Counterparty exposure has become an important topic for banks in the securities finance industry. What was once a fairly low-credit exposure activity, where the biggest concern was hitting a credit limit established by a central credit committee, has become a requirement for banks to hold capital against a wide range of transactions. Doing business with the right counterparty is no longer a question of good relations or the term of the trade. Banks must also factor in the internal cost that arises from counterparty exposure.

The challenge for banks is both measuring credit risk exposure at the end of a week or month, as well as managing the overall process during the trading day. To keep capital costs in check, banks need to track what is happening on their books intraday and at settlement while planning for a variety of settlement scenarios. Arriving at T+3 or T+7 with excessive counterparty exposure can mean additional capital costs and can have a direct impact on a banks RWA. This needs to be avoided in the new regulatory environment.

Measuring counterparty credit exposure

Regulatory capital is at the heart of the credit exposure conversation but it takes a bit of a walk-through to see how closely credit exposure is tied to an actual capital cost. These are the building blocks of Basel capital rules that have been adopted by national regulators across all major markets, although the specifics of the calculation can change by jurisdiction.

Credit exposure risk is part of the calculation for risk-weighted assets (RWA), which is then part of the methodology for arriving at a cost of capital or any given transaction. For example, to find RWA, the formula for a bank using the Standardised Approach is Credit Risk RWA + Market Risk RWA. Banks using the Advanced Approach must add on Operational Risk RWA. Whether for OTC derivatives or securities finance, the risk-weight of the counterparty is a critical component of determining how much capital a bank must hold against its transactions, and credit risk exposure is a central part of the RWA calculation.

In securities finance, exposure for off-balance sheet transactions is a product of the value of the transaction times a Credit Conversion Factor (CCF), which converts to the Exposure at Default figure.

The rules for credit risk exposure management continue to evolve. In December 2015, the Basel Committee on Banking Supervision published its second consultation paper on how banks need to measure credit exposure under the Standardised Approach. This document changed some important rules from the first consultation paper: in securities finance, there was a fundamental shift in the formula that agent lenders use to set aside capital for collateral held against indemnified transactions. While this may seem like a small fix, agent lenders report that they will see savings of 60% to 80% in capital charges just from this one adjustment.

The second consultation paper also mandated proscriptive rules on calculating credit risk for unsettled transactions:

“Unsettled transactions must be taken into account for regulatory capital requirements purposes. Where they do not appear on the balance sheet (i.e. settlement date accounting), the unsettled exposure amount will receive a 100% CCF.”

This is relevant to the majority of securities finance transactions. A 100% CCF – Credit Conversion Factor – means that the Exposure at Default value will be 100% of the face value of the transaction. Further,

“Banks are encouraged to develop, implement and improve systems for tracking and monitoring the credit risk exposure arising from unsettled transactions as appropriate so that they can produce management information that facilitates timely action.”

This means that tracking counterparty credit exposure cannot be simply a reactive task. Banks must also plan to supervise how their daily trading decisions impact their capital requirements across their credit exposure activities. Understanding on a real-time basis is paramount.

The practicalities of managing credit exposure

The management of credit exposure risk is both a technology problem and opportunity. On the one hand, in the current market environment only technology can track and measure credit exposure on a real-time or near real-time basis. On the other, any system must be fed with the right data to make any measurement meaningful; collecting only half of a data set or some transactions means that counterparty exposure records are incomplete. Technology is the right solution but it is also critical to get the data right before setting out.

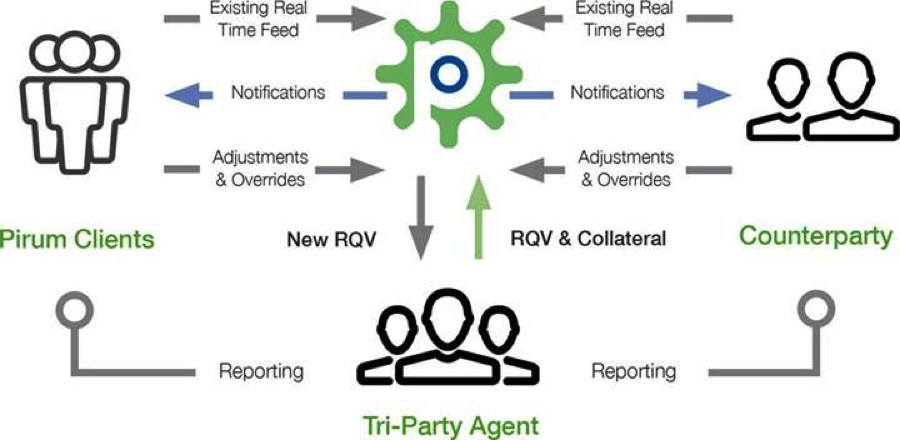

One way to solve the credit exposure problem for the securities finance market is by providing transparency on a real-time basis. Pirum views this challenge as core to its Centralised Hub structure, which delivers full transparency of issues back to the client. This puts control back in a bank’s hands and allows teams to make crucial changes that will ultimately impact their exposure and limit costly over-collateralised errors.

On a practical basis, we accomplish this task by aggregating intra-day positions, end-of-day market prices and FX rates on in nearly real-time, then calculating Required Value (RQV) figures for each side of a transaction. We then calculate figures at the tri-party account level for both sides, displaying the results on a secure, intuitive and flexible website. Pirum’s proven reconciliation platform analyses any differences to determine the root cause of any disputes leading to rapid resolution. Pirum can also provide near real-time reporting, on a scheduled basis throughout the day, giving clients visibility over collateral that has been allocated at a tri-party account level. This functionality creates an automated process and avoids potential issues arising from manual data entry. We identify issues on a real-time basis leading to problem solving and avoiding costly RWA charges.

Figure 1: Pirum’s Methodology for Calculating RQV in Near Real-Time

Source: Pirum

Managing counterparty exposure is an important task that, when managed correctly, produces tangible and genuine savings for banking institutions. When managed incorrectly and on a manual basis, it can be the source of late nights and conflicts with regulators. Pirum’s approach solves a key part of the exposure calculation process in the securities finance market, keeping RWA levels down and avoiding unnecessary and costly errors.

Mark Schilling is Global Head of Sales at Pirum.

1 Comment. Leave new

[…] http://www.secfinmonitor.com/getting-down-to-business-in-measuring-counterparty-credit-exposure/ […]