In the wake of our recent decision to enhance our presence in the US and Canadian securities finance space, we have been faced with important questions from market participants, including is there room in the US for another securities finance service vendor? Following detailed market analysis and consultation with our clients, we believe that there is a logical place for our services in North America. A guest post from Pirum.

Much as Pirum has become a de facto standard in European and other market places around the world, the US landscape has long been dominated by a short list of trade and post-trade vendors who have taken on the aspect of virtual utilities. The market structure and vendor landscape is constantly evolving, and it’s interesting to delve into the similarities and differences in the US compared to other parts of the world to this point.

The US securities finance market in a global context

Some historical reference is useful to set the stage. US and European markets in securities finance were long siloed and distinct. Each had its unique characteristics that ranged from underlying systemic banking structure to market mechanics and infrastructure. The US, for instance, has a single central depository in the form of the DTCC (in its various incarnations). In Europe, the role of the central depository was historically filled by custodial banks and a variety of local depositories.

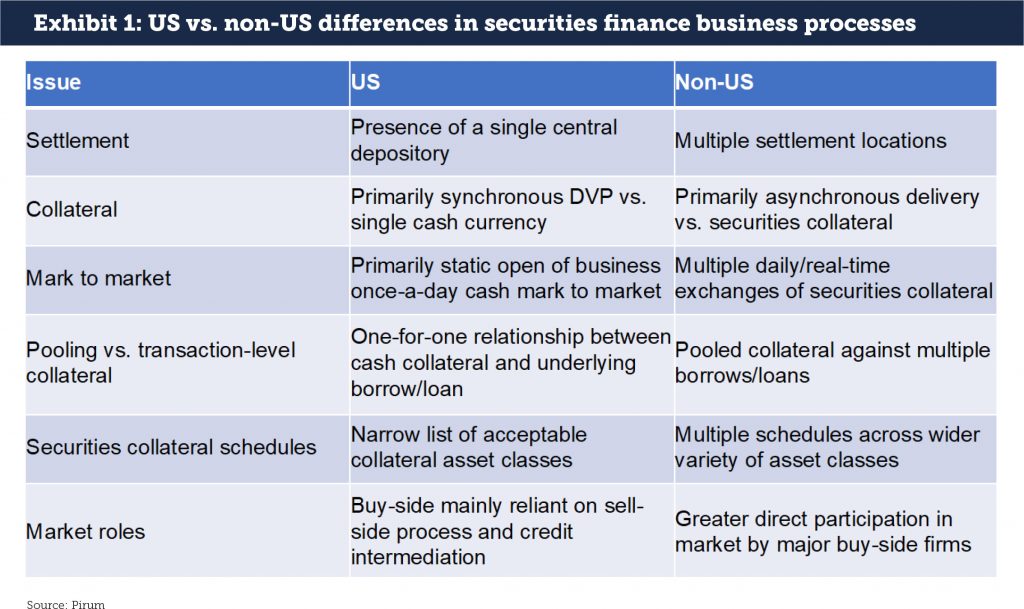

The US market evolved under a single, unified market with one regulatory regime, while Europe has been evolving from dozens of jurisdictions into a more uniform state. In the US, the roles of different types of entities were quite clear-cut by both rule and practice: commercial and custodial banks were different from investment banks and broker-dealers; and the buy- and sell-sides of the market were well-established with little overlap. This was far less true outside the US, where these roles and ways of participating in markets were blurred (see Exhibit 1).

The US-centric view of the world was that US markets were more mature, structured and efficient than abroad. The Euro-centric view of the world was that European markets were more sophisticated, less constrained and less constricted. Both views were true to some extent, but also oversimplified.

A globally interconnected marketplace

While arguing for the superiority of any team is a local and national pastime, in securities finance these views are increasingly less relevant in an interconnected world. Increasingly, success demands that we view the securities finance world as one large, complex ecosystem in which we appreciate regional differences and adapt our technologies and practices to meet them.

One example of global relationships is regulatory trade capture across jurisdictions. As European firms know well, the Securities Financing Transaction Regulation (SFTR) is requiring a vast rethink about how securities finance actually works on an operational level. Mandatory securities finance reporting has not yet hit the US but pilot projects are already underway. So, why would a global firm do the work in Europe and ignore the US when the same tasks are expected to be required? The fields reportable under SFTR provide much more detailed information, on a timelier basis, than the current ALD regime. Thus, it is widely predicted that ALD (Agency Lending Disclosure) could be modified or replaced by the richer data set produced for SFTR.

Even firms without a direct reporting obligation will have a duty to provide in-scope counterparties with sufficient information to fulfill reporting requirements. It makes sense to build once and roll out globally, and our joint solution with IHS Markit for this important mandate is the most comprehensive commercial solution available. Even if it isn’t a regulatory requirement yet in the US, the business benefits of having a solid grasp on securities finance data could be immense, from creating internal cost allocation methodologies to developing new trading strategies based on Big Data. This shifts regulatory reporting from a compliance mandate to an opportunity to build for growth.

Likewise, buy-side firms around the world are looking at the fiduciary conduct requirements of MiFID II and finding that it makes sense to have a global application. From Boston to San Francisco, the buy-side is now getting organized with MiFID II compliance projects that will require a securities finance component. Buy-side firms will have far more direct responsibility for control, oversight and reporting to their customers on an operational level than ever before. Issues like contract comparison and demonstration of best execution and pricing across multiple intermediaries will require access to systems, processes and data that has traditionally been the sole province of the intermediary. There is no longer a US vs. Europe, rather, there are global actors that must have an overarching technological and operational response. At the same time, there is no longer an absolute and clear-cut delineation of roles between the buy- and sell-sides of the market.

The role of vendors

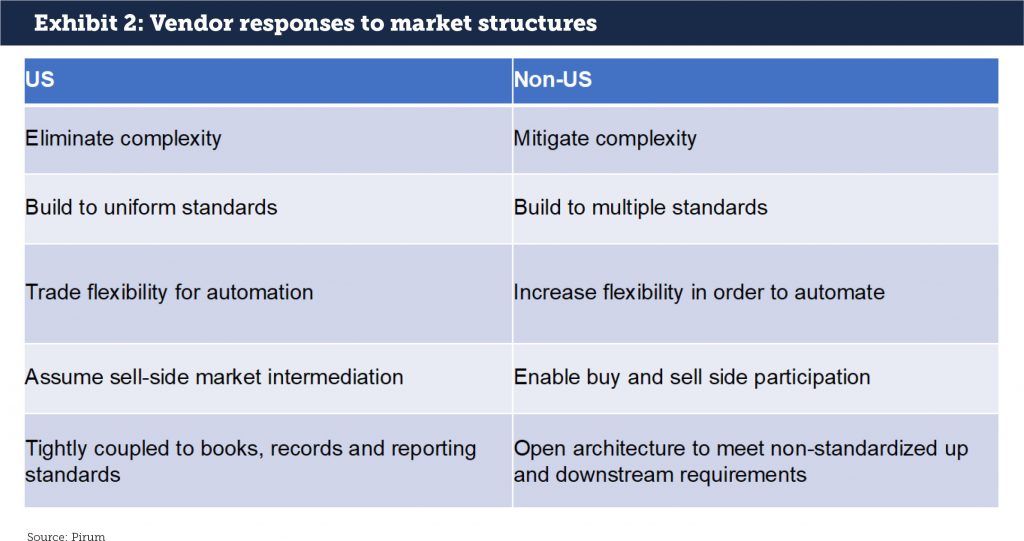

Technology and suites of services have been refined over time to meet the peculiarities of their local markets and customers. In the US, systems evolved to support and manage enormous volumes of very similar-looking transactions within a uniform set of standards. Outside the US, systems evolved to efficiently manage, normalize and control a wide variety of dissimilar-looking transactions across different standards and practices.

In both geographies, gaps have developed because it was no longer enough to be best of breed in just the US or just in Europe. These gaps continue to widen as the pace of change in market practices outpaces the services and support available to market participants. Like it or not, US and Canadian firms must look and act like European firms to keep their seats at the table and European firms must look and act like US and Canadian firms to maintain their positions in those venues. That does not mean that every firm is ready however, and that’s where our global expertise can be relevant in North America.

Existing Pirum customers operating in a less structured and more mechanically fragmented environment have gained the benefits of automation and efficiency, often while dealing in multiple geographies and product types that lack the uniformity of the US system. Their US activities are well-supported and folded into their larger book of business as yet another venue with its own methods of settlement and processing idiosyncrasies.

Our European experience has offered us multiple opportunities to connect with US infrastructure providers: for instance, Pirum has integrated into DTCC. This milestone into the US market begins with the SPO (Special Payment Order) charges. The settlement of SPOs, used widely in the US for the settlement of fees and rebates, as well as for USD collateral pre-payment on non-US deliveries, went live in June. Pirum has dedicated development resources to evolve its DTCC functionality which may include tracking of settlements, ARMS (Automated Recalls Management System), and ALD. This is another example of being able to use Pirum’s latest technology for interoperability with other vendors in the US.

Similarly, we have expanded support for tri-party RQV (Required Value) processing with European agencies like Euroclear and Clearstream, as well as with US tri-party agents J.P. Morgan and BNY Mellon. Pirum has developed near-real time processes to calculate, reconcile and settle collateral between lenders and borrowers directly; and between lenders, borrowers and their tri-party agent. These services include the monitoring and confirmation of collateral delivery against new loans and returns, and multiple daily re-margining to help eliminate daylight exposure and reduce inefficiencies in the utilization and allocation of collateral.

As the industry adapts to changes that increase the complexity of collateral requirements and the costs associated with managing collateral, more than ever there is a need for automation. Pirum’s future products address the growing trend for Enterprise Collateral Management (ECM), building on existing functionality to offer new, cutting edge screens and tools to centralize and highlight counterparty exposure risks.

From the perspective of the capital markets, the US and Europe have evolved towards one another. Our capital markets are neither US-centric nor Euro-centric. They have become global-centric, and this is something that even flagging political will towards globalization cannot undo. Regardless of whether or not the drive towards a global regulatory framework continues or fades, from all meaningful perspectives we exist within a single, increasingly complex and integrated financial system. This will only accelerate despite potential for further fragmentation resulting from geo-political events such as Brexit.

Pirum has evolved to meet complexity with flexibility and agility, and to rationalize disparate practices into a manageable, unified business process. This will work to the advantage of North American firms as they contemplate broader markets and market practices that no longer fit as neatly into the standardized model (see Exhibit 2).

As North American firms grow their European operations, and vice versa, they will need systems, utilities and vendors with global capabilities. Pirum’s comparisons are product agnostic and can support US domestic workflow with 40 entities currently using the US domestic service. Pirum’s handling of noncash collateral reconciliation and customizable rules means we are well placed to assist the market as its use of noncash collateral and tri-party grows

Pirum has committed to expanding its services and offering the best-in-class technology in North America by opening its first office in New York and making local hires. Pirum is ready and able to bridge the operational and efficiency gaps for North American firms just as we have for our European customers. We operate in a global world, and are committed to assisting our US and Canadian clients by delivering our solutions to the market.

Rajen Sheth is CEO of Pirum System. Raj joined Pirum in 2003 and has been in the role of CEO since 2014. He started his career in technology as a software programmer and progressed to running IT teams within investment banks. Prior to working at Pirum, Raj held IT programme management positions at UBS supporting both Equities and OTC products; his last role was head of cash equity post-trade strategic IT. Before this, Raj was head of Prime Broker IT at Lehman Brothers delivering front office and client technology solutions.