Labor and training costs will be far greater than the investment cost in technology when T+1 is expected to go live in early 2024.

Service providers get busy with any big market change. This was most recently seen in the adoption of Initial and Variation Margin for uncleared OTC derivatives. Some market participants were proactive to identify partners while others, reactive. This will similarly ring true in the move to T+1. The earlier that impacted firms look to solve manual bottlenecks and find the right technology partners, the better prepared they will be in securing vendor partners for this upcoming T+1 challenge.

About the Author

Steve Ito is the US Business Development Lead at MarketAxess’ Post-Trade Repo team. Steve works in building a community of existing and prospective clients to improve repo post-trade automation. Most recently, he spent over three years at Norges Bank Investment Management’s Transaction Management team, where he oversaw the full lifecycle of equity, fixed income, repo, and FX transactions. After obtaining his undergraduate degree, he worked at Point72 as an Intelligence Analyst. He graduated from the George Washington University School of Business majoring in Finance and International Business and interned in the US Department of the Treasury during his time in Washington. He attended an international school in Tokyo, Japan and is bilingual in English and Japanese.

Steve Ito is the US Business Development Lead at MarketAxess’ Post-Trade Repo team. Steve works in building a community of existing and prospective clients to improve repo post-trade automation. Most recently, he spent over three years at Norges Bank Investment Management’s Transaction Management team, where he oversaw the full lifecycle of equity, fixed income, repo, and FX transactions. After obtaining his undergraduate degree, he worked at Point72 as an Intelligence Analyst. He graduated from the George Washington University School of Business majoring in Finance and International Business and interned in the US Department of the Treasury during his time in Washington. He attended an international school in Tokyo, Japan and is bilingual in English and Japanese.