Singapore’s central bank, Monetary Authority of Singapore, released a report on the DvP-on-DLT project, which is an extension of Project Ubin seeking to achieve interledger connectivity and settlement finality for Singapore Government Securities (SGS) with central bank-issued cash-depository receipts (CDRs) on separate DLTs. Along with MAS, the report was developed with the contributions of Singapore’s exchange (SGX), Anquan Capital, Deloitte and Nasdaq.

To examine possible DvP settlement models and interledger interoperability, prototypes of different DLTs with

varied capabilities and features were developed. These prototypes allow the transfer of tokenised assets such as

SGS and CDRs on a trade-by-trade basis.

MAS and SGX observed that this setup provides the flexibility to compress settlement cycles and simplify post-trade settlement processes. The industry has taken actions to move from T+3 to T+2, shortening the settlement cycle and thereby reducing underlying risk exposures. DLT could potentially be an enabler for the industry to eventually

compress the settlement cycle even further.

In addition, smart contracts for DvP could enable the consistent and coherent implementation of rights and obligations that will increase investor confidence and reduce compliance costs in the market.

The solution design of prototypes also enables a Recognised Market Operator (RMO) to maintain a central role to monitor and facilitate market functionalities. Given that investor security is of paramount importance, the solution possesses the following key design features:

• Account controls with multiple signature conditions

• Contract locks utilising secure secrets

• Time boundaries established for asset recovery

• Dispute resolution through arbitration

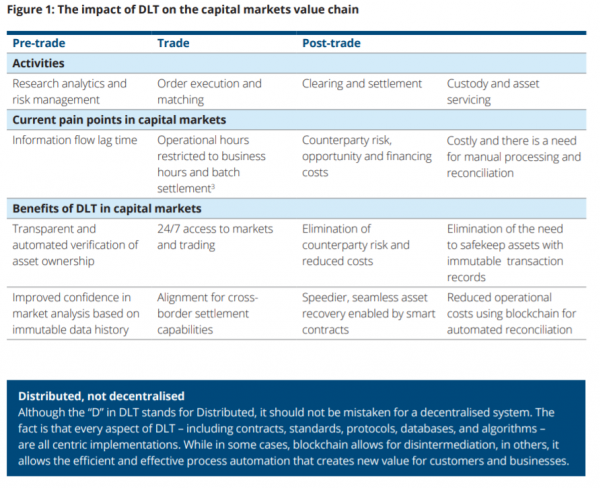

The paper explores how DvP settlement finality, interledger interoperability, and investor protection may be

realized using specific solution designs. In addition, it will highlight some future considerations for DvP-on-DLT and

its impact on capital markets.

It also looks at the private and public blockchain platforms employed by the appointed technology partners – Anquan Capital, Deloitte, and Nasdaq – to create the prototypes used in this project.