The introduction of the Securities Financing Transactions Regulation (SFTR) and the Central Securities Depositories Regulation (CSDR) are leading to shifts in how banks and buy-side firms manage data. These regulations are not just about the act of reporting; they also encourage a positive rethink on how market participants approach the securities finance business and exploit any opportunities that may arise. A guest post from Pirum.

A new wave of thinking on data analytics is arriving in the securities finance industry. This is the result of years of preparing for SFTR through project plans and operational reviews, plus working to mitigate the impact of both fines and fines management from CSDR. Analytics has always been central to securities finance, but these regulations are inspiring new ways of approaching solutions. This process has the potential to improve how the industry works and create additional revenue opportunities for market participants.

The average securities finance trade has 210 reportable events over its lifetime and is open for 94 days. Each step in the process generates one or more data points and could conceivably be connected to a break in post trade processes. The more breaks that occur, the less profitable the trade becomes. It is in the best financial interest of market participants, and the operating of the market as a whole, to minimize these breaks and the settlement fails and P&L impact that may result. The need to manage each event multiplied by the number of a firm’s open positions means that the more is known about each step, the more the extra costs can be avoided.

The ability to know the character of each step in the reporting cycle requires large-scale data analytics, and data needs to be dissected to its fundaments. This leads to a more nuanced understanding of where potential cost savings and revenue opportunities can be generated. The end result of better data for reporting also means better data for operations and the forecasting of transactional activity and ultimately, profitability.

What data matters

The types of data that are seeing an upgrade fall in two categories: internal operational metrics and reference data. Internal operations can show where processes are delayed or failing more than on average, and where a firm needs to make structural adjustments to deliver more efficient outcomes. While some of these required changes may already be known, the ability to focus on internal operational metrics can produce targeted responses that surpass a general “we’ve got to get better” approach. This also helps firms prioritise and define deliverables.

The introduction of Artificial Intelligence, Machine Learning and Robotics Process Automation at some firms can be applied to both data analytics and improving operational responses. While these projects remain at the early stages, applications that work to solve the least efficient processes first can have an outsized positive impact on the end result.

Better reference data can have a firm-wide impact, as accurate settlement instructions, LEIs (legal entity identifiers) and UTIs (unique transaction identifiers) mean smoother trade processing. This is as much an industry challenge as an individual firm challenge: accurate reference data requires sharing or agreeing standards across firms and upgrading account instructions that may be vague. It also means working together on operational challenges between counterparties; this has not always been a natural state for the industry.

The level of financial benefit that could come from improved reference data is similar to what could be gained from internal operational efficiencies. These include less time spent on figuring out trade breaks, better SFTR reporting, and more time on using operations as a competitive industry advantage rather than staff chasing errors.

Follow the money

The reason to pursue better data is rooted in financial returns. The opportunity is to spend less on operations: better data means better workflows, easier reporting and fewer manual steps to achieve the end goal. Shrinking securities finance settlement times increases the importance of low latency, especially if lenders require pre-collateralisation before initiating their side of a settlement process. More efficient settlement times combined with better visibility can also result in more optimal collateral use and fewer balance sheet capital requirements. This can move quickly into using data to be proactive: predicting breaks before they happen, identifying counterparties for targeted data quality improvements, and translating operational savings into improved client pricing, greater revenues, or both.

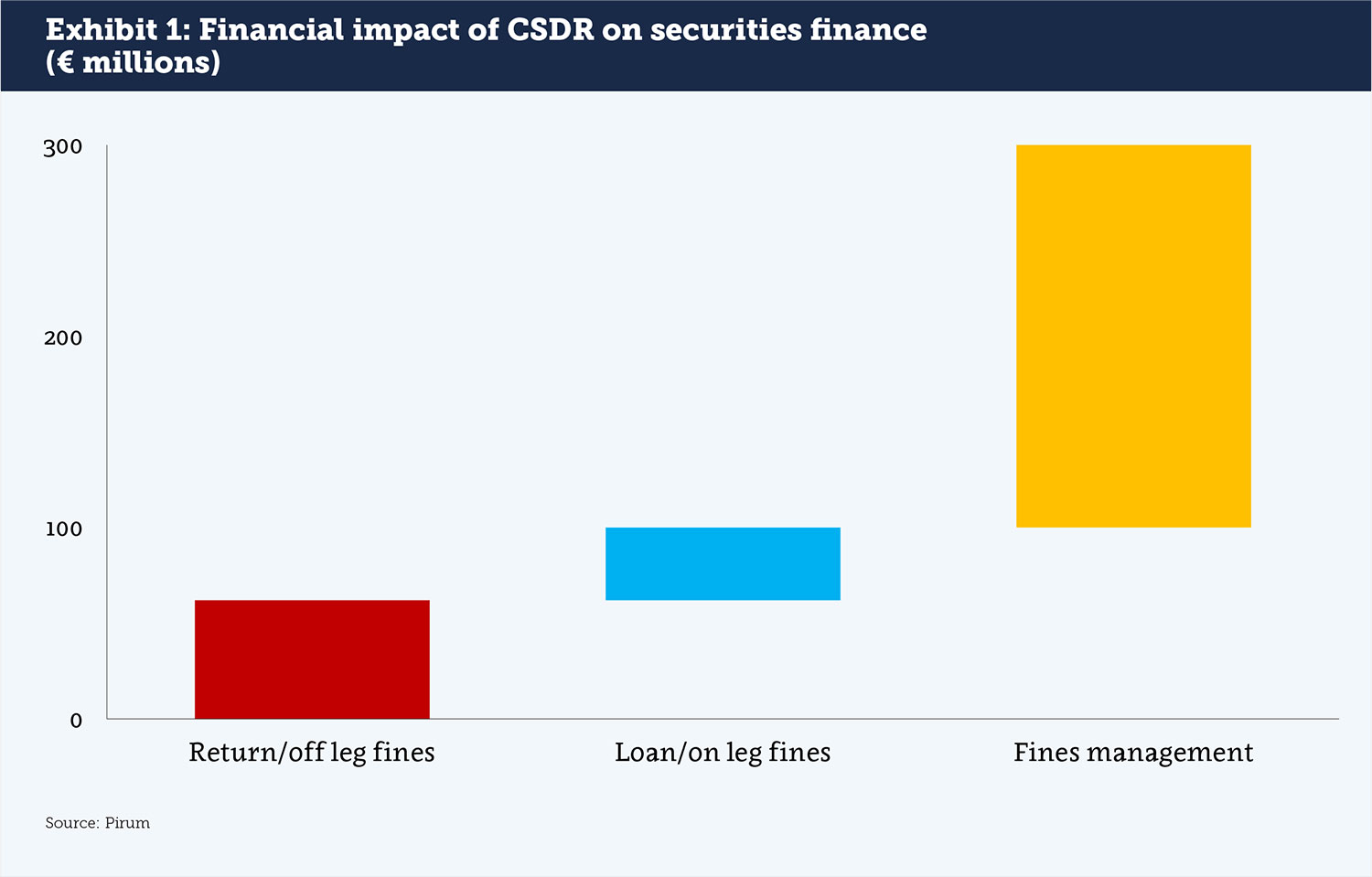

CSDR presents a good example of the financial impact. Pirum has calculated that the industry CSDR cost of current practices and processes for tracking fines amounts to €300 million ($353.9mn), a hefty sum (see Exhibit 1). This includes direct fines, additional processes, systems and resources. Expected fines can be broken down between loan/on leg and return/off leg settlement failures, with most of the difficulty arising in the return/off leg part of the trade. Setting up a mechanism for fines management is expected to cost upwards of €200 million for the industry. The incentive to avoid these costs should lead to better data management, not to mention cooperation with industry utilities to generate solutions to common problems.

Four operational benefits of better data analytics

An internal focus on improving data quality works to solve four direct challenges in the industry today: 1) data sharing, 2) lack of transparency, 3) low automation and 4) lack of controls. Firms will need to cooperate to solve common challenges in settlements, while a focus on generating data at each step in the transaction life cycle can lead to improved automation and better controls. This is a self-reinforcing process, as better data means improving existing challenge areas, and a focus on these areas results in better data.

Other practices will fall by the wayside as part of an industry-wide upgrade in data management. A general move to get off of PDFs and spreadsheets and into machine-readable data transfer formats will reduce errors and manual processing time. These human readable files can be retired in favor of electronic exchanges of data in standardized formats. PDFs and spreadsheets can join fax machines in the retirement line.

Better data will assist pre- and post-trade analytics for both operations and trading. The ability to reduce collateral exposures and, where they still exist, collateralize them more optimally, will reduce balance sheet costs, and targeted analytics on counterparties can make a material difference to funding costs. Firms can use this same information to identify counterparty trades that consistently result in higher expenses. Firms can work together to solve common problems or individual firms may choose to reprice based on a more informed understanding of balance sheet costs.

An important change we are seeing is the front office’s desire to participate in making these improvements. The relationship between back and front office has never been more symbiotic as the importance of data and the value it helps in eliminating exceptions becomes clear. Once CSDR takes effect, there will be direct monetary consequences for getting post-trades instructions right and getting them wrong. A data-oriented management process can show how, where and when the front office can help.

The benefits of better securities finance data analytics will be felt across other business units as well, given the central role that securities finance has in the capital markets industry. More efficient settlements will assist in minimizing fails in cash settlement business. Operational teams can take advantage of the standardization forced on them by SFTR and CSDR to create firm-wide procedures that benefit the whole firm, ultimately improving Straight-Through Processing. A focus on data resulting from these regulations can turn a burden into an opportunity and is one that truly excites us at Pirum.

About the Author

Phil Morgan, CEO, Pirum Systems

Phil Morgan, CEO, Pirum Systems

Phil is CEO of Pirum Systems and was previously Head of Business Development. Prior to Pirum, he was a Managing Director in Nomura’s Prime Finance business and had responsibility for Equity Finance, Delta 1 and Prime Brokerage in EMEA. After starting his career at Chemical Bank in 1996, he went on to hold several positions at J.P. Morgan, culminating in sales responsibility for their clearance & collateral management products (including tri-party). In 2007 Phil left JPM to join Lehman Brothers and ran Liquidity Sales across fixed income and equity, before joining Nomura following the integration of the Lehman business in October 2008. He holds a BSc (Hons) from Cardiff University.