The US Office of Financial Research (OFR) published on July 22nd an interesting paper “Incorporating Liquidity Shocks and Feedbacks in Bank Stress Tests”, written by Jill Cetina. There is something new on the horizon beyond Comprehensive Capital Analysis and Review (CCAR) stress tests: regulators are now looking more closely at funding shocks.

Basel III does address liquidity issues in the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) rules. But as banks seek to comply with these rules (as well as leverage and capital rules), there could easily be unintended consequences. What happens to a liquidity ratio, for example, when a bank is under stress? Will efforts to keep within certain rules cause problems with others? From the report:

“…The potential interactions of these regulatory constraints are not fully understood. In the extreme, banks seeking to avoid a breach in one ratio could create undesirable consequences for financial stability, such as deleveraging and asset fire sales…”

and

“…during stress events, compliance with these ratios could cause a feedback loop that pushes a bank toward deleveraging, which could further stress other banks and the broader financial system. For bank supervisors formulating stress tests, consideration of these second-round effects and the impact of the types of regulatory ratio breaches could help improve understanding of how shocks are spread…”

How will banks respond to shocks?

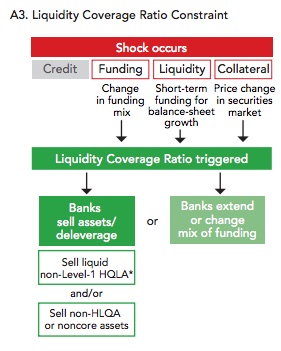

How will funding shock flow down?

“…Under normal circumstances, the ratio of HQLA stock to one-month net cash outflows is, at minimum, 1 to 1. However, if a funding shock caused a maturity shortening or an adverse change in the bank’s funding mix, the bank’s one-month net cash outflow would rise. Alternatively, if a collateral shock were to occur affecting securities markets, the value of the bank’s stock of HQLA could fall. In these scenarios, the bank’s liquidity coverage ratio would fall below the regulatory minimum of 100 percent. The bank could respond by either changing its funding mix, extending the maturity of its funding (if able) or by selling less-liquid assets to obtain cash…”

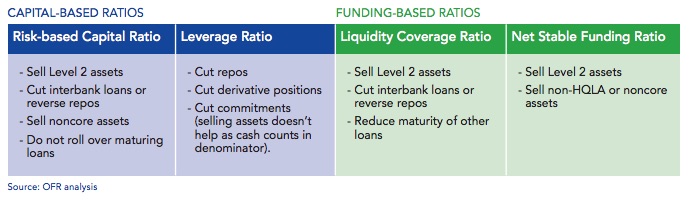

Can’t a bank simply deleverage to stay within the ratios? Sure, but then there is the risk of fire sales as assets are sold down quickly. And which assets to sell? Level 2 assets are the first to go, but repos aren’t far behind. From the report:

“…A bank could quickly and easily improve its leverage ratio denominator by shedding off-balance-sheet items, such as repurchase agreements, derivatives, and loan commitments…”

We thought repos were on balance sheet, but you get the point.

This is how the paper sees banks reacting to problems in LCR and NSFR:

Predicting what will break and how banks respond is more art than science. The inter-connectedness of regulation hasn’t gotten a lot of press, but that is starting to change… thankfully.

1 Comment. Leave new

The unintended consequences of regulations were addressed pretty wisely in the FSOC Annual Report. The low rate environment was also referred to repeatedly as a potential source of dislocations in leverage and liquidity. It is wise for the OFH to continue to address the potential for new unforeseen unintended imbalances in the funding markets which appear to have been made complacent by the Fed’s aggressive easy monetary policies.